Description

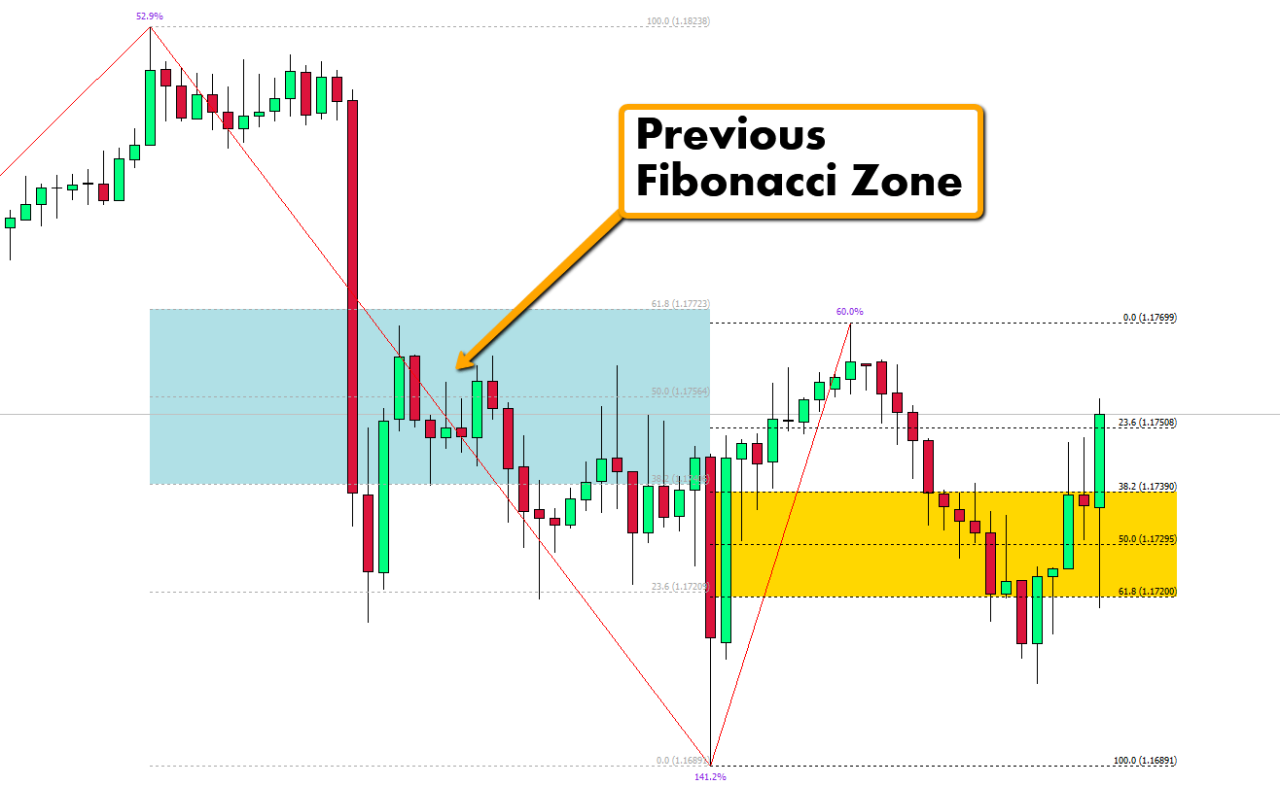

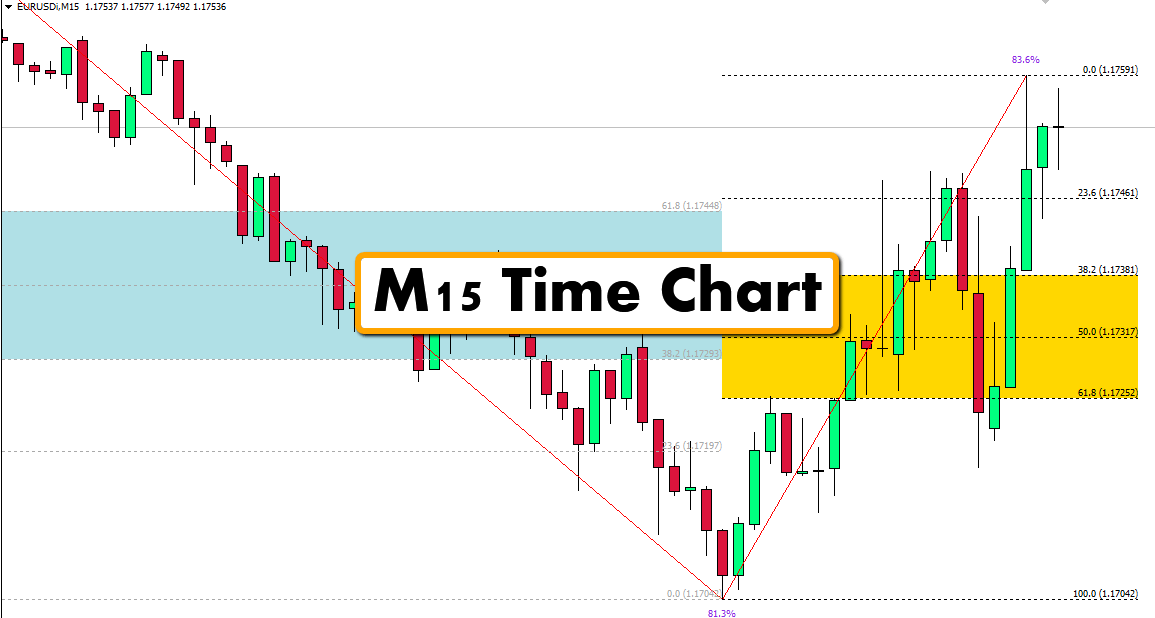

