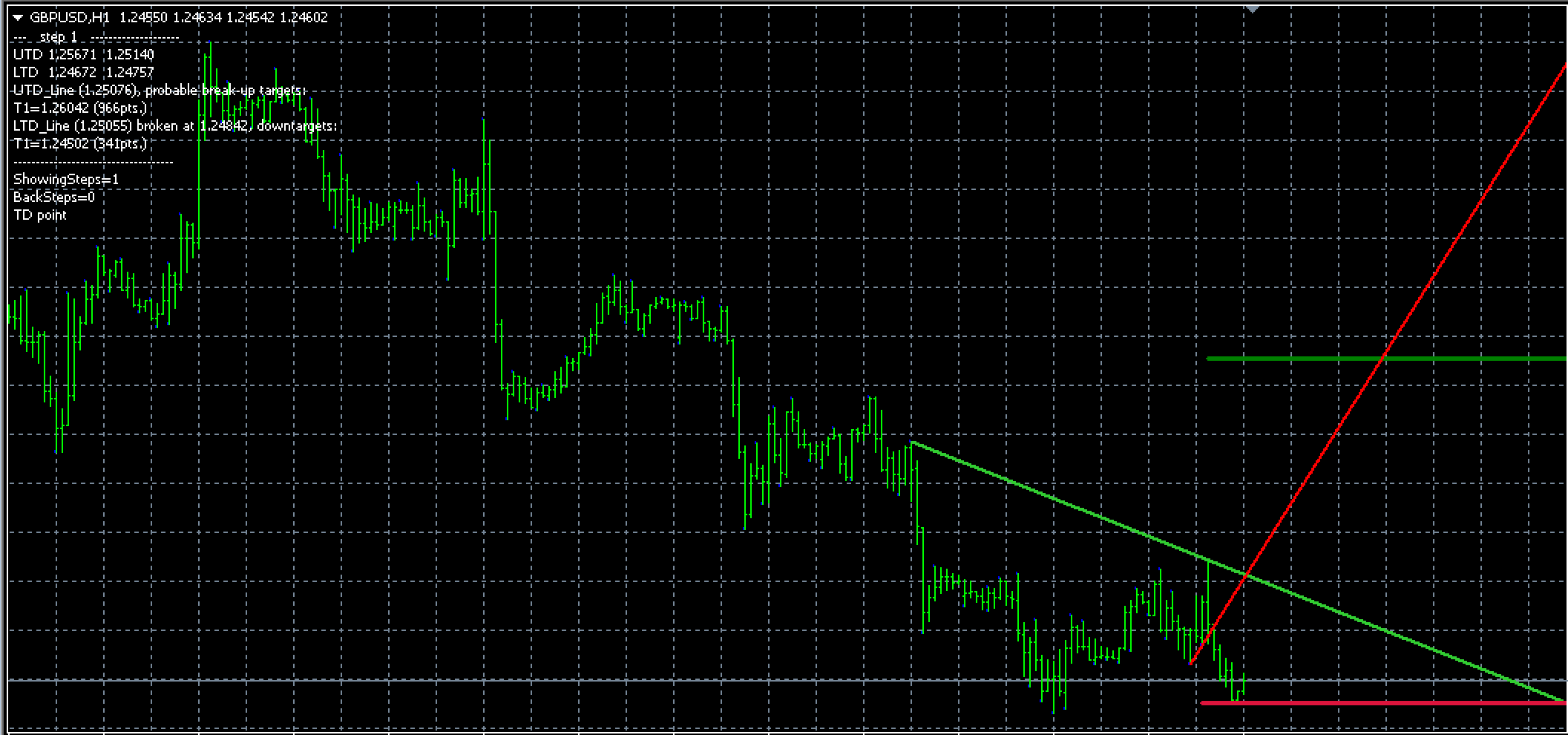

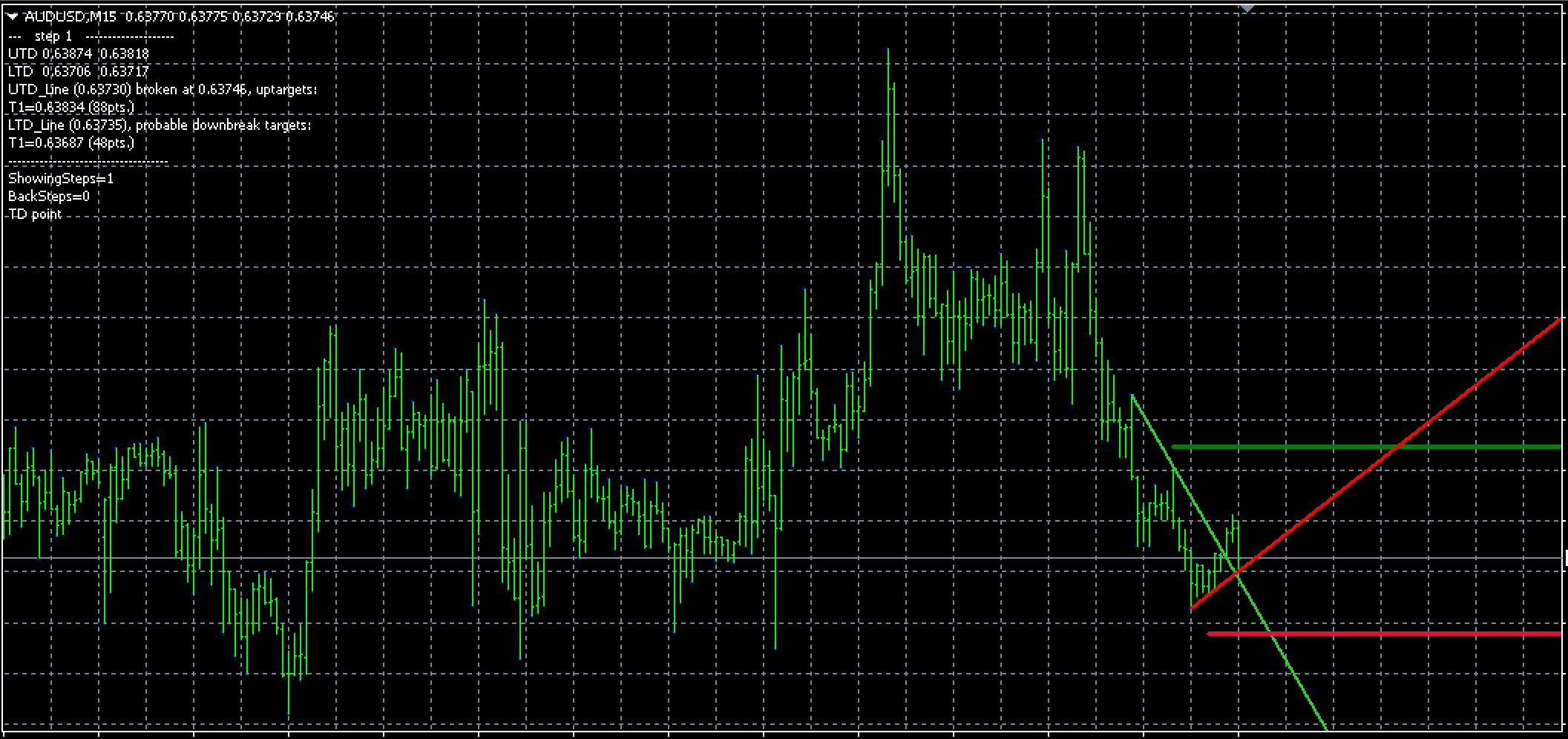

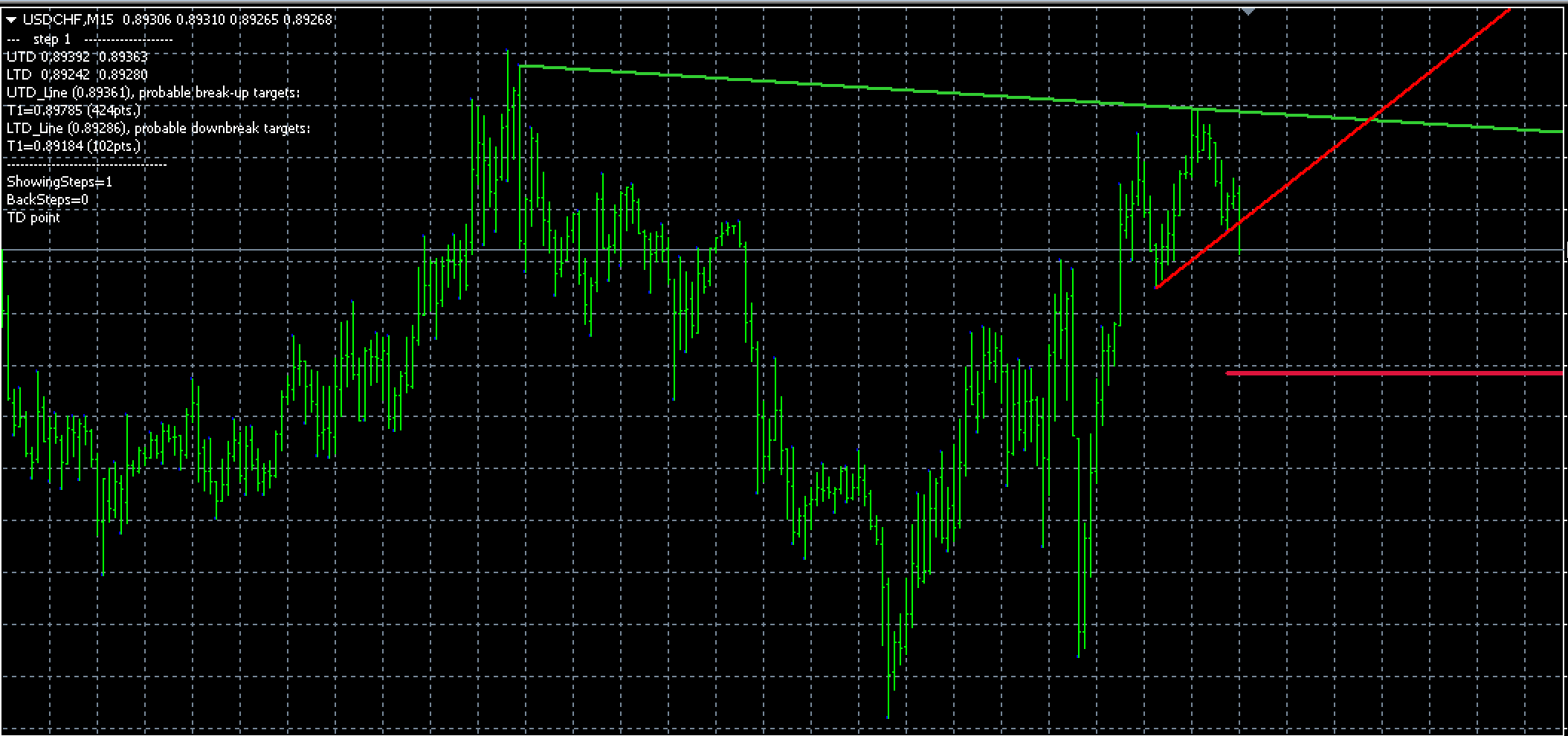

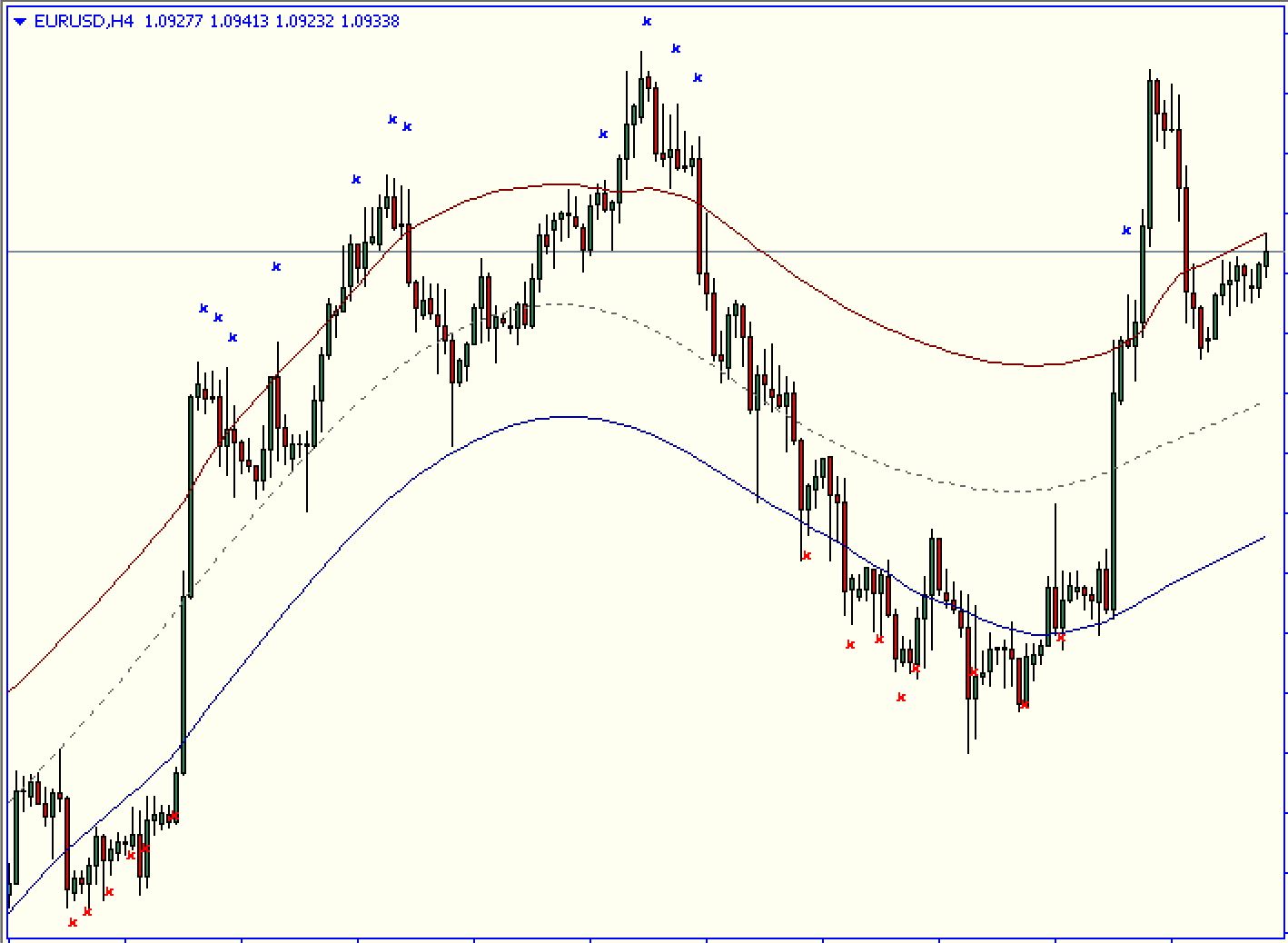

The DeMark trendline The Trader Indicator can be described as an MT4 indicator that plots trendlines in order to determine which direction the trend will take. These are also levels of resistance and support. The indicator shows two diagonal and two horizontal support resistance levels to illustrate how the trends are moving. The diagonal lines consist of lime green and red. The red line is called HL1, and the lime green color line is LL1.

