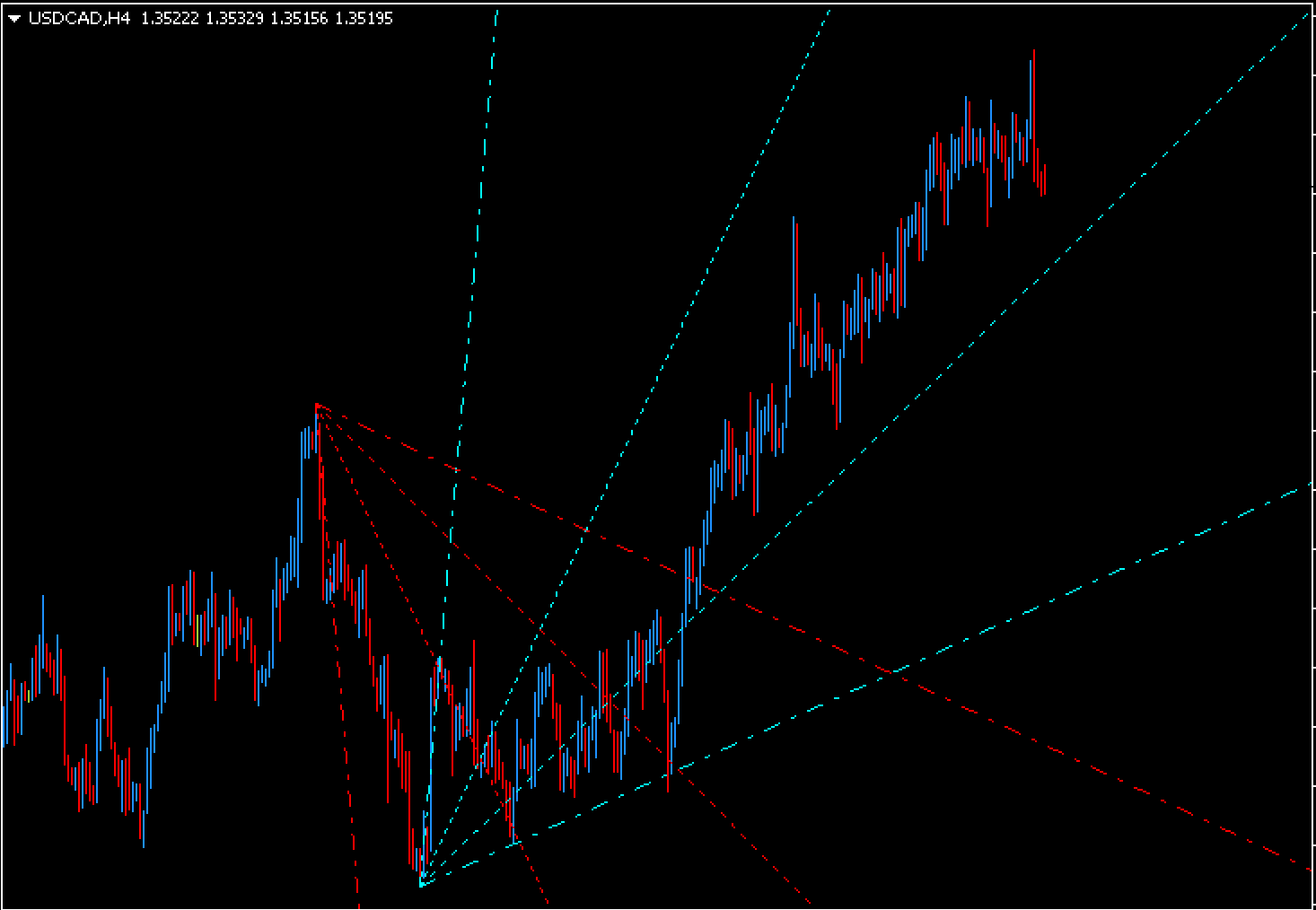