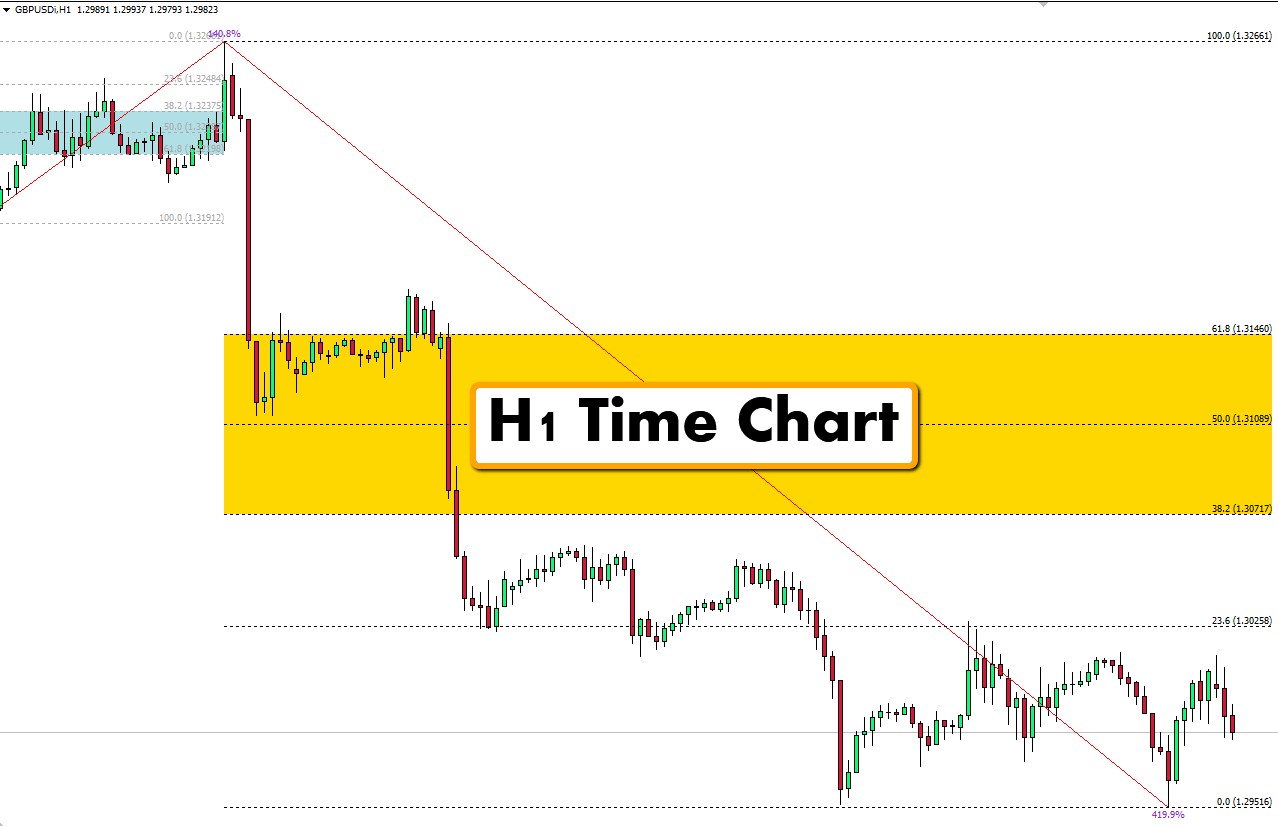

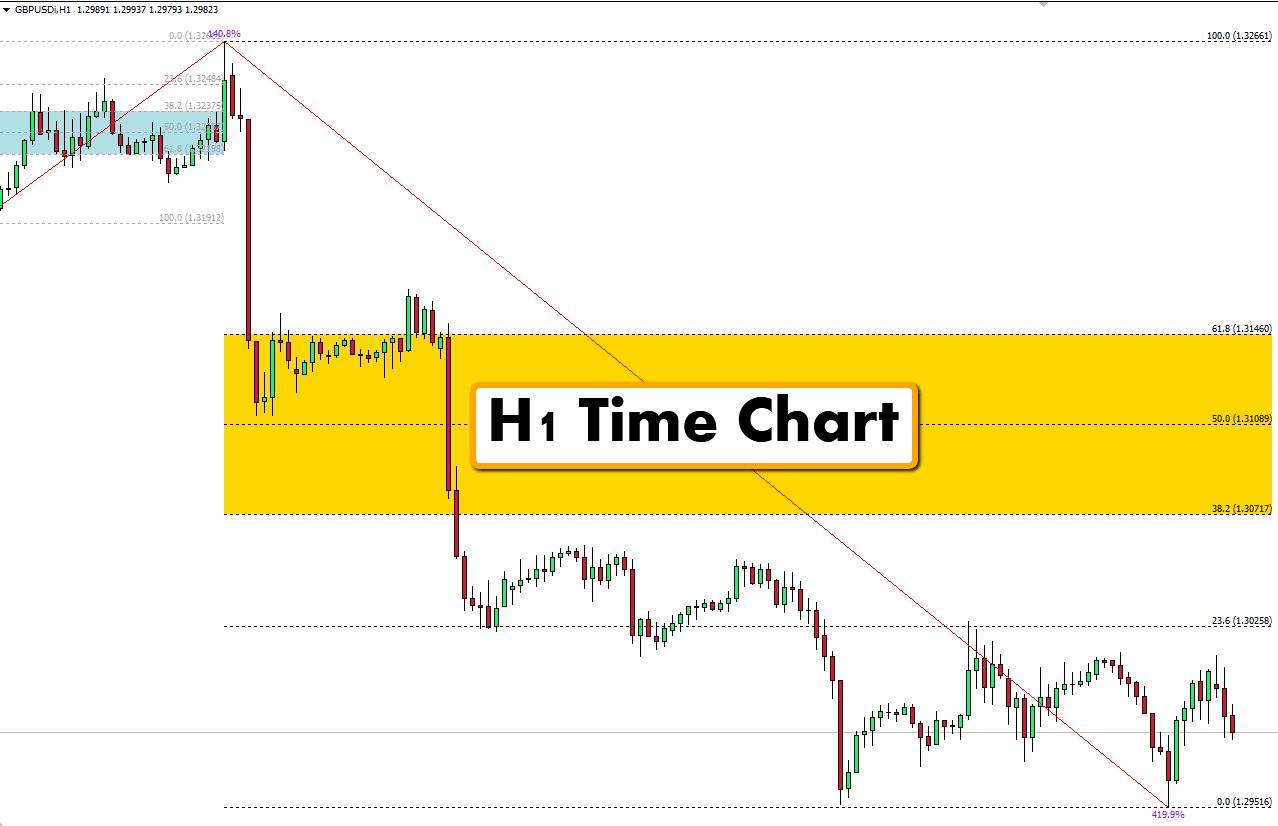

As you can see, the Fibonacci Golden Zone Indictor has not yet provided a clear signal to sell.

