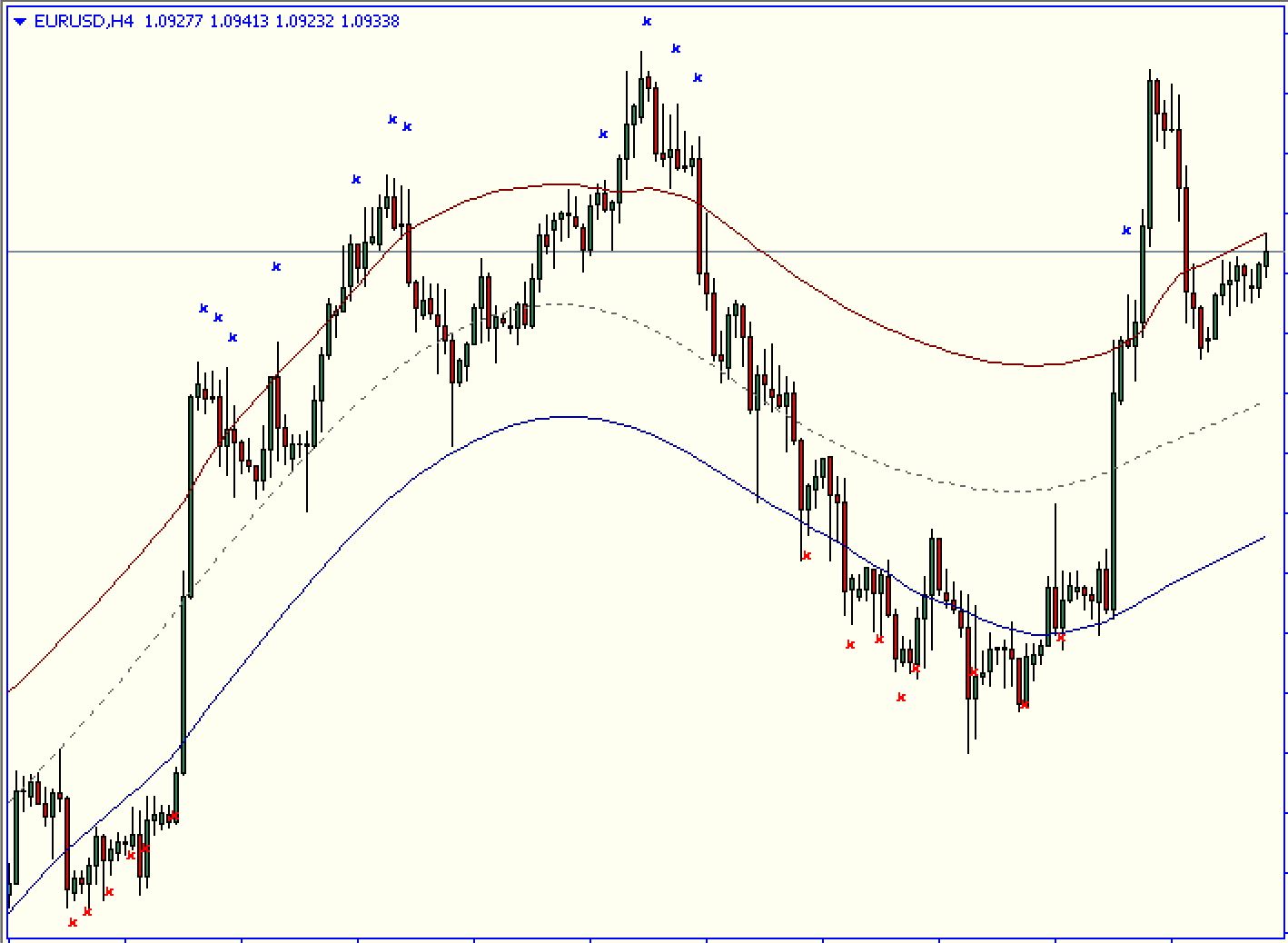

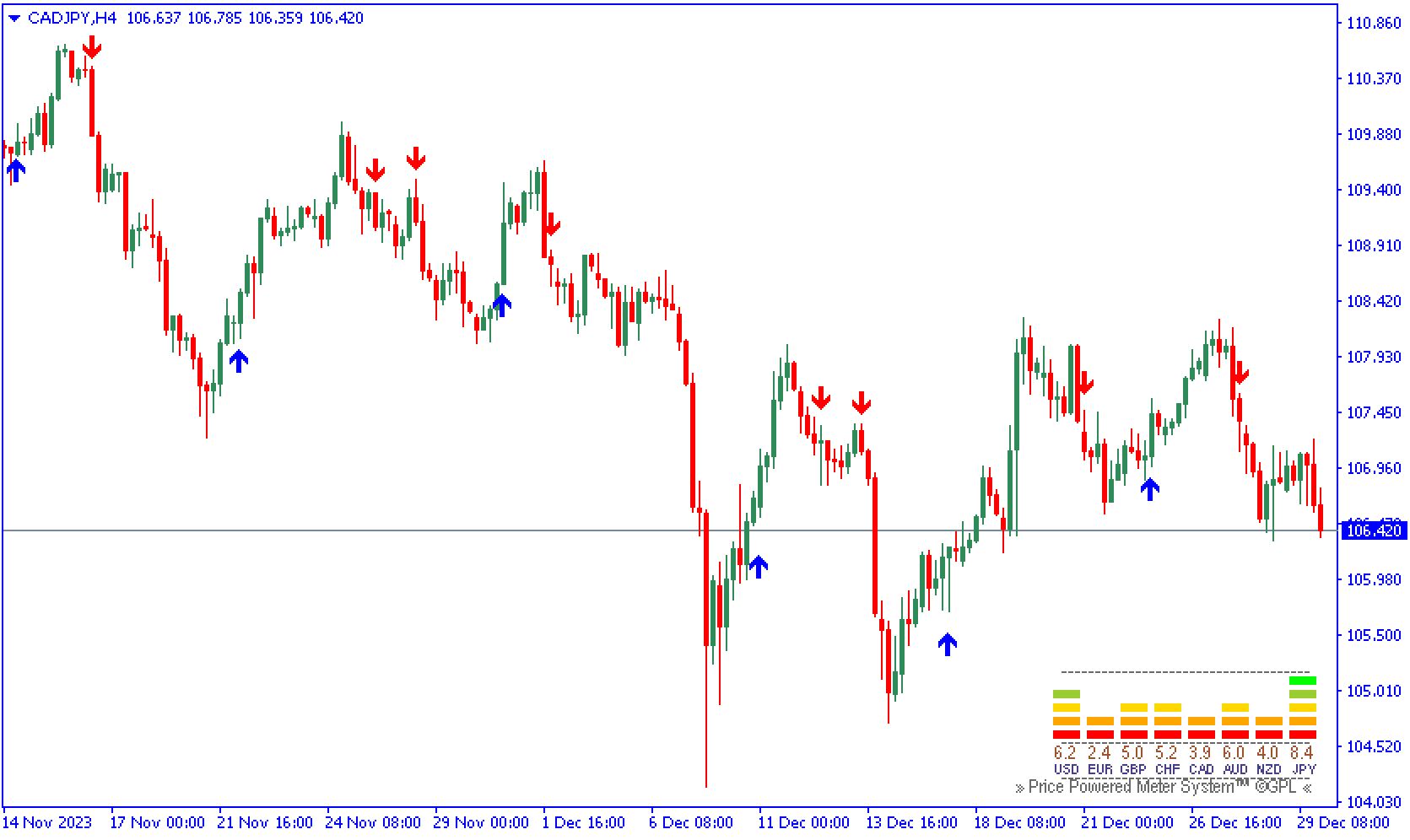

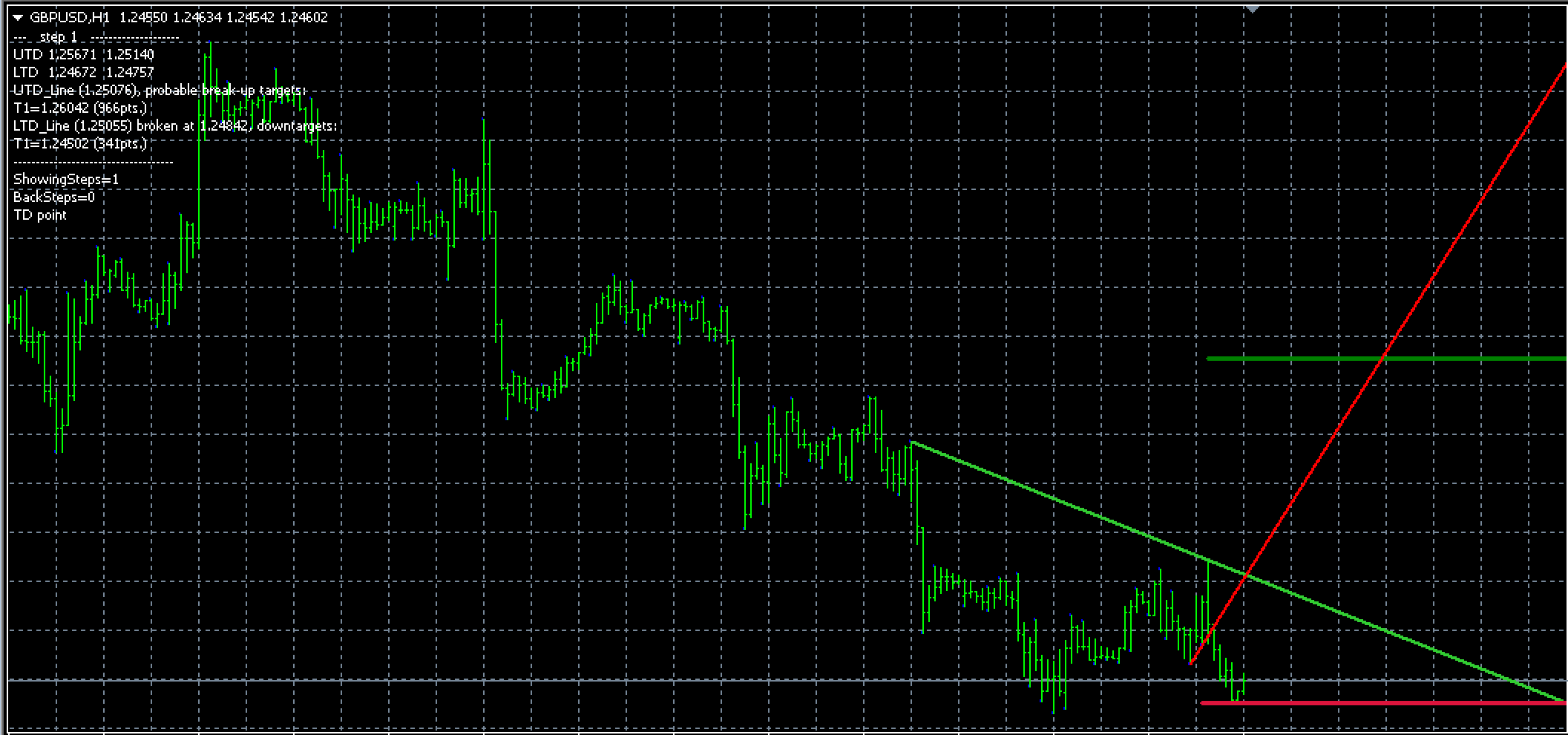

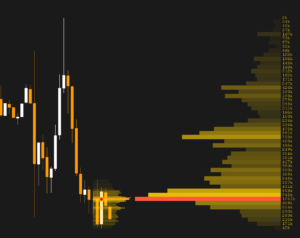

The name suggests that the indicator CAP channel trading is utilized to trade channels. It employs an envelope strategy in which prices generally fall within a channel, which is bound by a lower and an upper line. The upper channel is an overbought region, and the lower channel serves as an oversold zone.

The indicator is volatility-sensitive, which means it analyzes the daily price fluctuations of an instrument to identify the supply and demand zones. This indicator will show you where you can begin to enter the market. It also assists in determining the best way to stay in or out of the market entirely. The post-arrows indicate points of trend reversal, which allows traders to benefit from trading opportunities.

The indicator can be used to trade any instrument or currency pair. It is also suitable for short-term or long-term trading strategies for 15 minutes or greater timeframes.

