QQE stands for Qualitative Quantitative Evaluation. The indicator is based on RSI, which has been enhanced by a smoothing method. Qqe, unlike most indicators, has stood the test of time in terms of volatility changes. This was especially true after the 2008 global financial crisis. It is also a very accurate indicator, as it produces few false signals and has no lag.

Trend Trading

An indicator is used to determine trends. The indicator will move above 50 if the market is ascending or bullish. You should therefore be looking to purchase. You can use this indicator to filter trades by opening long positions when the indicator exceeds the 50-value threshold and short positions for lower values.

Positions that were overbought or oversold

The indicator can be used to determine when a price is in an oversold or overbought position. When the indicator exceeds 70, this is a sign that the market is strong and perfect for long positions. You can also take a position when the indicator moves towards negative values.

Divergence

The indicator can be used to detect divergence in price and momentum. A bullish divergence, for example, occurs when the QQE indicators set higher lows but the prices form lower highs. This is an indication of a bullish reversal.

A bearish divergence is when Qqe prices are setting higher highs but the Qqe price is farming lower highs. This indicates a possible bullish reversal.

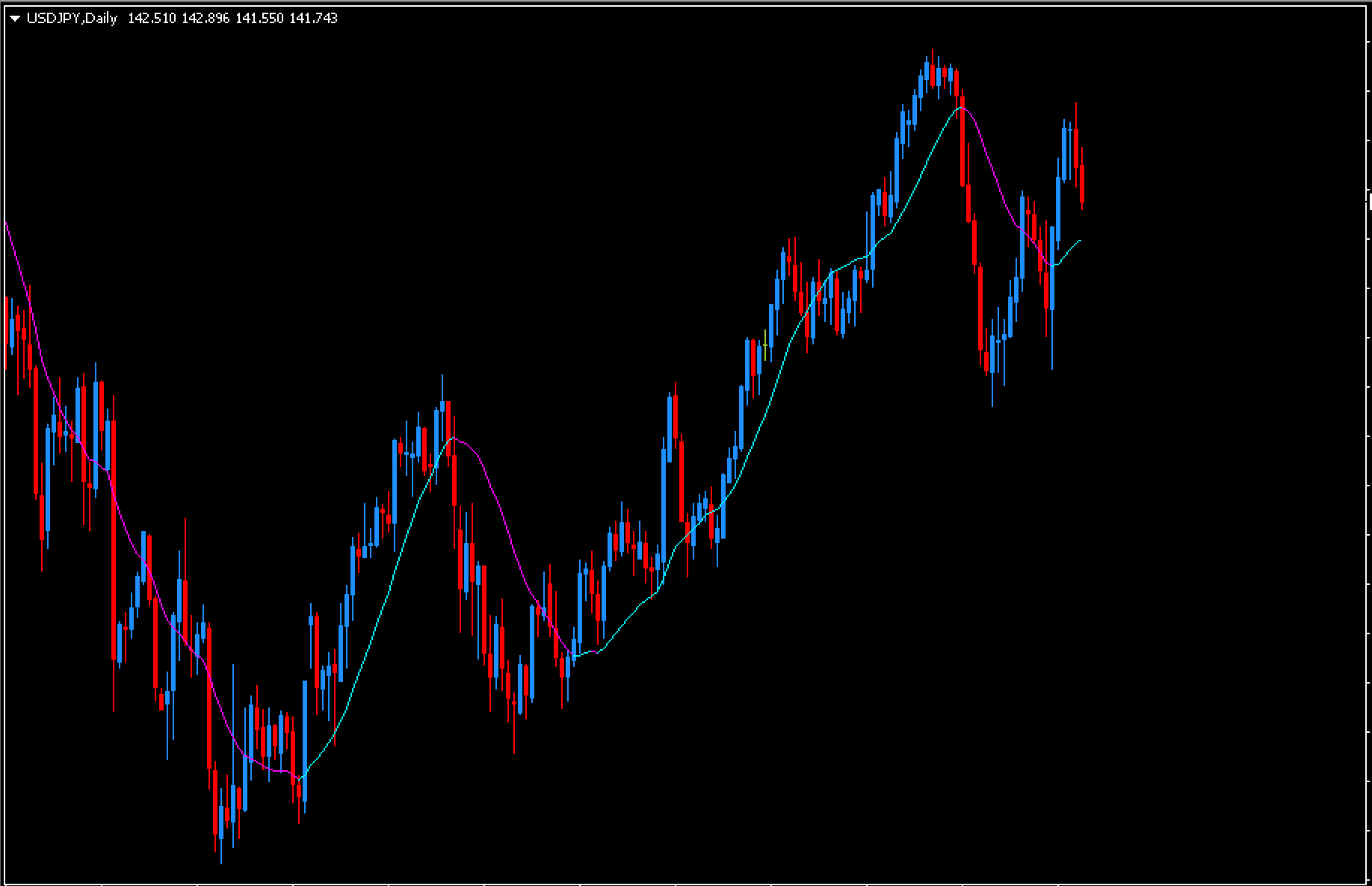

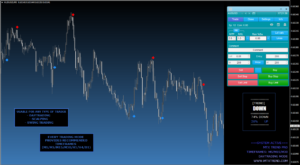

When the bold line crosses over the trailing line, it indicates a change in momentum. It is an indication of bullish momentum when the bold line crosses over the slow trailing lines. When the smooth line crosses under the trailing lines, it shows short-term downward momentum.

