Candlestick Patterns PDF Free Guide Download

Are you a Day Trader looking for a way to increase profits? You can’t go wrong with candlestick patterns. Day traders can use these patterns to gain valuable insight and make informed trading decisions. This post will explore the top four reasons why candlesticks patterns are a great day trading strategy.

Table of Contents

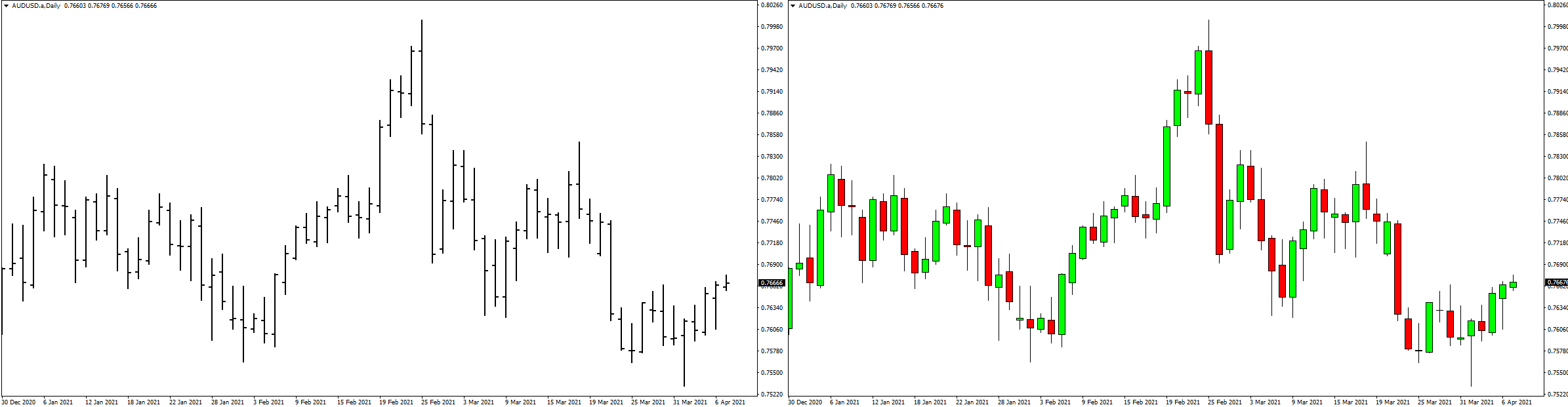

These are easily spotted

Price action is an important indicator when it comes to day-trading strategies.

You have a choice of many candlestick patterns. These include dojis (also known as hammers), shooting stars, bullish and bearish engulfing pattern. With the right tools and techniques, traders will quickly be able to identify each pattern.

Overall, candlesticks offer valuable insight into a stock’s or market’s behavior. Traders can make better decisions when it comes to trading stocks if they are able to interpret and recognize price movement.

The products can be used at any time.

Candlestick patterns can be used to trade price action in any timeframe. They are incredibly flexible, allowing traders the flexibility to adapt their strategy according to their goals. These patterns are a valuable tool for any trader.

Candlestick patterns help identify when trends have reversed, when trend reversals are imminent or when momentum has built. They can also be used to improve decision-making regarding short-term or long-term price movement.

These signs provide clear exit and entrance signals

Day traders use candlestick patterns as one of their most popular trading techniques. This strategy can determine buy and sale signals in any market, and at any timeframe. By analyzing previous price movements, it can help traders better understand the markets.

These patterns are very helpful for identifying entry and exit point possibilities. This gives traders an advantage over the traditional system of trading that relies on indicators for deciding when to buy or sell. Candlestick patterns allow traders to interpret data quickly and in real-time.

Candlestick patterns are a great way to enter and exit a trade. They can be part of an overall trading strategy.

