Positional Trading Strategy Guide

Positional trading is a great way to increase your chances of making large, profitable trades.

Positional trading involves holding trades for a long time. This allows you to take advantage of trends that continue to move in your favor and increase your profits.

This article explains what positional trading means and shows you how to use it.

Table of Contents

What is a Positional trading strategy?

Position trading is an extended trading strategy that allows you to make profits by holding your positions for several months or even years.

Position traders ignore the short-term movements in price and take a longer-term perspective.

Many traders view positional trading as a form of buy-and-hold investment. The main difference is that with positional trades, you can benefit from both price movements higher and lower.

You can make more money with position trading because you can hold your positions for longer. However, it also means more risk.

As we have discussed in this article, position traders use a combination of technical and fundamental analysis.

Positional Trading: The Best Markets

Some markets are better suited for position trading than others.

Stocks, commodities, and major indices are the most popular assets and markets for positional trading.

Position trading is not suitable for markets prone to high volatility such as Forex or cryptocurrency.

Due to the nature of position trading, which is a long-term strategy, the best markets will be those that allow a trader to get a clear picture of the value and potential future price increase or fall.

Position Trading vs. Swing Trading

The main difference between swing trading & position trading is how long each trader wants to hold the trade.

A position trader looks to make trades that they can hold for several months or years. These trades may also be expanded as they begin to move in the traders’ favor.

Swing traders are interested in profiting from swings both upwards and downwards. The trades that are held by swing traders can range from hours up to days.

The Best Indicators For Positional Trading

Position trading uses many of the same indicators as other types of trading, but some are more effective than others.

The average true range and longer-term moving averages can be extremely helpful for managing trades and assessing the market.

Long-term moving averages

Slower reacting moving averages are a popular indicator for long-term traders. The most common is the 200-period Moving Average.

This moving average is closely watched by market participants in the longer time frames as it gives a clearer picture.

You can use the 200-period moving average to see if a price is above or below the moving average in a higher or lower trend.