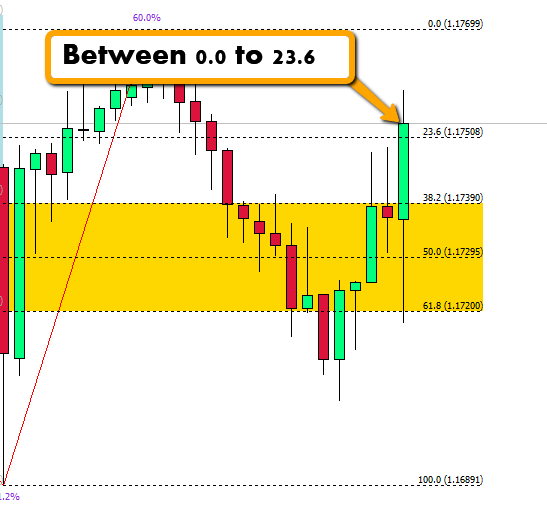

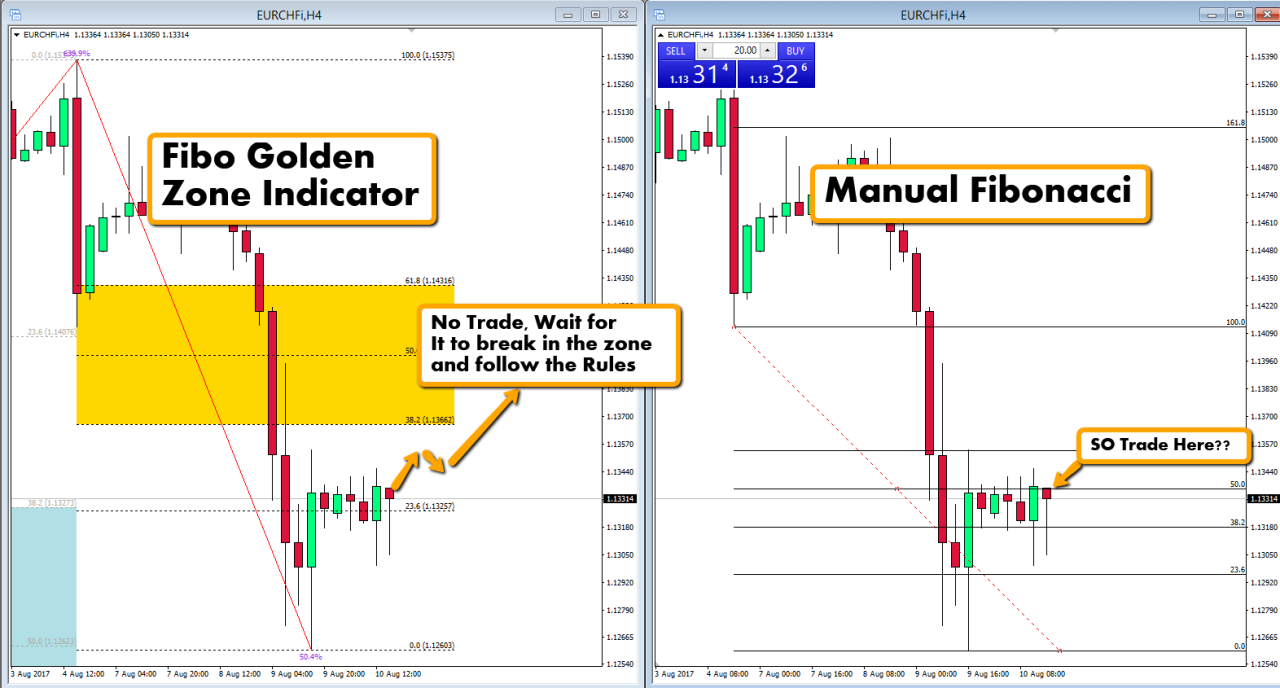

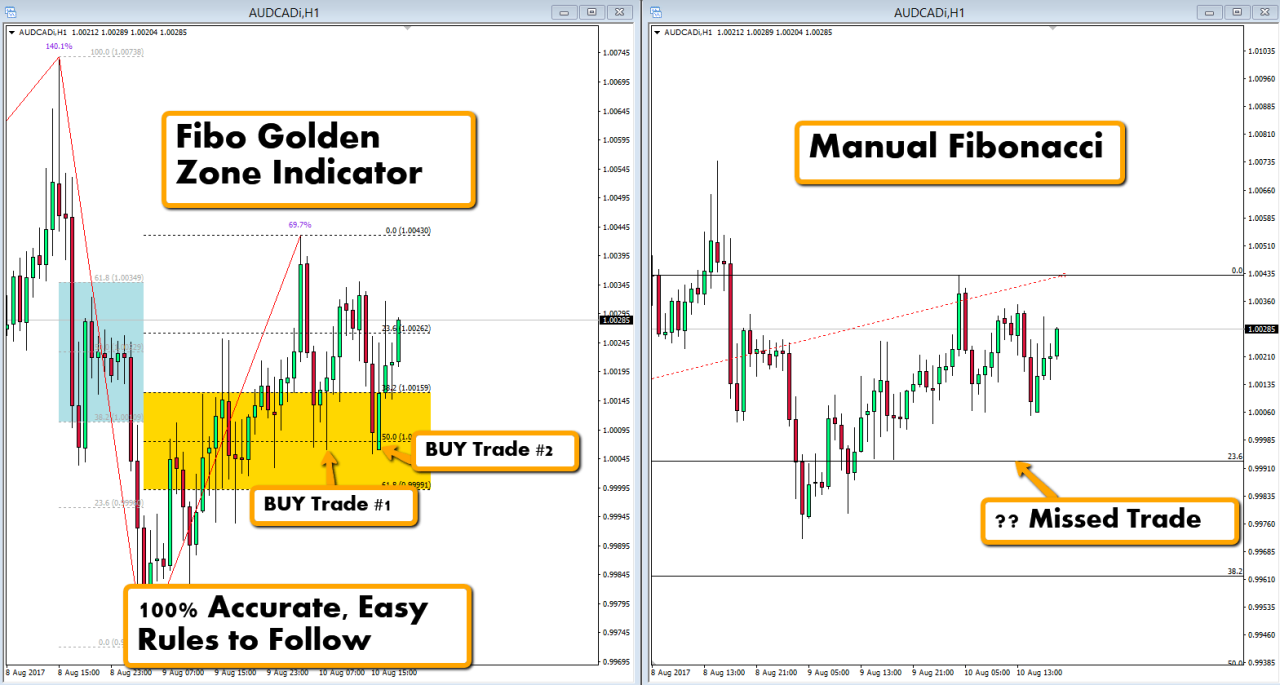

