Description

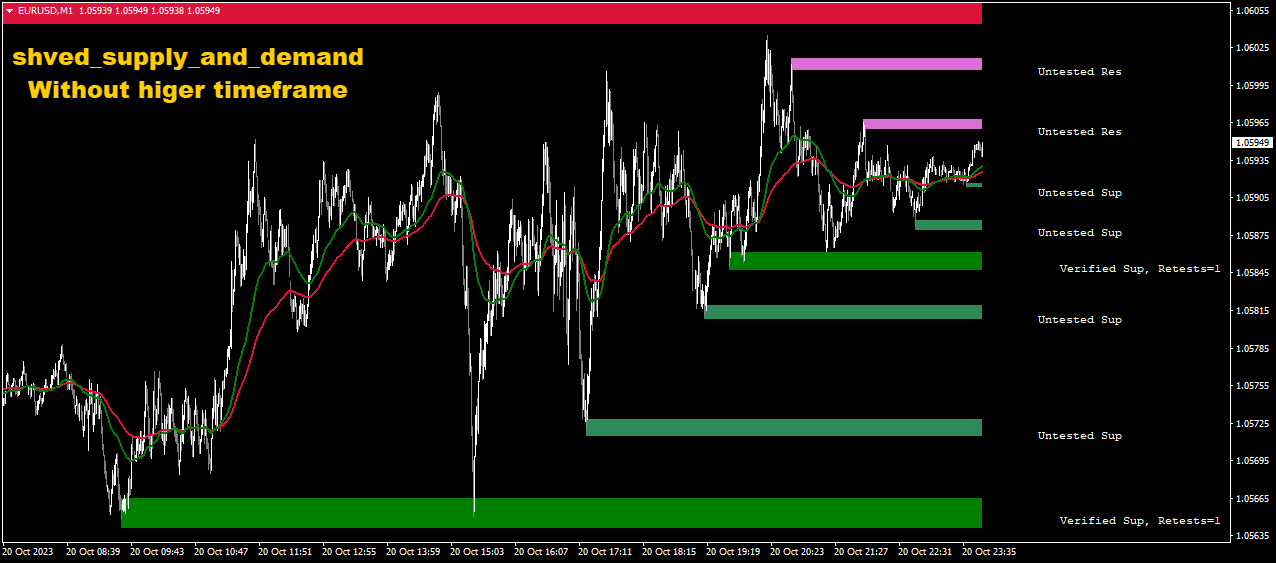

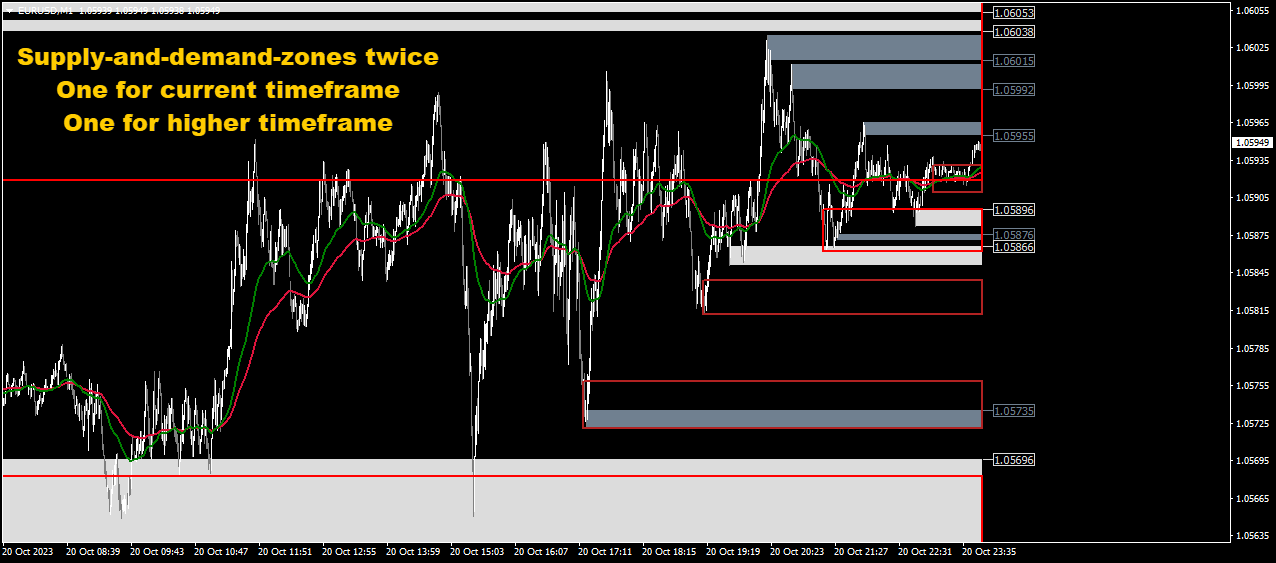

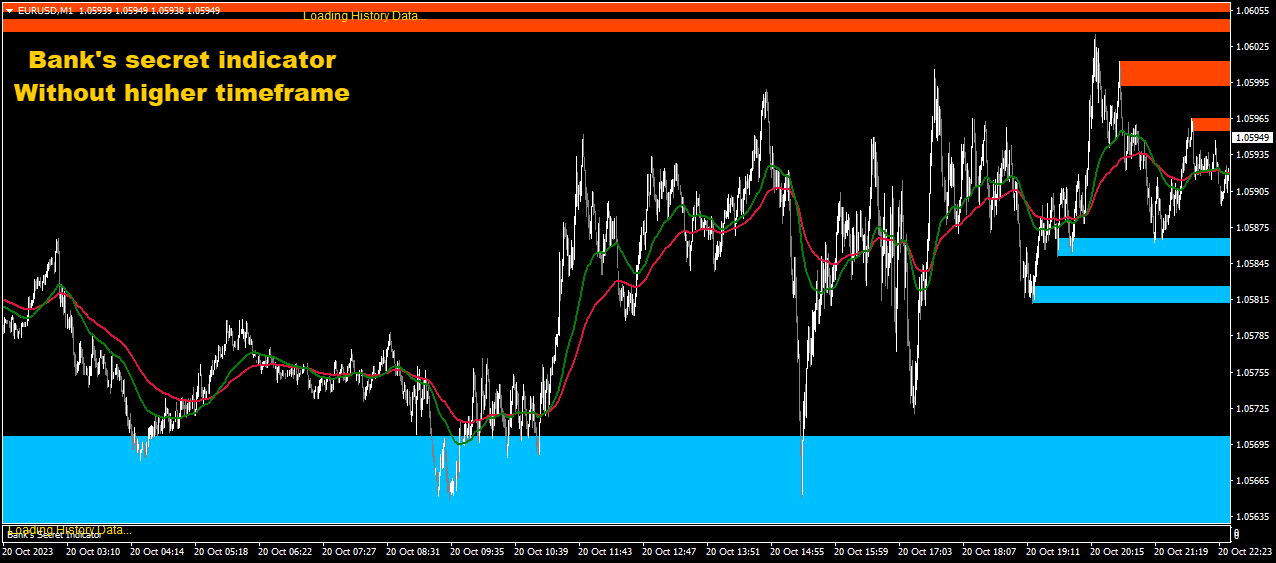

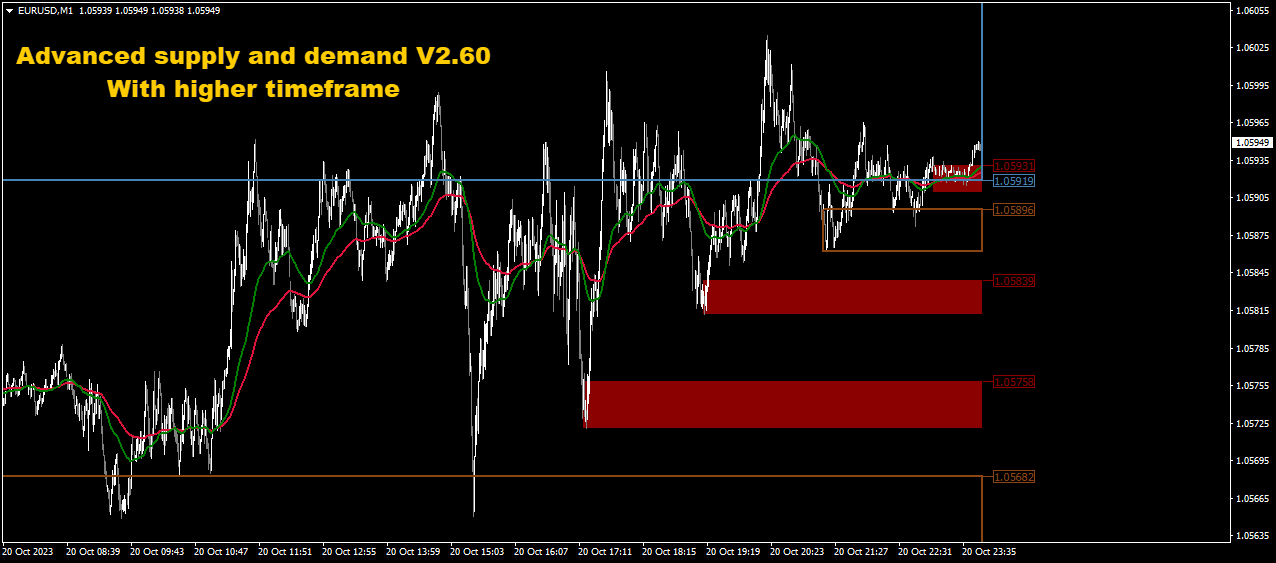

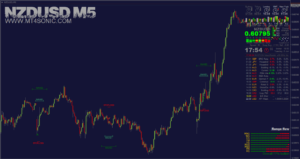

There are 4 different supply and demand mt4 indicators, which you can choose to use according to your preference.

Contains 4 indicators

Supply and demand indicators are widely used in technical analysis to identify potential areas of support and resistance on price charts. These indicators help traders identify zones where buying or selling interest may be concentrated, leading to potential turning points in the market. Here are a few popular supply and demand indicators:

Reviews

There are no reviews yet.