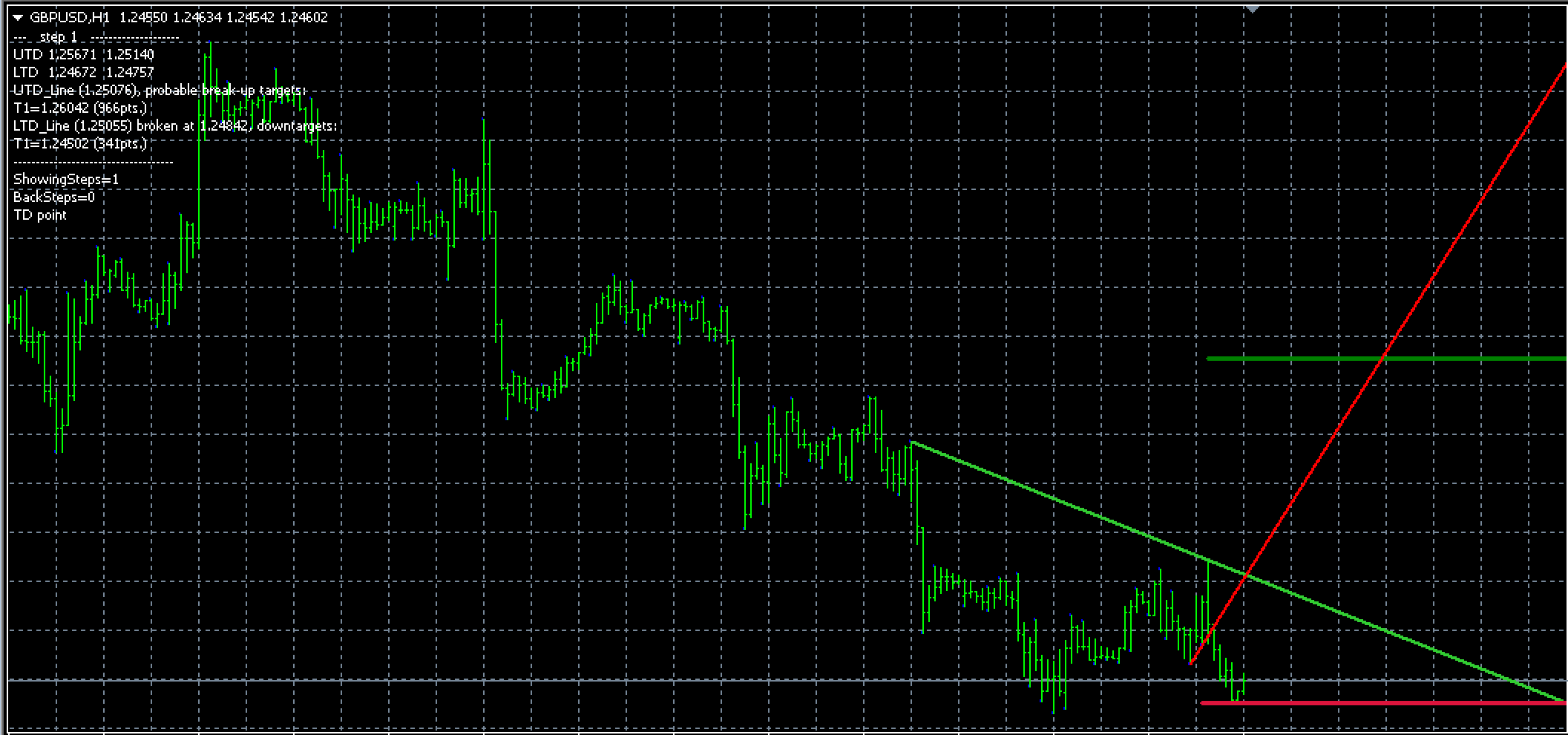

The TTM Scalper indicator identifies potential price rollovers in the Metatrader and converts them into super-swing trade signals.