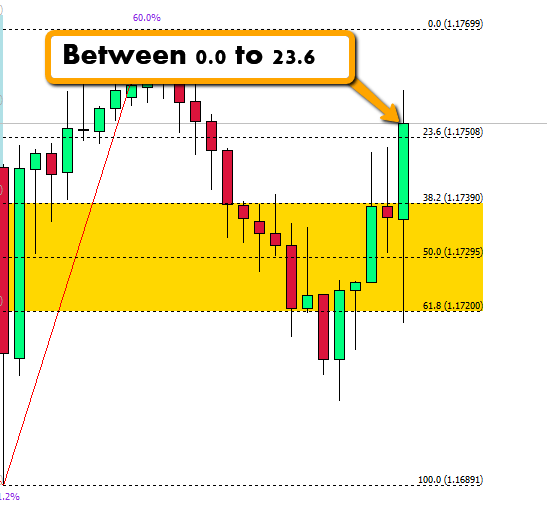

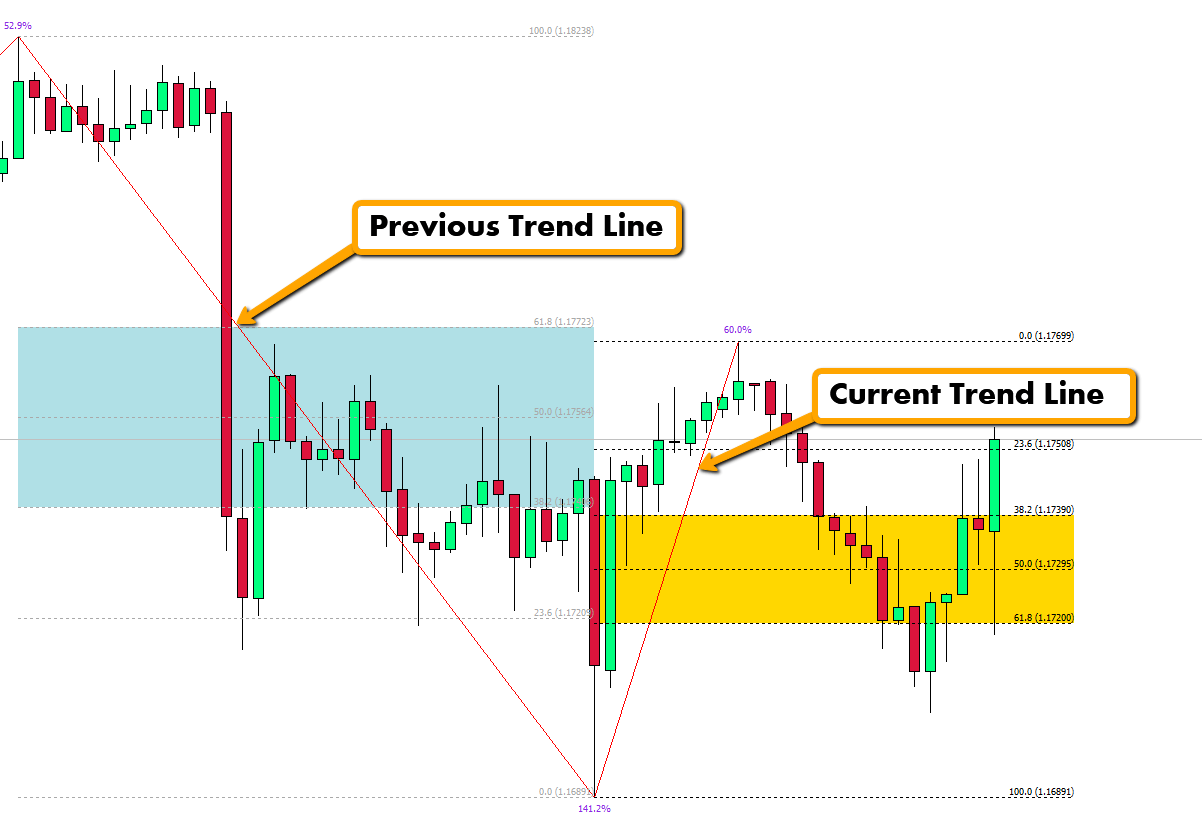

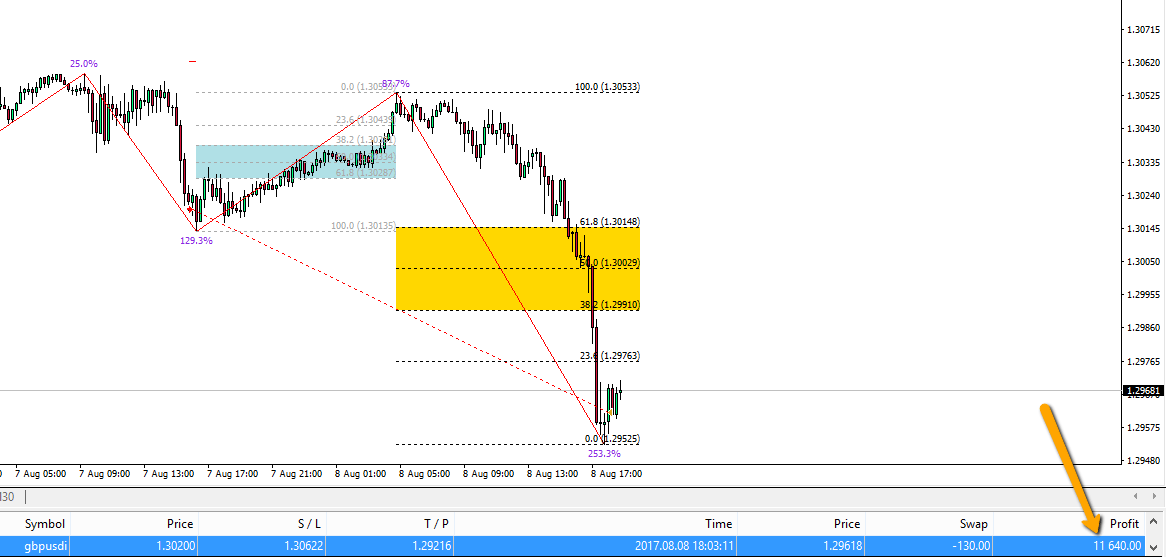

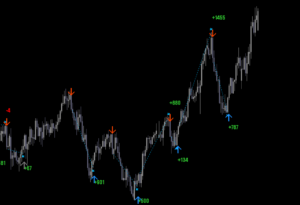

See how easy it is to trade pullbacks using the Fibonacci Golden Zone Indicator in these four examples?