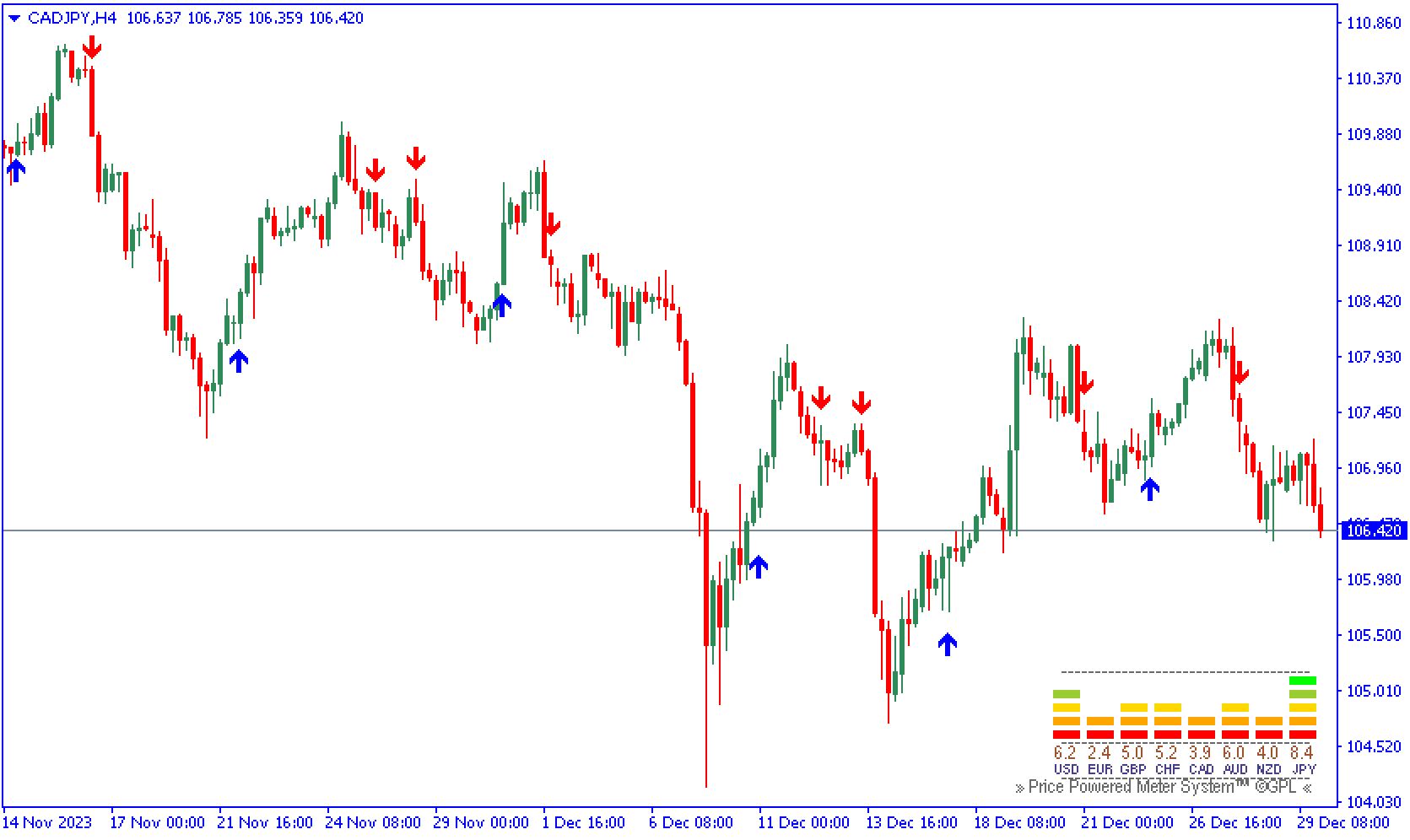

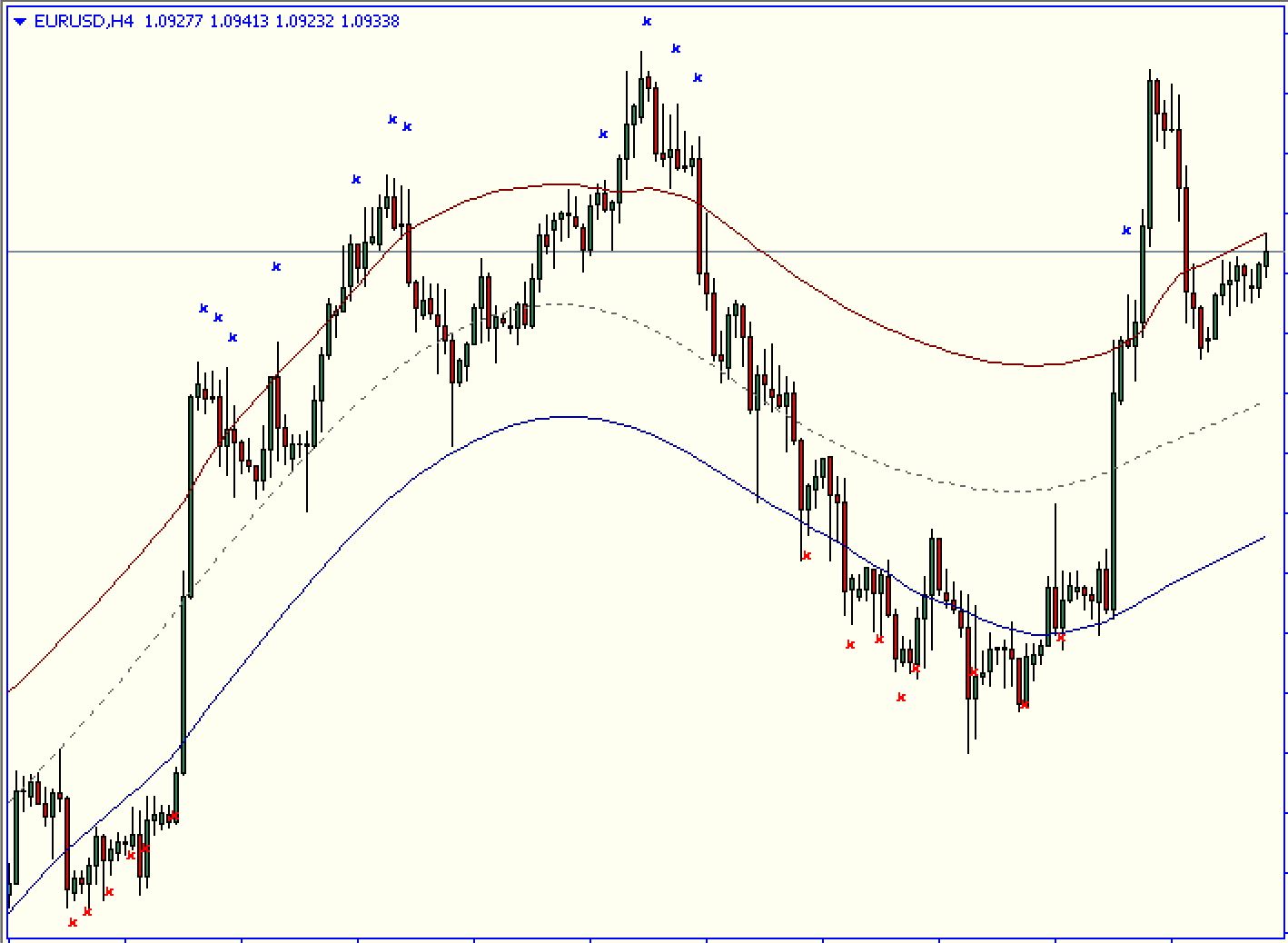

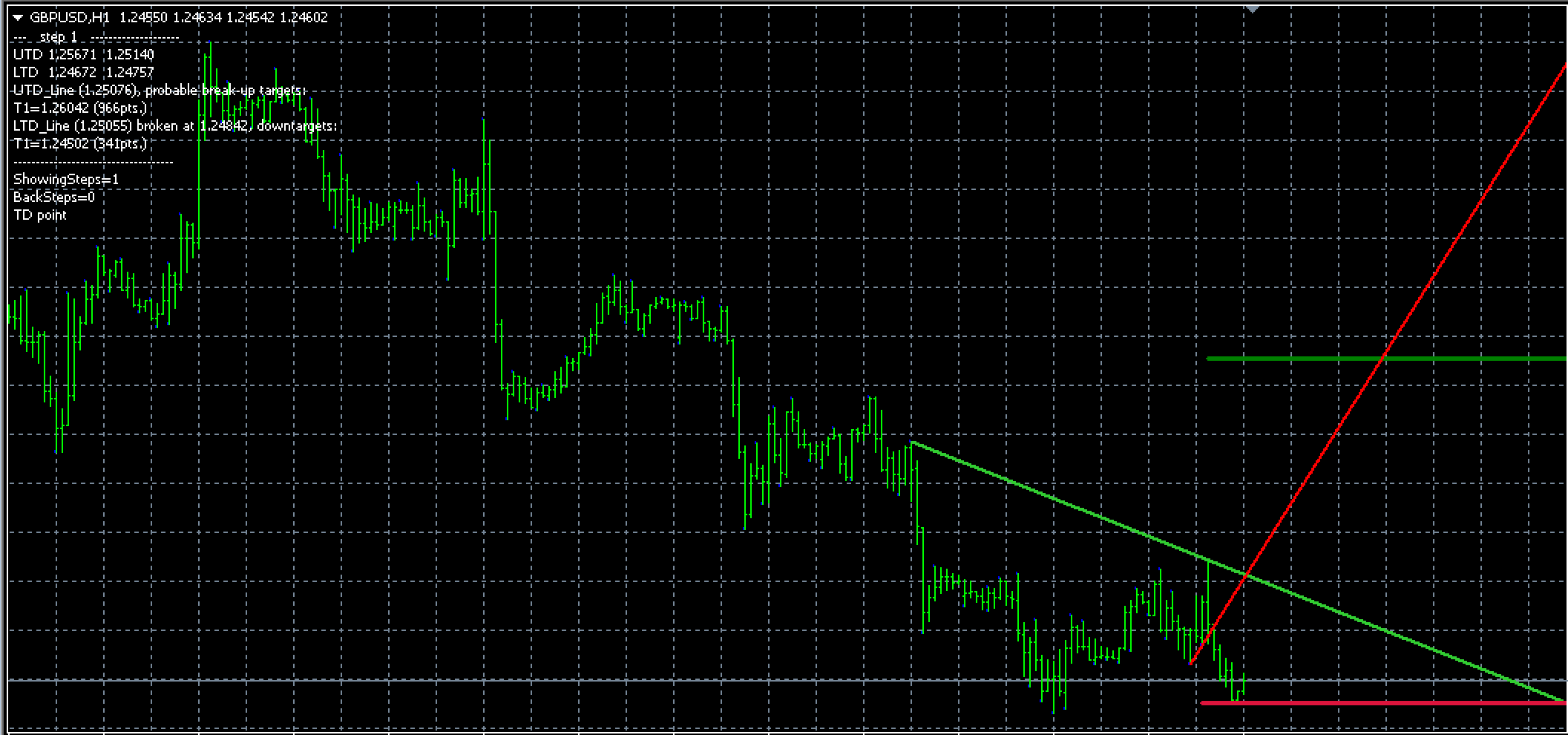

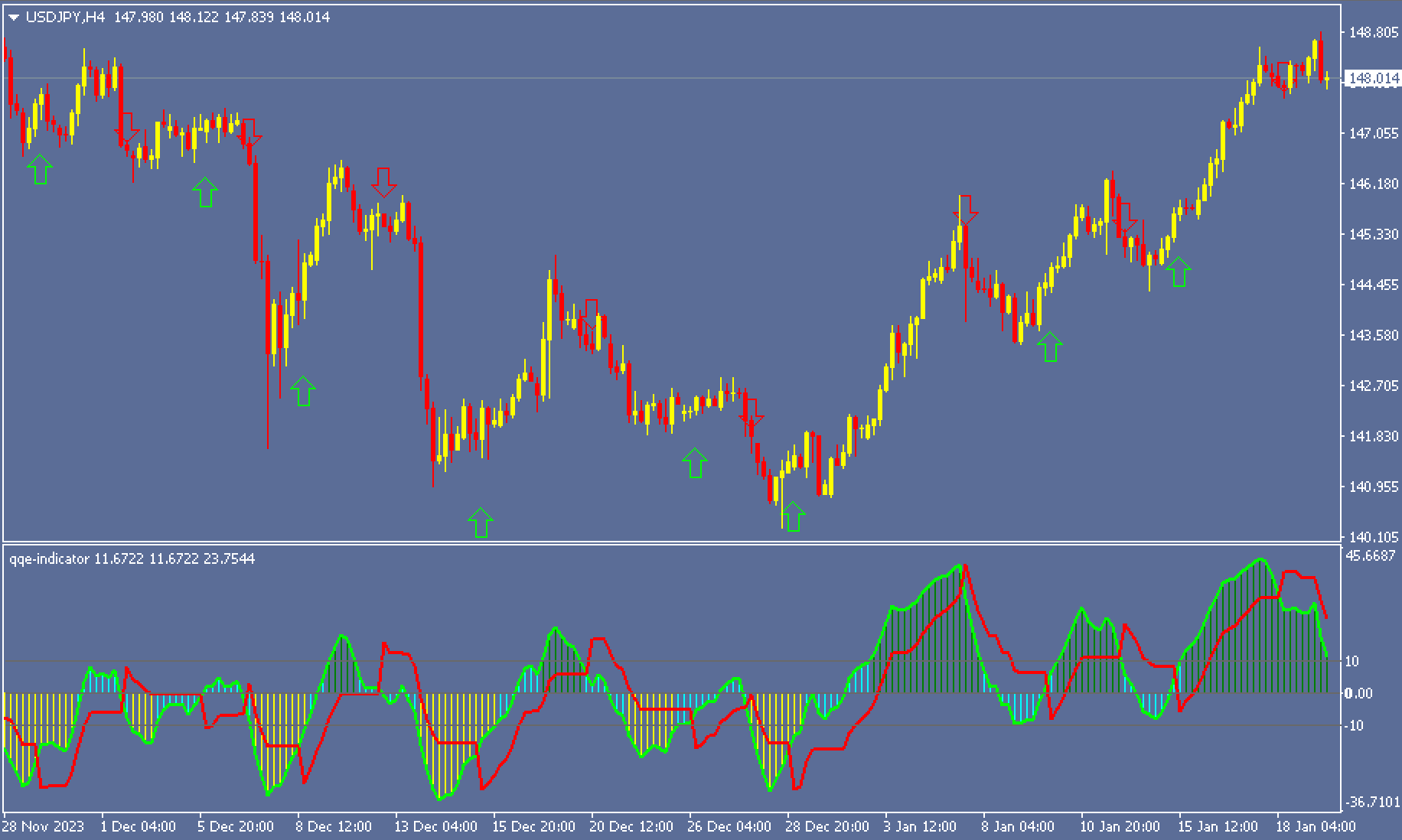

Trading Example

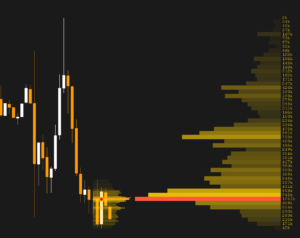

The smoothed RSI (green line) provides a clear indication of price movements. The green line will rise with minimal lag when the price goes up. The green line also moves in accordance with the downward movement of prices. Be sure to note how the price reverses once it reaches the overbought or oversold area.

As shown by the red lines, the indicator gives a signal to sell when the green line crosses under the red line. The green line crosses over the red line as the price begins to rise. After the lines cross, there is a sharp rise in price.

The conclusion of the article is:

The QQE indicator has a high accuracy rate. The indicator offers a variety of strategies to use the buy and sell signals. It can be used to detect a trend reversal and help you enter trades at the best positions. Include the indicator in your trading strategy.