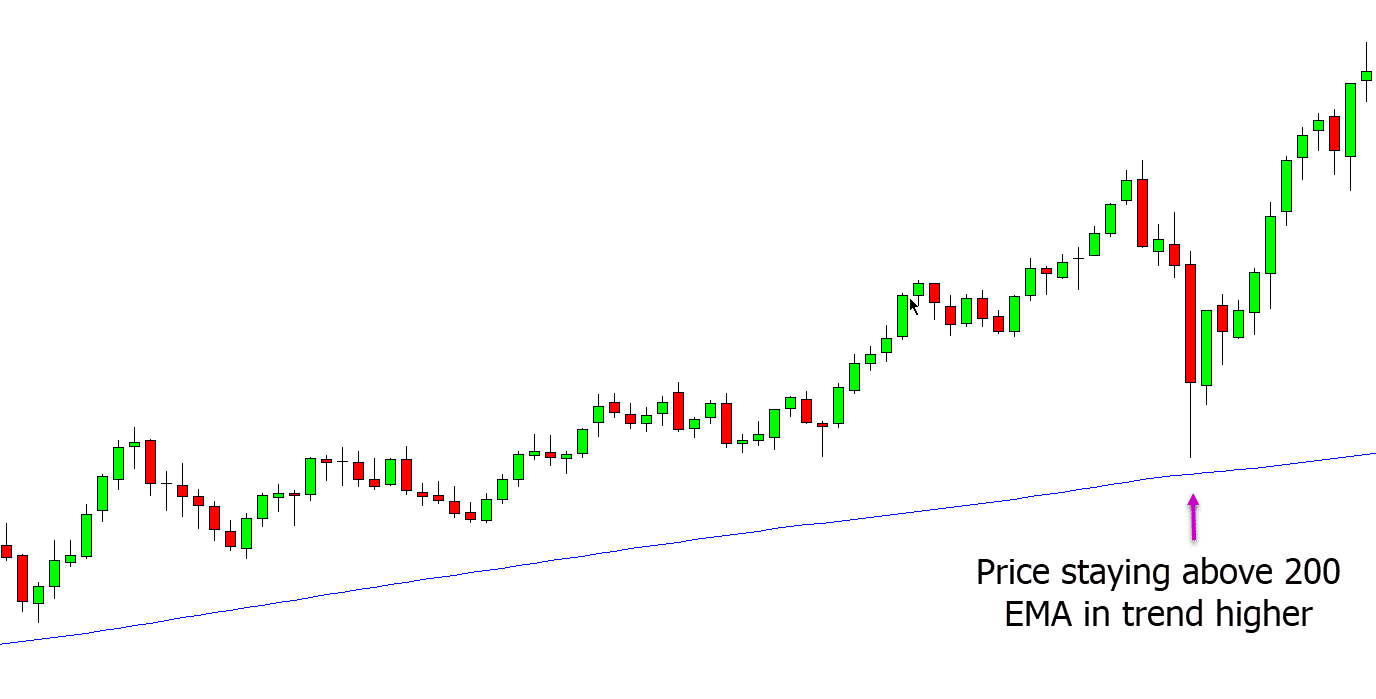

The 200-period moving average can also act as dynamic support or resistance for longer timeframes. In the following example, we can clearly see that the price is rising above the 200-period moving average. You can see that every time the price falls below this moving average it finds support, and then bounces higher in line with the trend.

Long-Term Trading Strategies

Breakout Trading

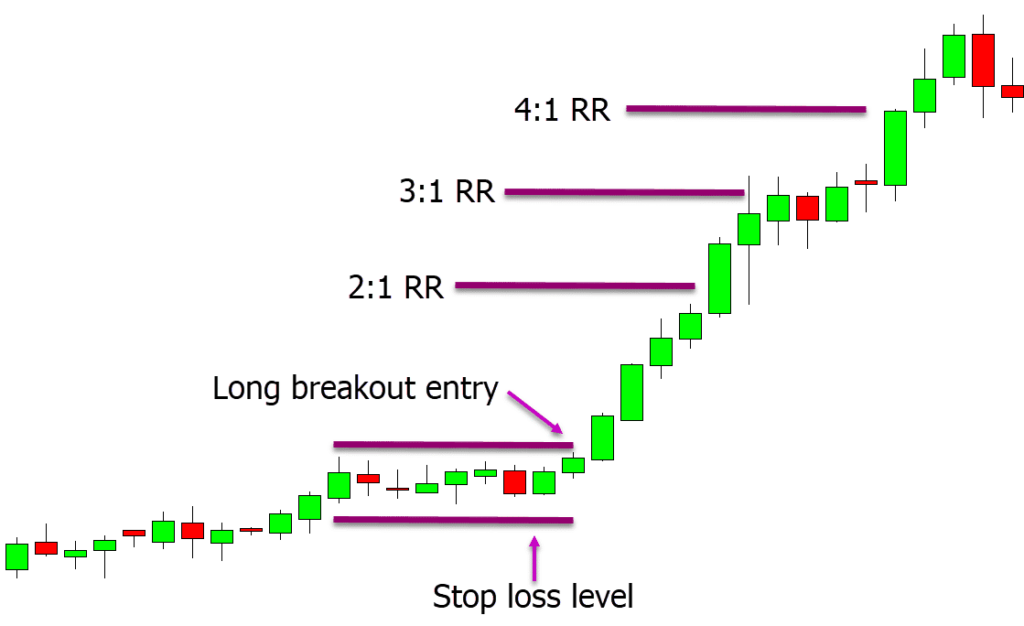

Breakout trades are a popular way to position trade.

You can make a winning and long-lasting trade if you get in on a breakout early.

