Description

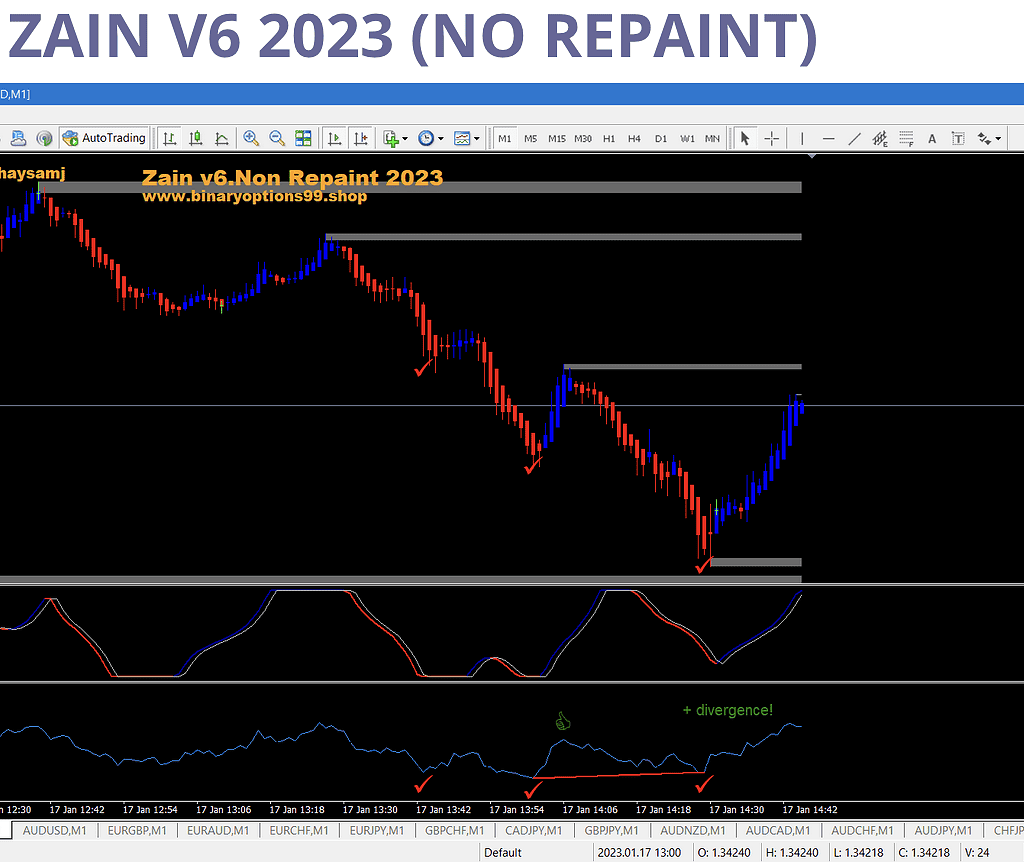

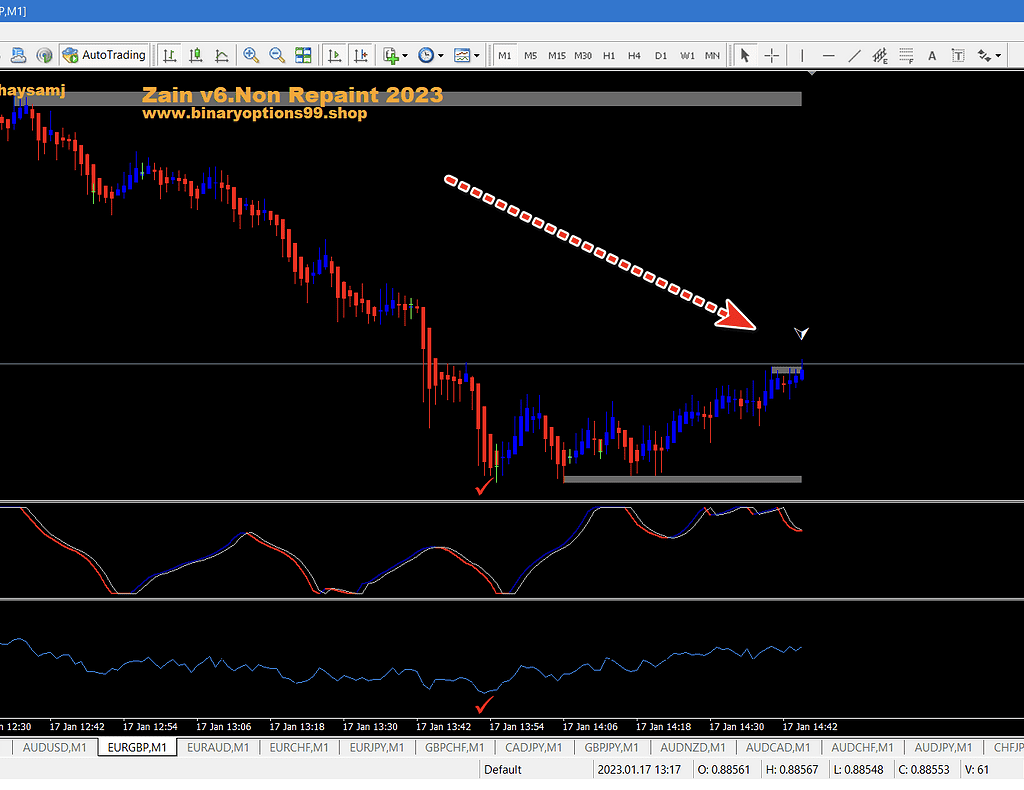

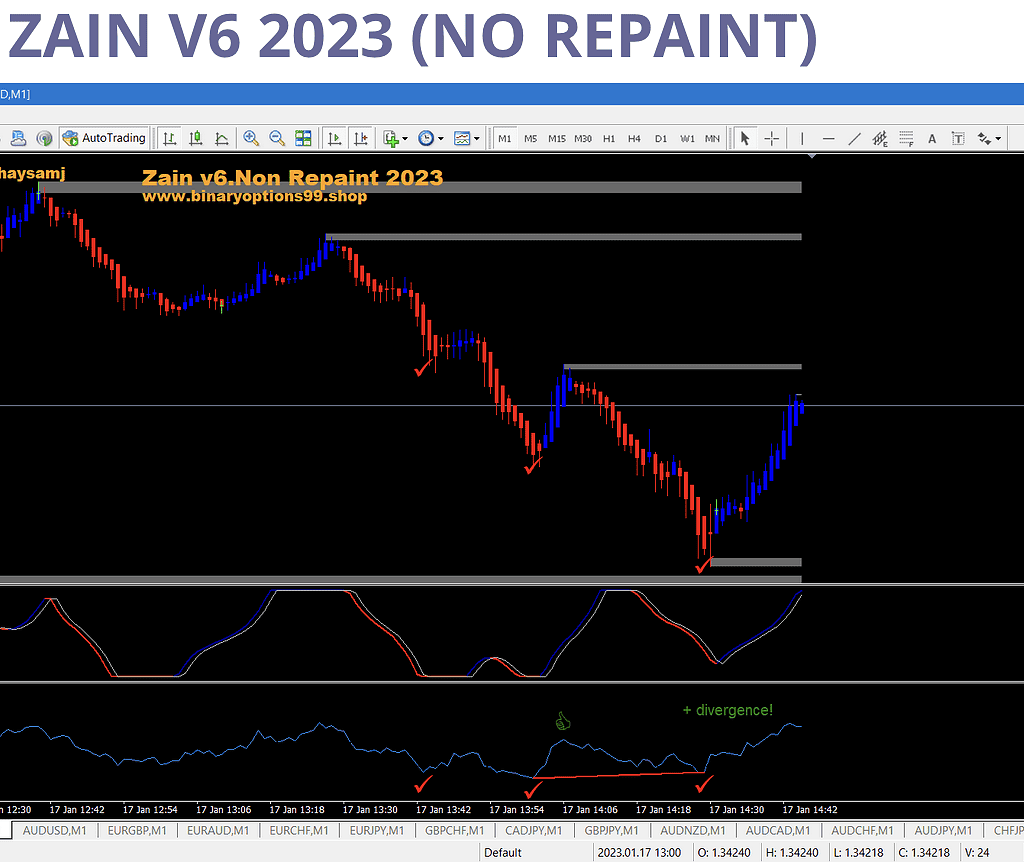

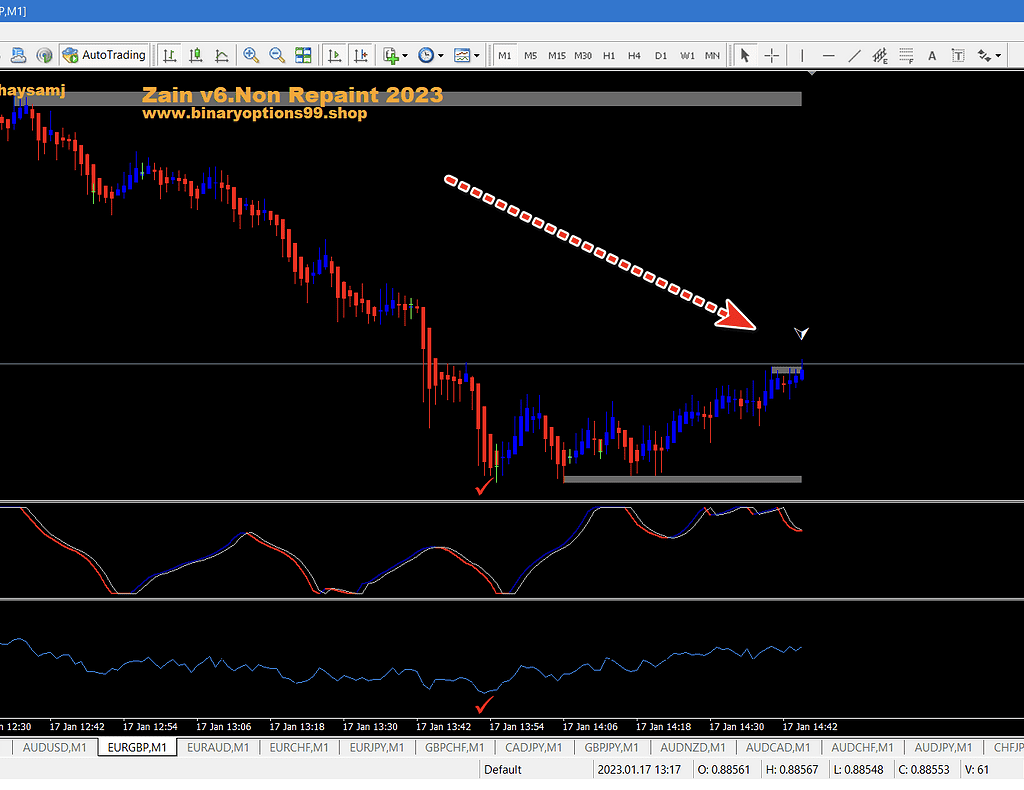

Content: Indicators: zain.ex4, zain v6 rc 2023.ex4, ZAIN V6 2022_fix.ex4, zain co v6 2023.ex4, stochastic-cg-oscillator.ex4, Heiken Ashi-.ex4, Template: ZAIN V6 2023.tpl, How to install MT4 files.pdf

Content: Indicators: zain.ex4, zain v6 rc 2023.ex4, ZAIN V6 2022_fix.ex4, zain co v6 2023.ex4, stochastic-cg-oscillator.ex4, Heiken Ashi-.ex4, Template: ZAIN V6 2023.tpl, How to install MT4 files.pdf

Reviews

There are no reviews yet.