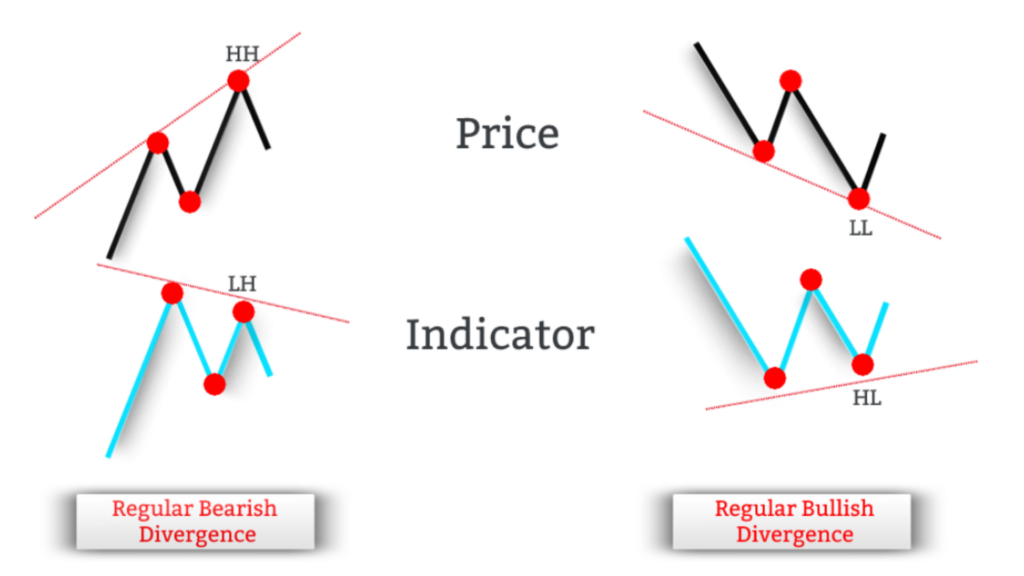

You can use them with other indicators

Candlestick patterns and other technical indicators can be used to assist traders in making informed decisions. Combining candlesticks patterns with other indicators allows traders to get a better view of the market, which can ultimately lead to more profitable entry and exit points.

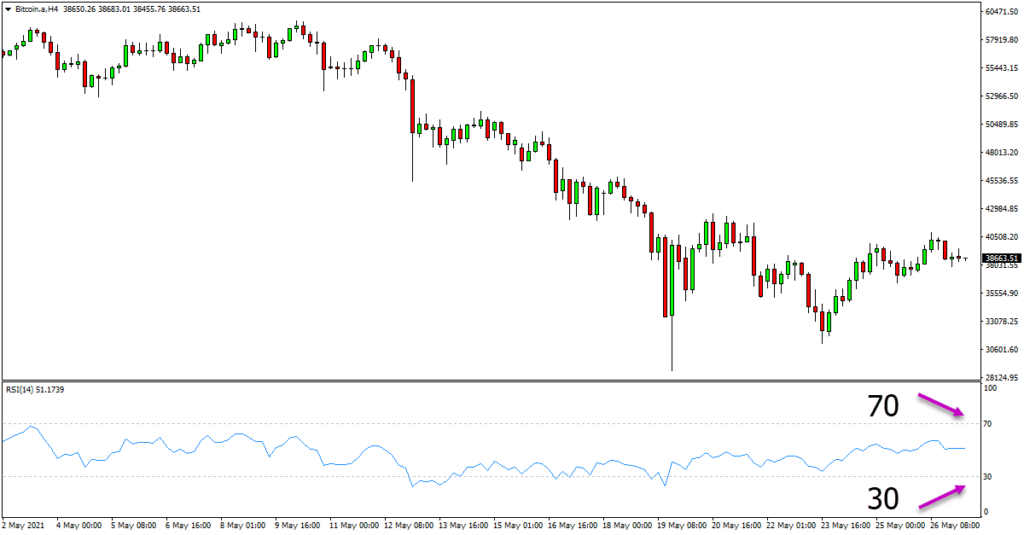

If you want to get into day trading, for example, you might combine price action and stock patterns. This will help you identify the best buy and sale signals. You can get an edge on the market by combining candlestick patterns and indicators like the Moving Average Convergence Divergence(MACD), Relative Strength Index(RSI) or Bollinger Bands. This combination will also allow you to develop your own trading strategies, and customize them according to your risk tolerance and goals.

Cheat Sheet Download PDF

Learning to read chart patterns is a great advantage for day traders. Once you have gained experience with these powerful tools for trading, you might want to refer to a guide in the middle of a trade. We offer a candlestick pattern cheat sheet in PDF format.

This PDF is ideal for day traders who are just starting out and want to understand the chart patterns better. The PDF is great for day traders with more experience who need a quick guide to refer to while scanning the market. This PDF cheat sheet is a valuable tool for anyone who wants to be a successful trader.

![PipFinite Volume Critical [Indicator Reviews]](https://mq177.com/wp-content/uploads/2023/05/5374034a40c8d6800cb4f449c2ea00a0-6.jpg)

Responses