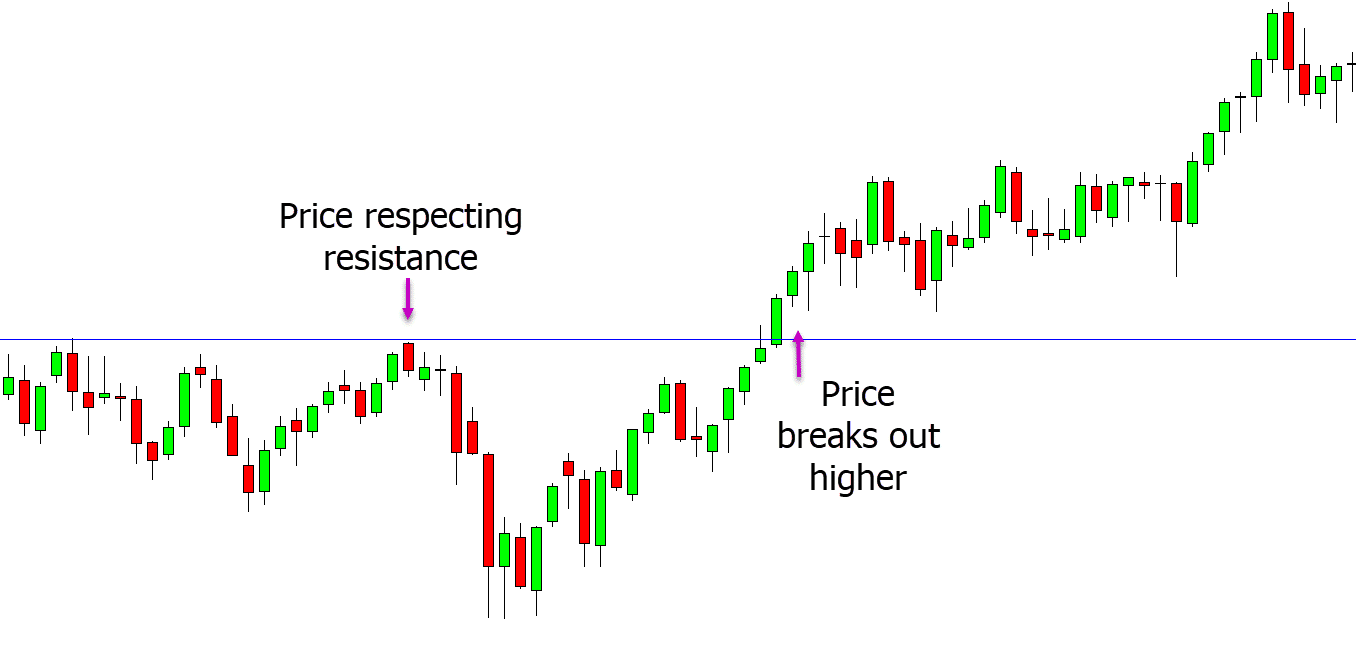

In the example below we can clearly see a region where multiple times, price has encountered resistance.

We could take long breakout trades when we see the third retest. This is if the price breaks this area.

Support and Resistance Trading

It is also possible to make high-probability trades by looking at the support and resistance levels on higher time frames, such as weekly or monthly charts.