The horizontal lines are made up of crimson and crimson colors. This green line of color is called HC1, whereas the red color line with crimson is LC1. This indicator displays text in the upper left corner of the chart. The text discusses levels of the price and potential breakout goals.

In addition to its textual content, it draws dots on the candlesticks. The indicator works best with longer timeframes, as it could generate false signals when using shorter timeframes.

A trendline indicator for traders from DeMark Signals for buy/sell

To discern the signals for buy and sell, traders must look for diagonal trendlines. If a red-colored line appears, it indicates the level of support, and traders can take it long. When the lime green-red color is seen in the market, it’s a resistance line, which means traders are allowed to take a short position.

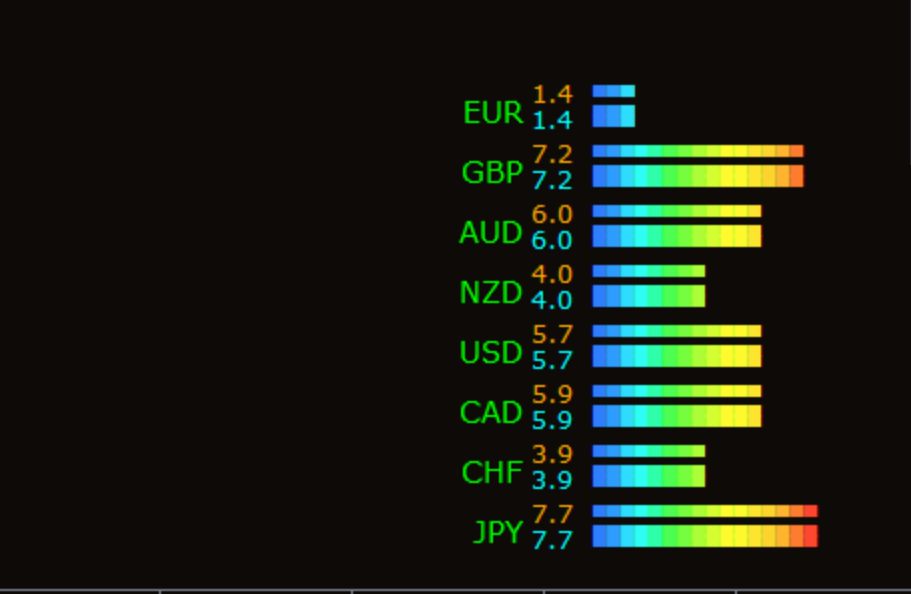

The green and red crimson horizontal lines represent both the lower and upper levels. The red color indicates the level of support, whereas the green color depicts resistance levels. Sometimes, the indicator does not plot any of the lines horizontally. In this instance, traders have to determine that diagonal line. Also, traders can apply this DeMark Trendline Trader Indicator along with other indicators such as the RSI or MACD to further confirm signals.

Conclusion

The DeMark trendline The Trader Indicator draws diagonal and horizontal levels of resistance and support to indicate what direction is trending. It also provides alerts on price breakouts. Additionally, you can download the DeMark TrendlineTrader indicator for free on our website.