Description

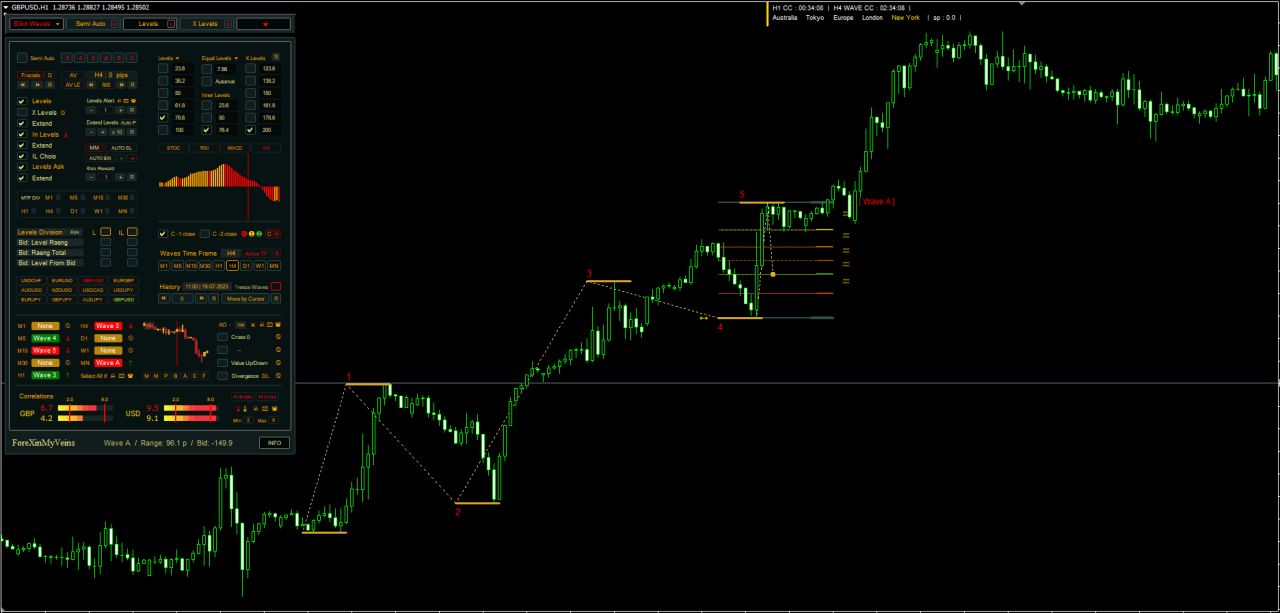

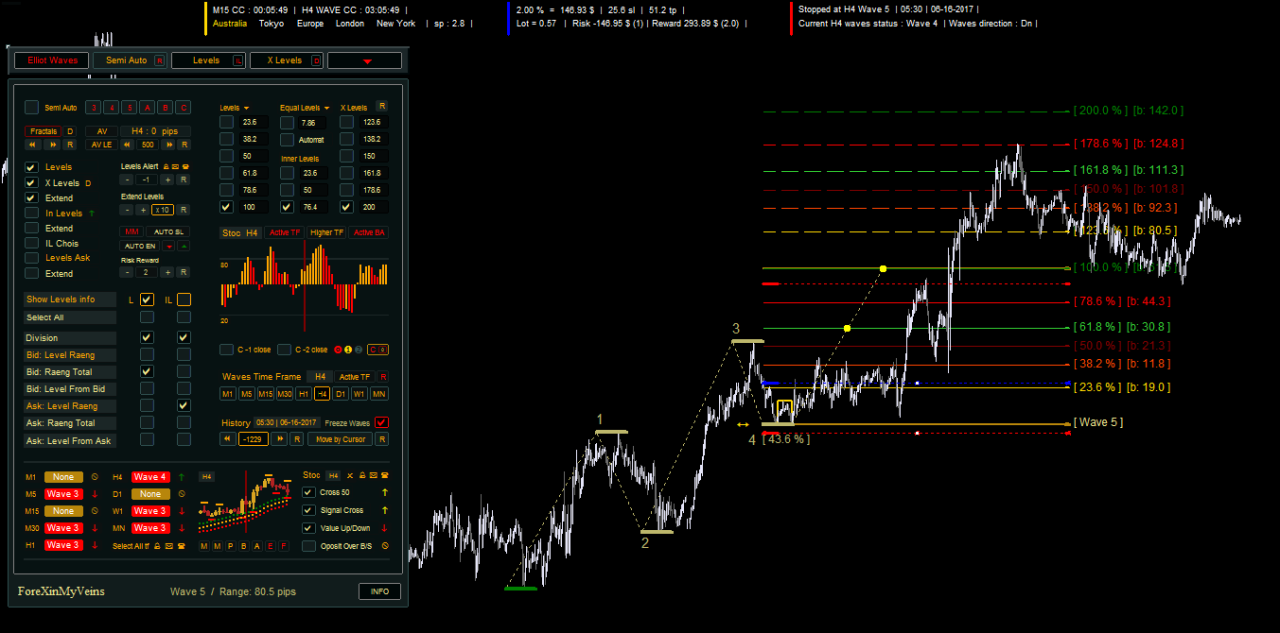

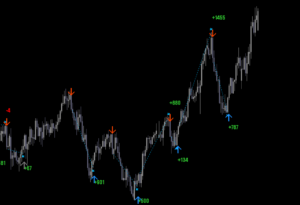

This Auto Elliott Waves is an indicator for MT4 that automatically plots Elliott Waves in the chart. The Elliott Waves Theory is incorporated into this sophisticated tool that has a multitude of features.

It is important to note that the word “you” means “you”. Waves Fully AutomatedThe. Semi-automatic waves Then, there are those who say: Two major features In the Auto Elliott Waves indicators.

Fully automated, the software will automatically place waves in the chart based on the selected timeframe. This software allows traders to focus on their strategy rather than technical analysis. This allows traders to focus on strategy instead of technical analysis.

Semi-automatic allows you to manually place waves anywhere on the chart while adhering to fundamental wave principles. The placement of the waves is guided by you, ensuring a balance between convenience and control.

The Elliott Waves Indicator works with MT4 All Forex currency pairs and other assets like commodities, Cryptos (Cryptocurrencies), binary options, stock markets, Indices, etc. The charts can be displayed in any timeframe, from 1-minute charts to monthly charts.

What is Elliott Waves?

Elliott Wave Theory, a form of technical analysis, is used by traders for forecasting market trends and analyzing financial market cycles. This technique is used to identify extremes in investor psychology, price highs and lows, as well as many other factors. Ralph Nelson Elliott developed it in the 1930s. His theory says that markets follow repeated cycles. He said that this was due to the ever-changing moods of investors, which are influenced by external influences.

Elliott claimed that market cycles result from investors’ reactions to external influences at the time or the dominant psychological state. He noticed that the upward and downward swings in mass psychology always followed the same pattern. He further subdivided these patterns into “waves”.