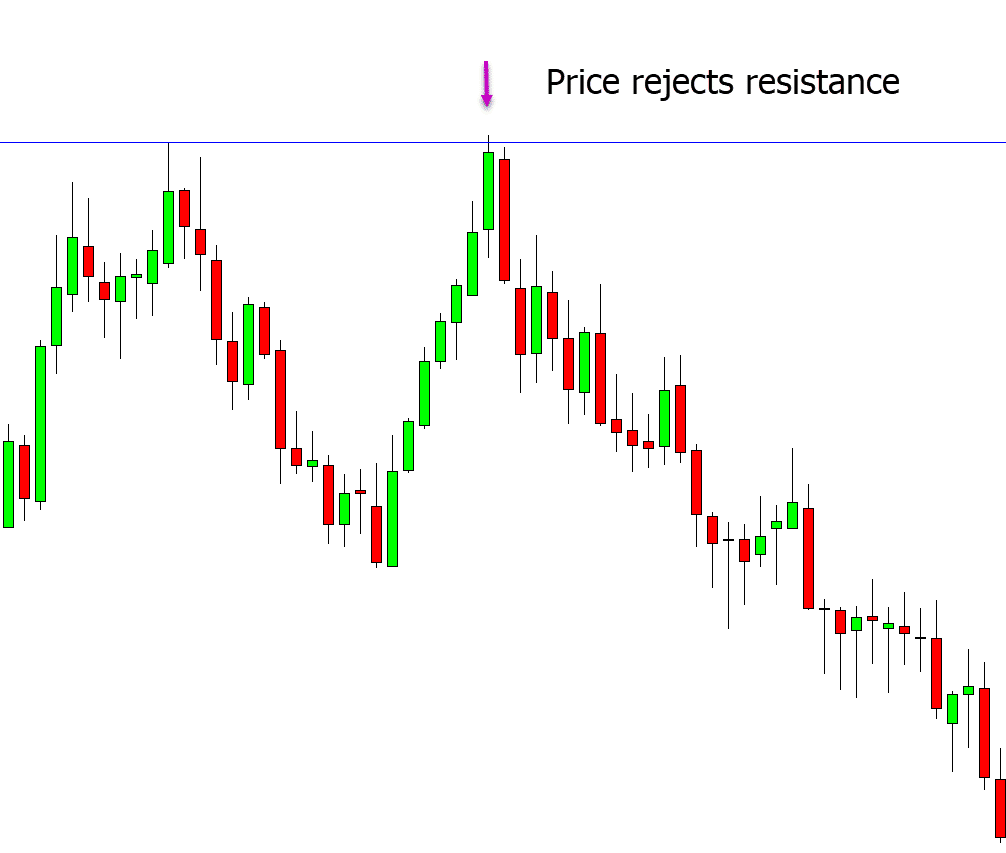

In the example below we can see how price is starting to reject a clear resistance level.

If we see this rejection we can look for short trades to profit from the move lower.

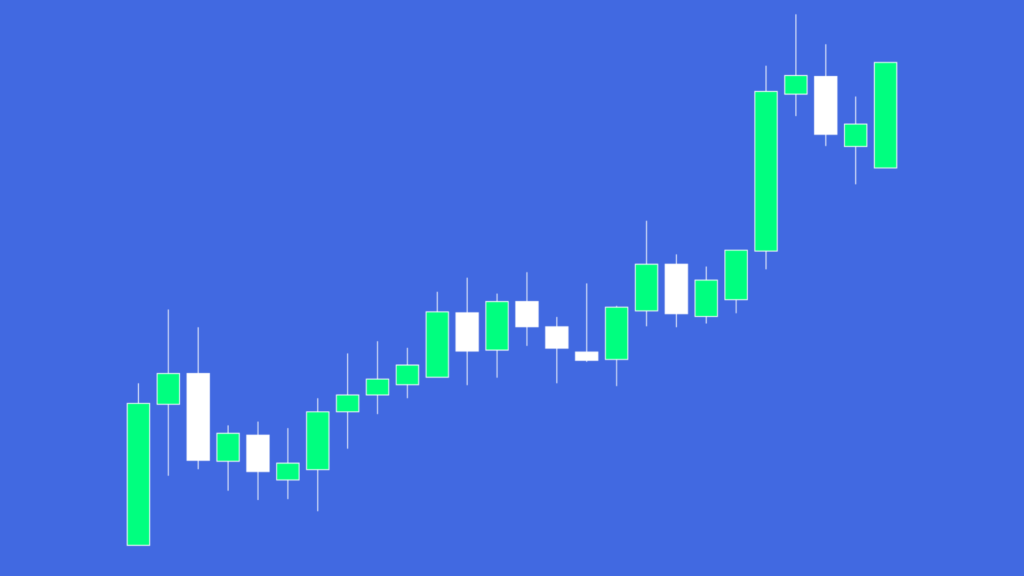

Trend Trading

Position trading can benefit from a clear trend.

Give your stop room to move and you will be able to trade for a very long time, as the trend continues to go in your favor.

You can also use a “pyramid” strategy when trend trading to continue entering positions and make more profits.

Fundamental Analysis

Position traders use fundamental analysis in some form to evaluate their trading.

Position trading occurs most commonly on major markets, such as stock exchanges or indexes. Traders will use fundamental data to get an idea of the asset’s value.

These data can be used to help determine whether an investment is overpriced or undervalued. Then, you can combine them with your own technical analysis in order to refine your trades.