It’s amazing how the times change…and how one big discovery can change an entire life!

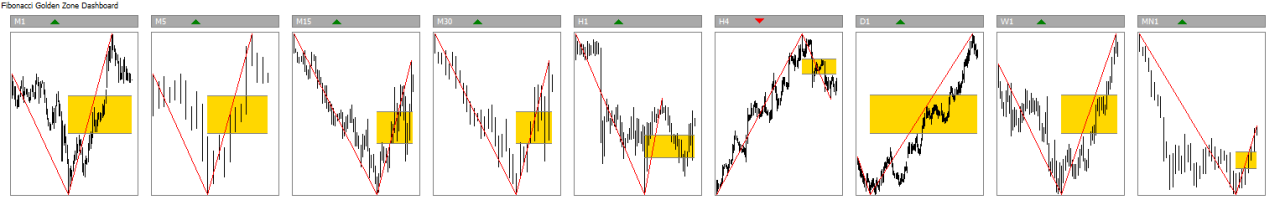

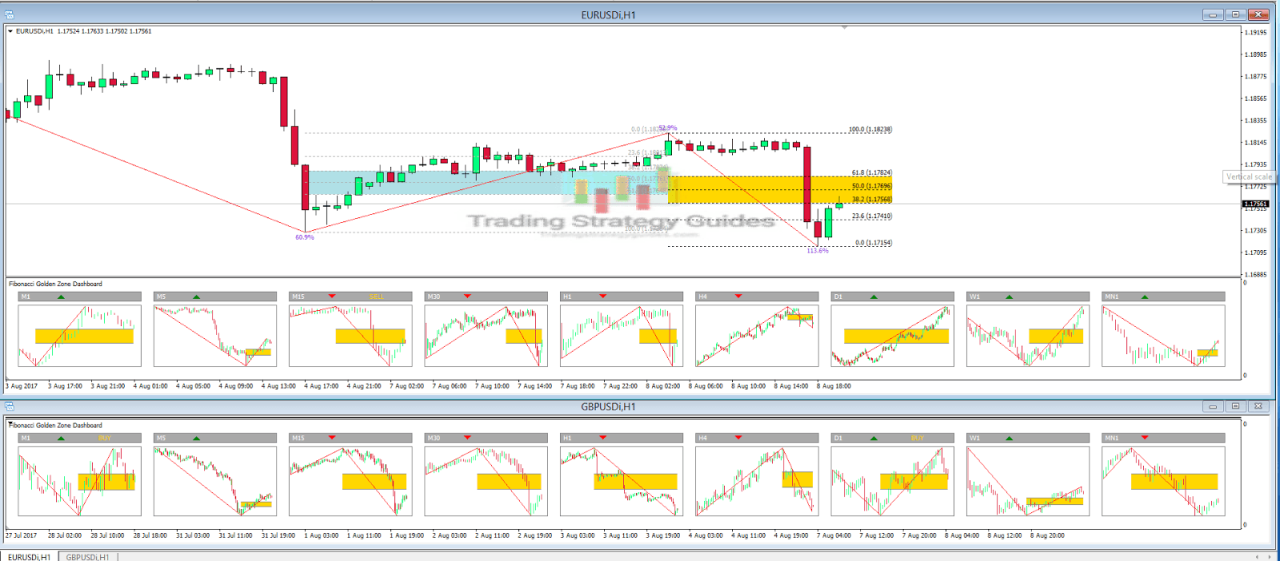

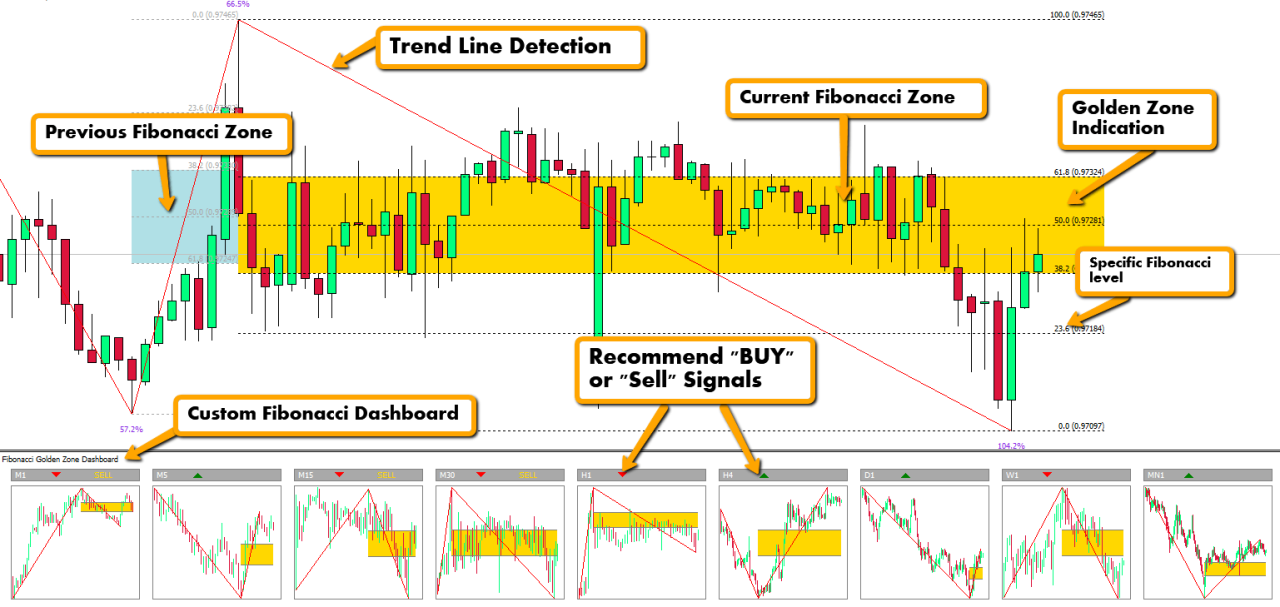

The trader can choose the market, timeframe and the currency they wish to trade.

Fibonacci Dashboard can be viewed only for a specific time period.