According to the Elliott Wave Principle markets exhibit patterns. These patterns are directly linked to the psychology of traders: optimism and pessimism. The theory distinguishes two types of waves: impulse waves and correctional waves.

- Waves According to Elliott Wave Theory the impulse waves are composed of five smaller wavelets that move in the opposite direction. These are important parts of the pattern. The net movement is towards the larger trend.

- Corrective WavesThe corrective wave is made up of 3 smaller waves moving in the opposite direction to the large wave. These waves indicate when the market’s trend ‘corrects’ itself.

The combination of the impulse and corrective wave creates a complete cycle of eight waves. According to the theory, eight-wave cycles are part of a bigger pattern. Understanding the current market cycle will help traders to predict future price movements.

The Elliott Wave Theory is a good tool to give a general idea of the direction a market could be heading, but it’s not a tool that can provide precise timing. Analysts and traders still use it to plan trading strategies, conduct market analysis, and perform market research.

What is Forex Trading and how it works?

Elliott Wave Theory is a tool forex traders use to plan and analyze their strategy. Its focus on wave cycles helps predict price movement, by identifying extremes in investor psychological patterns and price highs or lows. Here’s how to use it in forex trading.

- Identifying trends and market cycles First, determine if the market is going up or down. This can be done by using charts with larger timeframes, such as those that show the daily, weekday, or monthly period. Elliott Wave Theory states markets move in a 5-3 wave pattern. The 5-wave patterns represent a general trend, whereas the 3-wave patterns represent a consolidation or countertrend period.