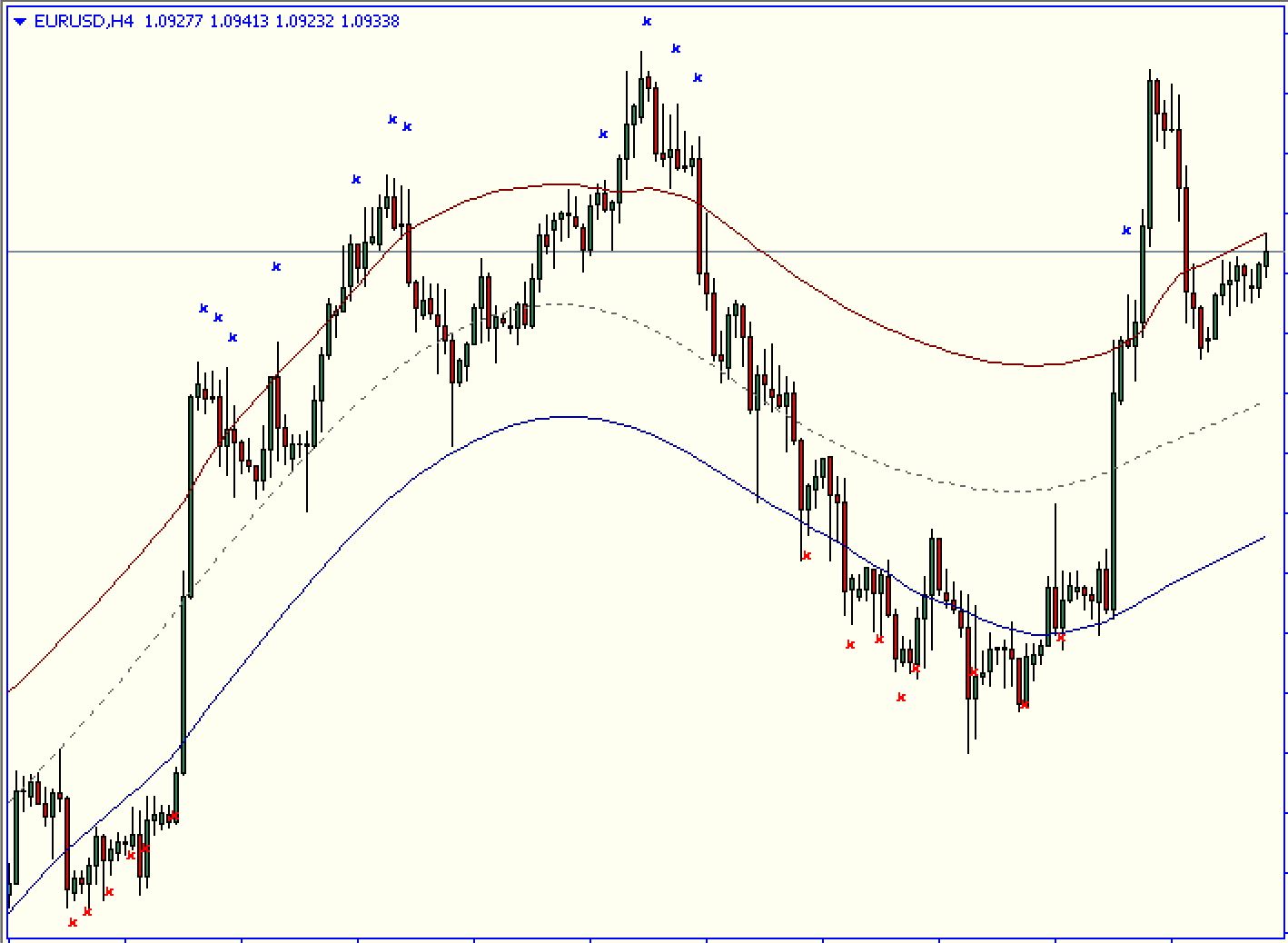

It is a technical indicator that helps you forecast short-term gains/losses and long-term gains/losses so that you can take advantage of strong price momentum. It is based on reversal patterns and identifies potential price levels at retracement levels under tailwind market conditions.

TTM Scalper is compatible with MTF chart analysis. This allows you to trade both intraday and day trading. Our review found that the 1-minute to 4-hour charts are the most useful time frames for this indicator. It works with any of the financial instrument charts listed in MT4, including stocks, ETFs, and commodities.

This guide will show you how to use the TTM Scalper indicator (MT4) to determine the likelihood of trade setups.