Boosting Position Size Profits With a Pyramid Strategy

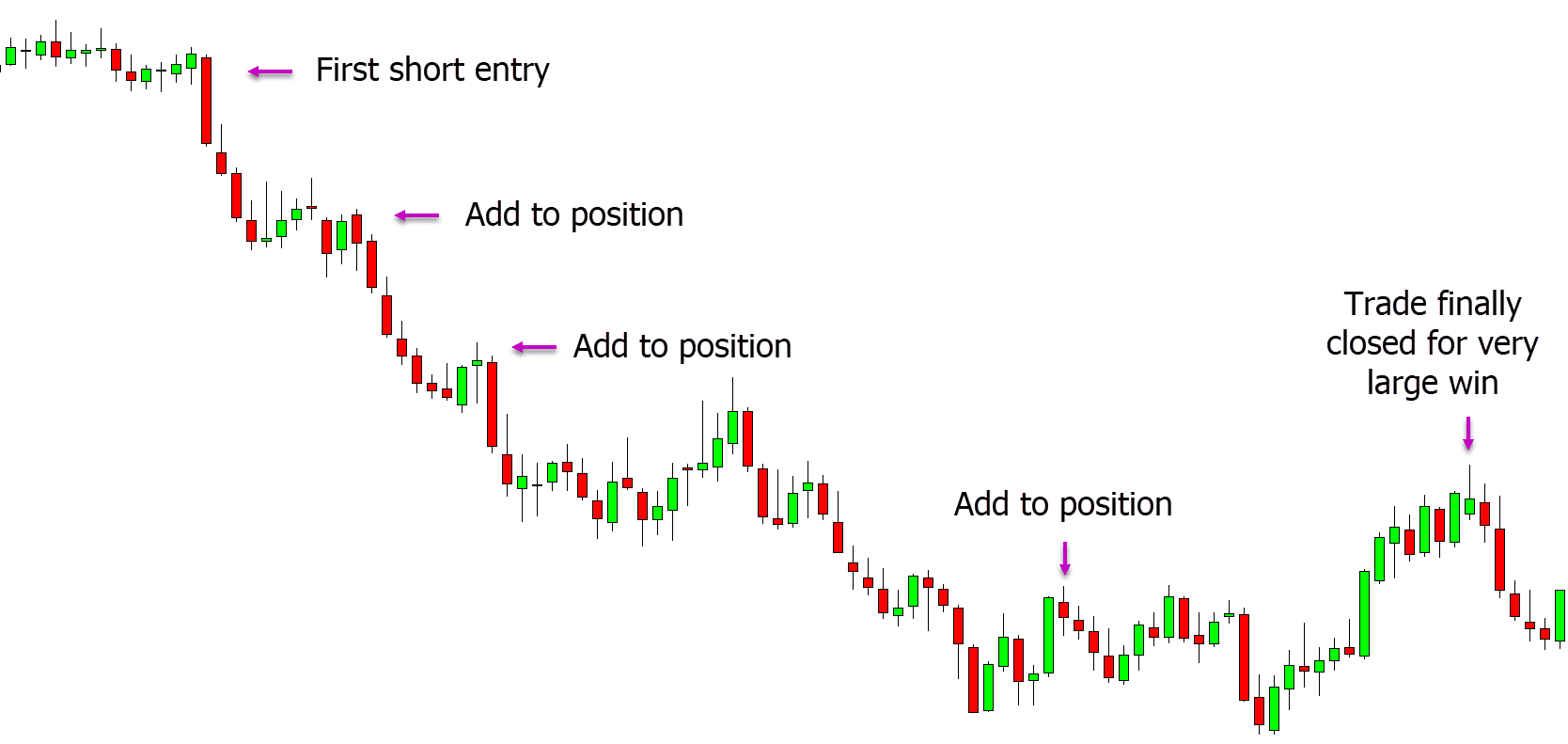

You can increase your profits by increasing your winning trades when they go in your favor. This is called “pyramiding”.

In a pyramid scheme, you will be constantly adding new products and looking for price increases in your favor.

You can make huge profits when you correctly use pyramiding. You can see in the example how the number of short trades increases as the price falls. Finally, the trades are closed when the trend changes and the price goes back up.

![PipFinite Volume Critical [Indicator Reviews]](https://mq177.com/wp-content/uploads/2023/05/5374034a40c8d6800cb4f449c2ea00a0-6.jpg)

Responses