- Price Forecasting Traders can forecast future price movements by identifying wave patterns. If a trader is able to determine that a market’s 5-wave pattern has ended, then he can predict that the next pattern will be a 3-wave pattern. If the market has finished a three-wave correction pattern, a trader should expect a five-wave impulse pattern.

- Calculating Exit and entry points Elliott Waves can also identify possible entry points and exits. When a trader notices that a five-wave chart pattern is nearing completion, they can open a new trading position to capture the three-wave chart pattern in the opposite direction. A trader could decide to exit the market or take profit after a 5-wave pattern if they anticipate a reversal.

- Risk management theory is applied in risk management. The trader who expects to see a 3-wave correctional wave but the price breaks past the start of the previous impulse, as predicted by the theory, will know their analysis is wrong and they should exit the trade.

Elliott Wave Theory, while a powerful and useful tool, can also be complicated and open to interpretation. The same as all trading strategies this strategy does not guarantee results. It should be used in conjunction with other technical analysis tools and fundamental analysis.

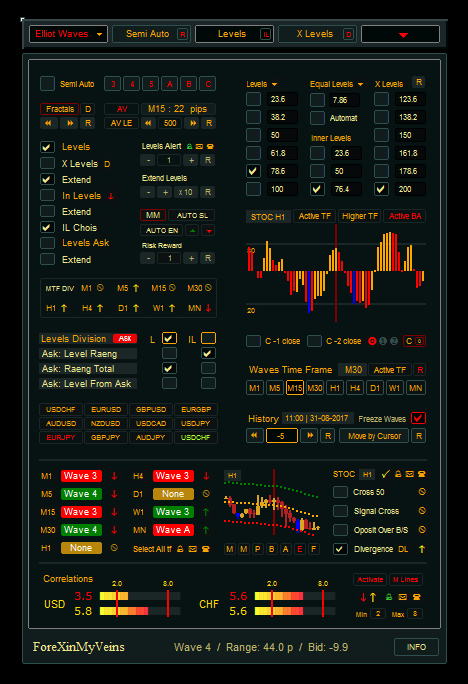

Elliott Waves Indicator – Customize the Dashboard Inputs and Outputs

The Elliott Waves Indicator offers a superior level of customizability. Over 100 input parameters are adjustable. This allows traders to tailor their strategies and risk profiles. Included in the package are oscillators as well as money management settings. Also included is the wave placement.

Elliott Waves Indicator features a comprehensive dashboard with a wealth of information that is easily navigable. Users can customize the dashboard. The user can select the data that they want to view and create customized alerts. This allows for a customized trading environment that optimizes trading profitability and efficiency.

Auto Elliott Waves Indicator: Features

The Auto Elliott Waves has many unique features.

- Automated money management The software automatically manages investments using a risk-reward ratio, which promotes disciplined and risk-adjusted trading.

- Wave Display with Multi Currency and Multi Timeframe: This display features an alarm system that can be set for multiple currencies and timeframes. The panel lets traders easily switch the chart timeframes and currencies.

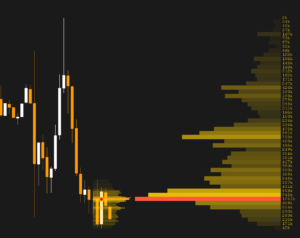

- Comprehensive Mini-Charts: Elliott Waves Indicator offers mini charts that include Candles, Moving averages, Fractals (MAs), Average True Range (ATR), Bollinger Bands (PSAR), Envelopes (PSAR), Parabolic Stop and reverse (PSAR), Average True Range (ATR), and Bollinger Bands (PSAR), offering a comprehensive trading view.

- Divergence-Oscillators: With options from four oscillators – Stochastic, RSI, MACD, or AO, the software provides multi-time frame divergence and signaling.

- Strength of automatic correlations: This newly added feature measures the correlations between different trading pairs.

- Trading levels Fibonacci level: Auto Elliott waves allow the division of trading levels into pips or regular divisions and percentages. It can also create a Fibonacci level.

- Average Price MovementThis innovative feature calculates the average prices between fractal lows or highs for up to 1000 candles back in the wave’s timeframe. It allows accurate price forecasting.

- Trading Levels Internal: This provides internal levels for each of the major trading levels.

Reviews

There are no reviews yet.