How to use the TTM Scalper indicator in MT4 to spot potential swing trade signals

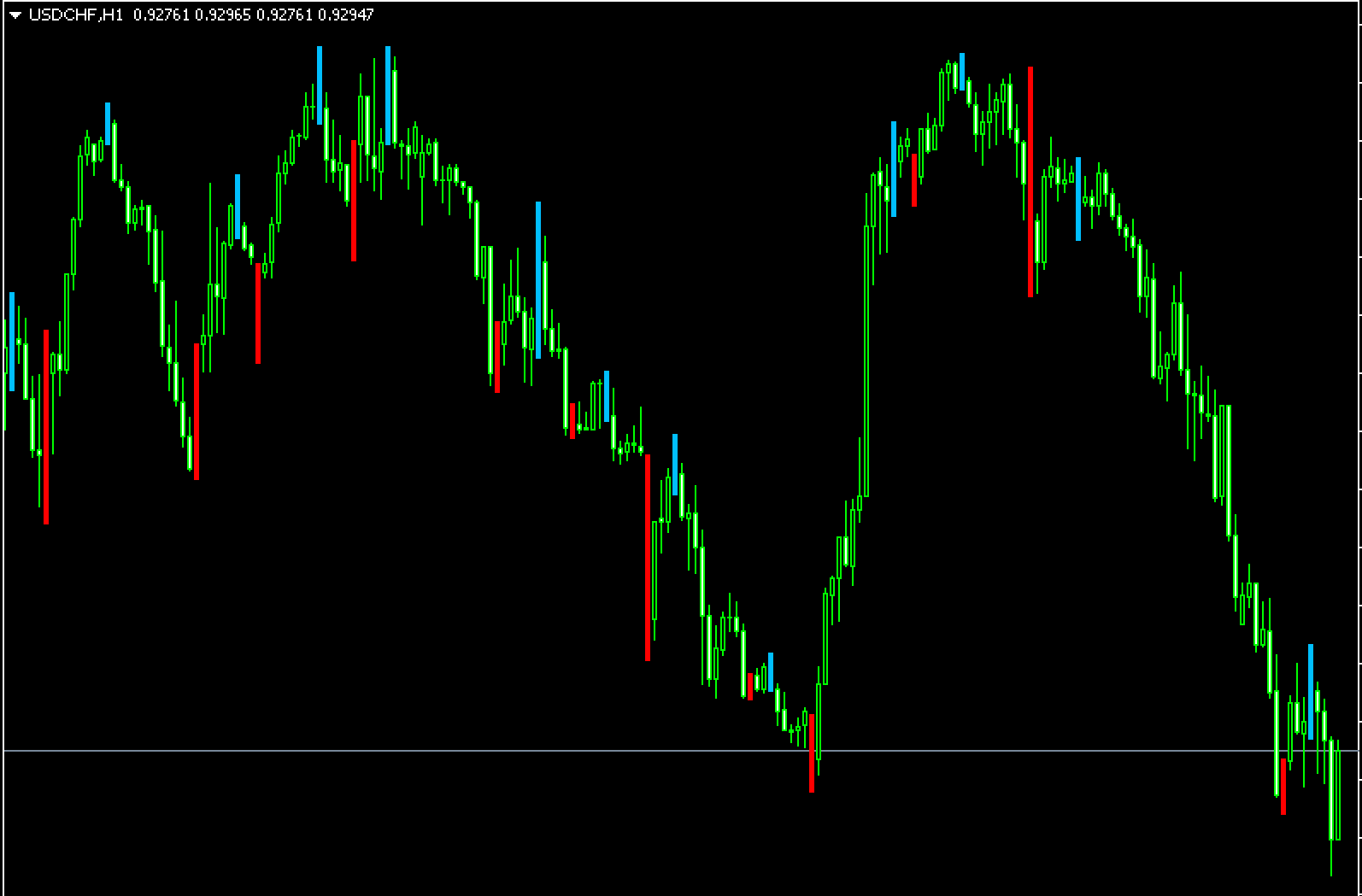

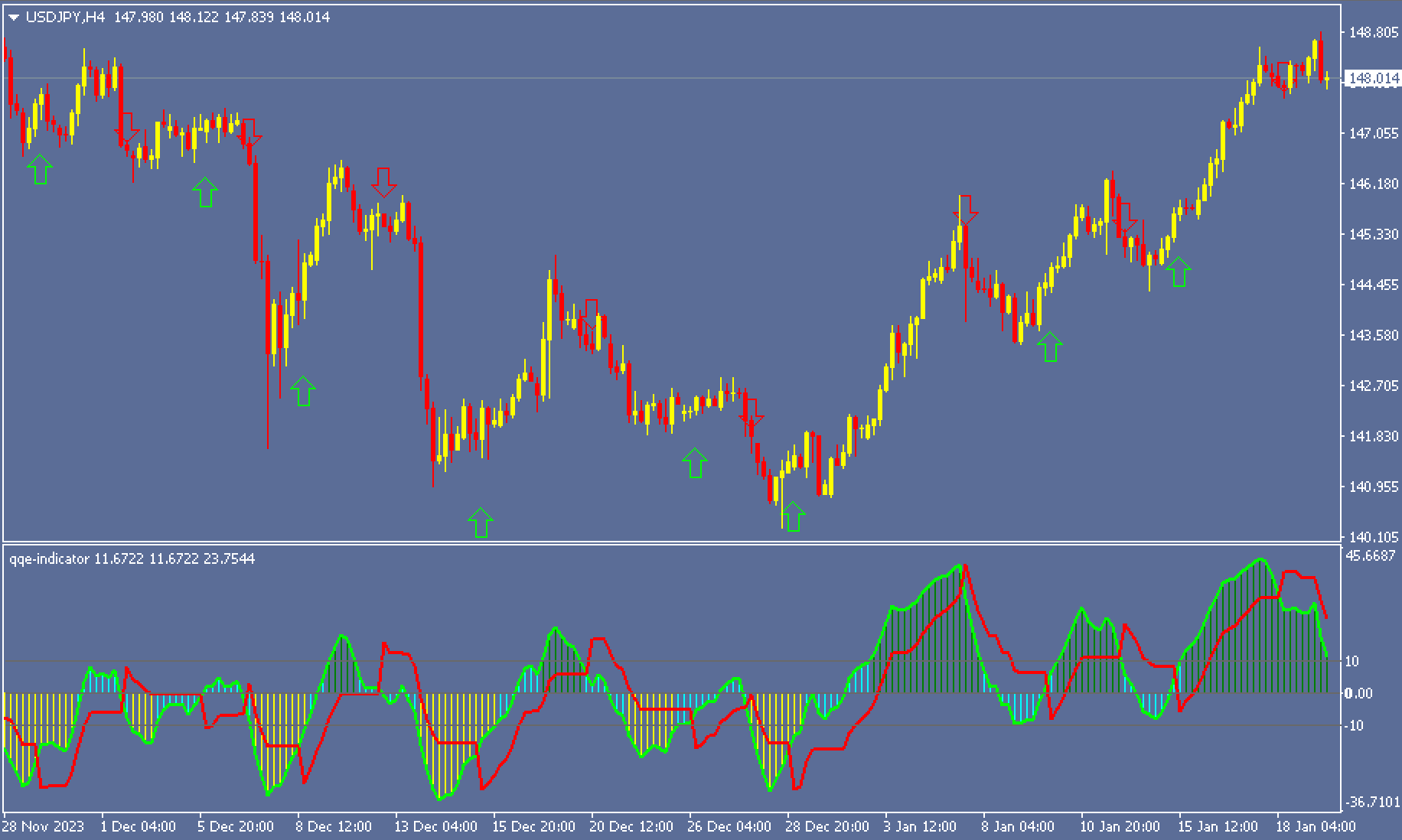

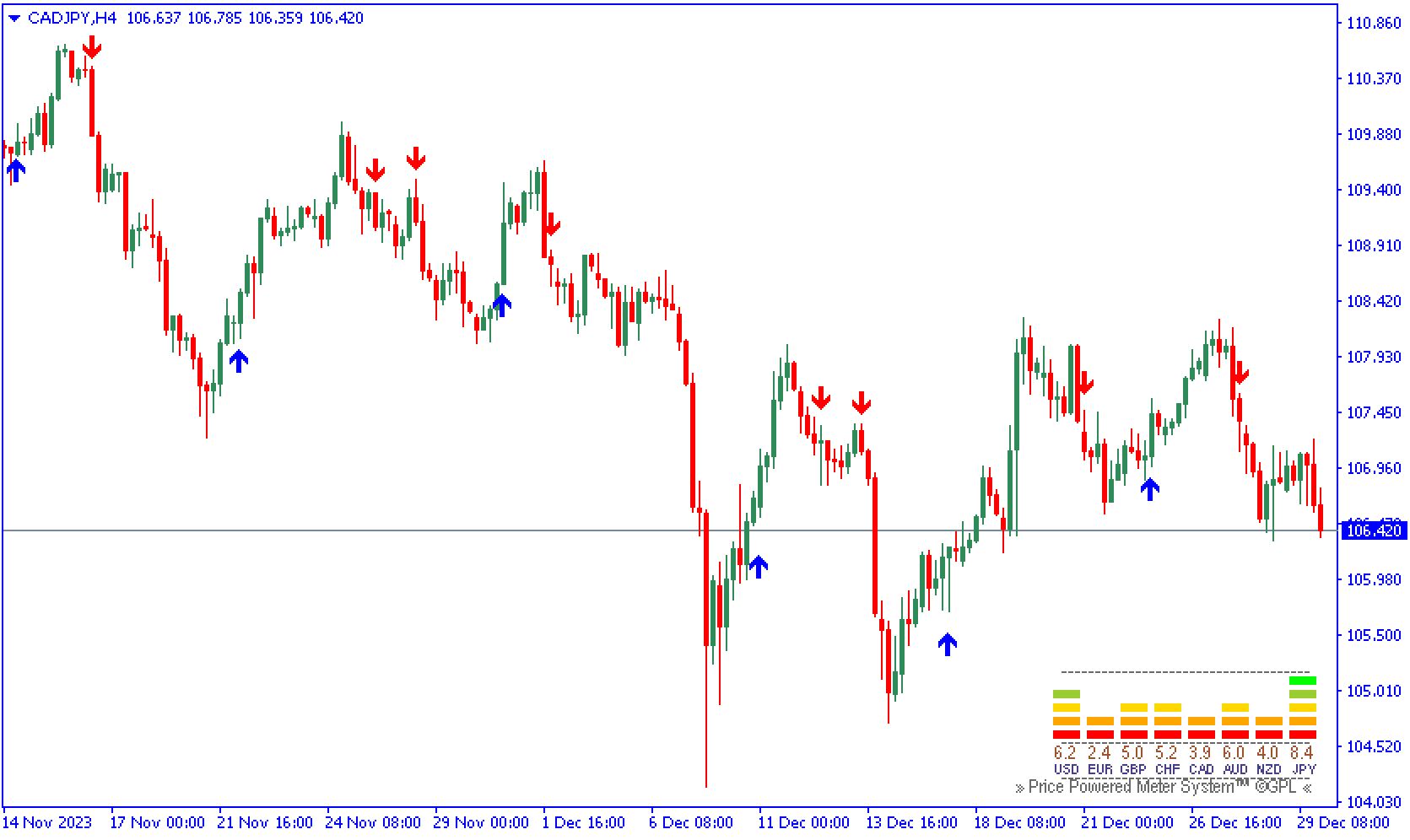

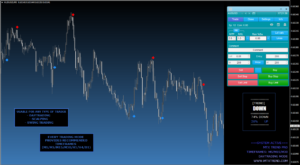

The TTM Scalper indicator detects price action patterns that are reversing. It detects valid areas of price action by focusing on potential highs or lows in the price band. It plots colored bars at the top of price candles to indicate reversals. These signal systems are easy to understand and simple for beginners.

In a real-time market, price reversal signals may appear at any time. However, it is important to have an accurate grasp of the price area and signals when considering entry. It makes no sense to look for buying opportunities when the market momentum is already strong. The basic rule of thumb is to buy at the bottom and then sell when the price rises.

The blue vertical bars of a candle indicate a possible bearish reversal. The red bars, on the other hand, indicate a possible bearish reversal in price. We cannot place buy/sell orders based on each colored candle. To improve the accuracy of your trading judgment, you must filter the signals.

Whenever the TTM Scanner plots an orange candle near trendline resistance, a strong bearish move in price will occur, providing a profitable shorting opportunity.