How to Open a Buy and Sell Signal Using the Indicator

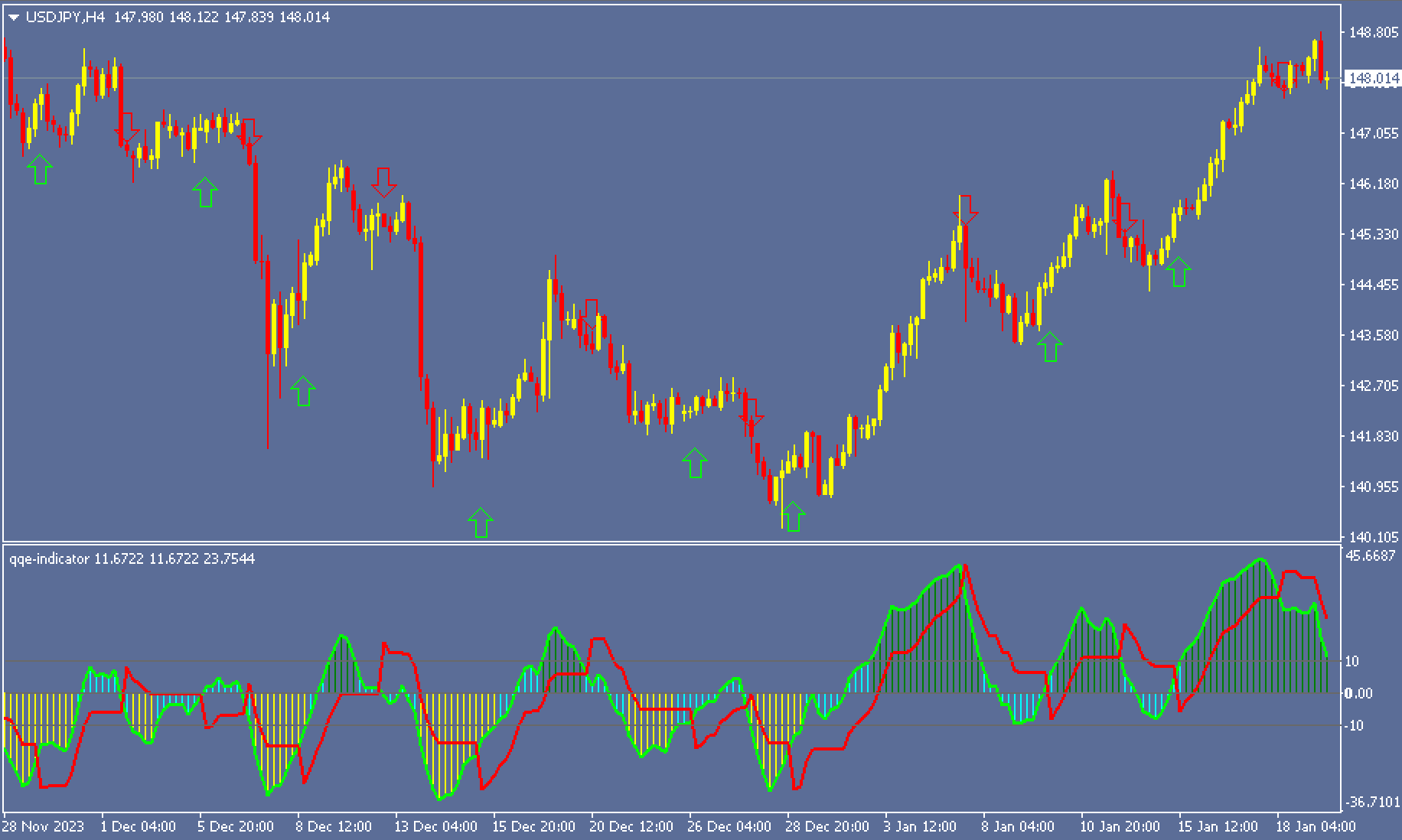

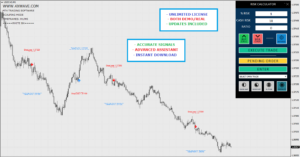

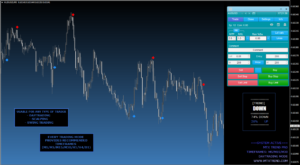

Buy Signal

- Then wait for the rate to reach support in the lower band.

- Buy whenever a red cross appears. You should consider entering the trade after the end of the candle with a bullish pattern or candlestick pattern.

- Stop losing your trade below the most recent swing low.

- Exit when the price reaches the upper limit of the indicator. The indicator plots the blue cross.

Sell Signals

- Then wait for the price to be able to find resistance near the upper part of the band.

- The indicator displays the blue cross as a sign that the market is reversing.

- Stop loss: stop loss at a point that is above the most recent high of your swing.

- Exit when the price reaches the channel’s lower line or the indicator shows a red cross.

Conclusion

CAP A channel trading indicator is the ideal instrument for traders using channel trading strategies. It maps price charts incorporating price volatility and then shows an envelope in which the price typically ranges. If you are a trader, you just need to watch until the price reaches the line of channel, then make blue or red crosses, and then exit whenever the indicator crosses the opposite line of channel. It’s a tool all traders should be making use of.