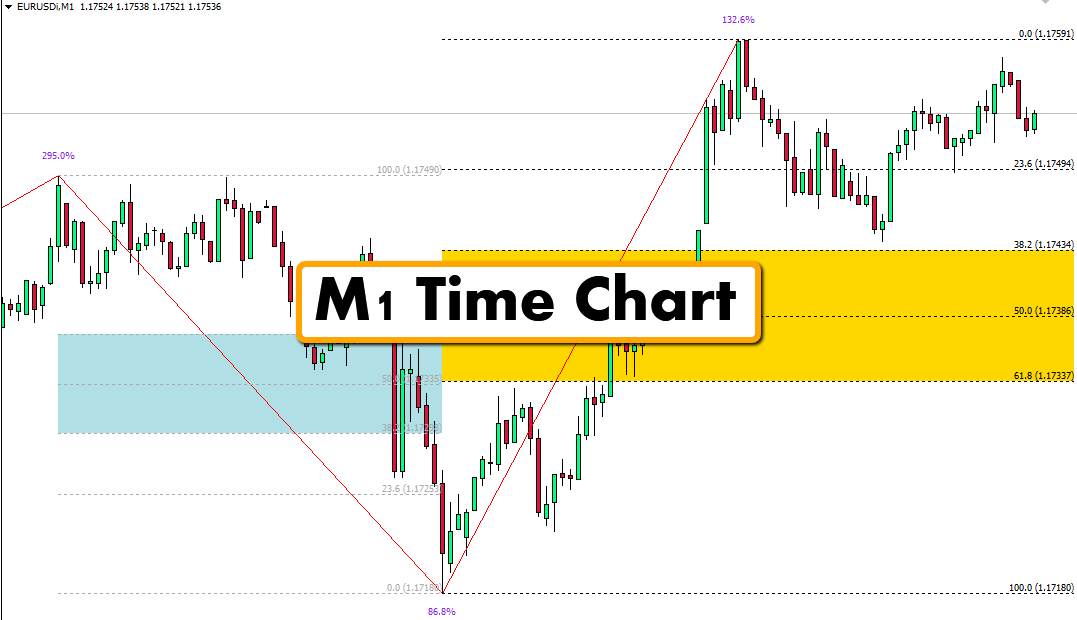

All of us have busy lives, and we understand that you can’t stare at charts all day.

This allows you to know exactly where the action is in terms of price at any given time! It is an enormous benefit, as we have missed many entries but not because of the pop-up alert.

Reviews

There are no reviews yet.