Trading Signals

The core trading signals given by the TTM Scalper indicator are:

Long Entry Signals

- 2 consecutive green bars after red/yellow bars

- Price rejection at the support level

- Moving average crossover

Short Entry Signals

- 2 consecutive red bars after green/yellow bars

- Price rejection at the resistance level

- Moving average crossover

Exit Signals

- 1 yellow bar after green/red bars

- Price hitting profit target or stop loss

- Moving average crossover

Optimizing Parameters

The TTM Scalper has customizable settings that traders can optimize for market conditions:

Moving Averages

Faster MAs like 5-15 for scalping, slower MAs like 20-50 for swings

Resolution

Higher resolution for tighter stops/targets, lower for wider stops/targets

Volatility

Increase for highly volatile instruments, decrease for quieter pairs/stocks

Targets and Stops

Wider profit targets and stops for volatile markets, tighter ranges for calm markets

Timeframe

Shorter TFs like 5m/15m for scalping, 30m/1hr for day trading

Trading Rules and Management

Follow these guidelines when trading the TTM Scalper system for the best results:

- Only trade in the direction of the higher timeframe trend

- Confirm entry signals with candlestick patterns or other indicators

- Define stop loss levels below swing lows and resistance lines in uptrends, above swing highs and support lines in downtrends

- Book partial profits at resistance targets in an uptrend, support in a downtrend

- Move the stop loss to breakeven once the trade moves sufficient pips in favor

- Avoid overtrading – focus only on high-probability setups

- Use larger position sizing for greater trend momentum

- Manage risk accordingly for each trade’s parameters

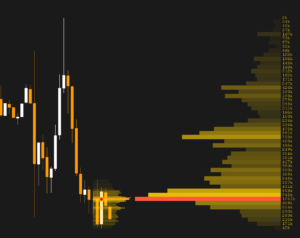

Scalping Strategies

The TTM Scalper indicator excels in these common scalping techniques:

Momentum Scalping

Ride the momentum in the direction of green/red bars till the target or reversal

Support and Resistance

Buy at support and sell at resistance when TTM flips green/red

Moving Average Crossover

Go long on bullish crosses and short on bearish crosses

News Fading

Fade the fake moves after volatile news events when bars start flipping

Pattern Breakouts

Trade breakouts on green bars after channels, flags, and triangles

Benefits of the TTM Scalper Indicator

Here are some of the main advantages of using the TTM Scalper indicator:

- Simplified trend analysis with easy signals

- No complex indicators required

- Effective for scalping and intraday trading

- Spot reversals early as the signal changes color

- Visual display simplifies analysis

- Incorporates volatility in calculations

- Dynamic support and resistance levels

- Customizable parameters to suit preferences

- Works across forex, crypto, stocks, futures

- Clear risk management points

Limitations and Risks

However, traders should be aware of these potential limitations:

- Increased risk in volatile markets

- Potential for false signals in choppy conditions

- Lagging – based on past price data

- Not optimized for higher timeframes

- Does not work as well in ranging markets

- Overtrading due to ease of signals

- Increased drawdown if risk is not managed properly

Conclusion

The TTM Scalper indicator provides a simplified approach to gauging short-term trend direction and strength. By combining its signals with robust risk management protocols, traders can boost win rates and capture profits in fast-moving markets. However, the usual risks of scalping apply, and money management remains critical. Within its intended use case, the TTM Scalper stands as an invaluable tool for scalpers and intraday traders.

The TTM Scalper in MT4 is a simple and easy-to-use swing trading indicator. It also provides real-time price reversal signals, enabling you to make more comfortable short-term trading decisions. Swing trading signals are more frequent than trend-following trades. We recommend that you do this by using additional technical tools such as support/resistance and automatic trendlines.

FAQs

Q: What’s the best way to use the TTM Scalper indicator?

A: Use it in conjunction with price action and candlestick patterns for high-probability setups. Define stop loss and profit target levels.

Q: Does it repaint or lag?

A: No, the TTM Scalper is designed not to repaint so signals remain valid once triggered. There is a minor lag inherent in indicators.

Q: What markets can it be used for?

A: It can be used across forex, stocks, commodities, indices, and crypto markets. Works best for liquid assets with consistent volatility.

Q: Can it be used alone for trading?

A: For best results, confirm signals with other indicators or price action context. Don’t rely solely on the TTM Scalper.

Q: What timeframes is it most suitable for?

A: The TTM Scalper is optimized for the 5m to 1hr timeframes, making it suitable for scalping and intraday trading.