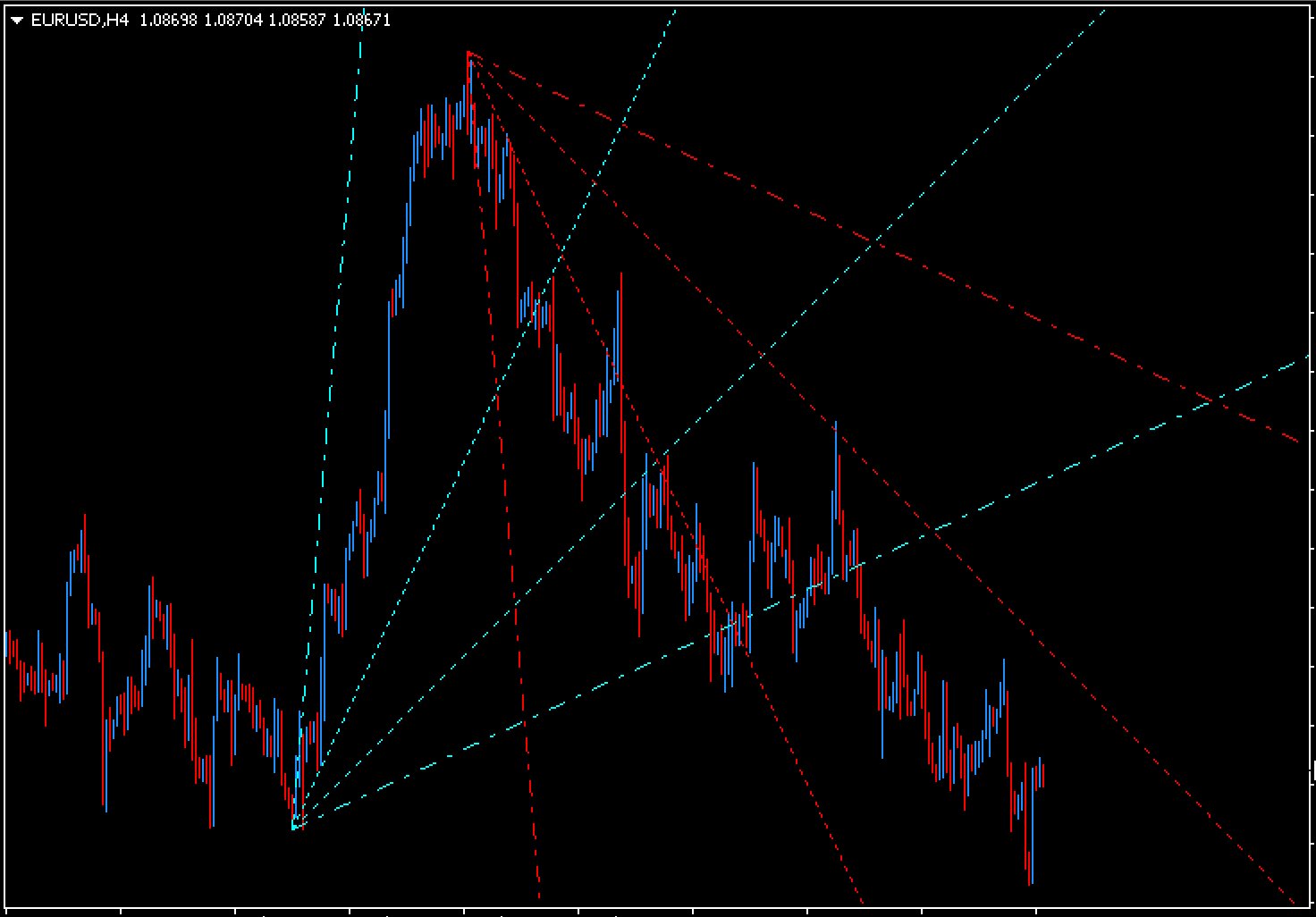

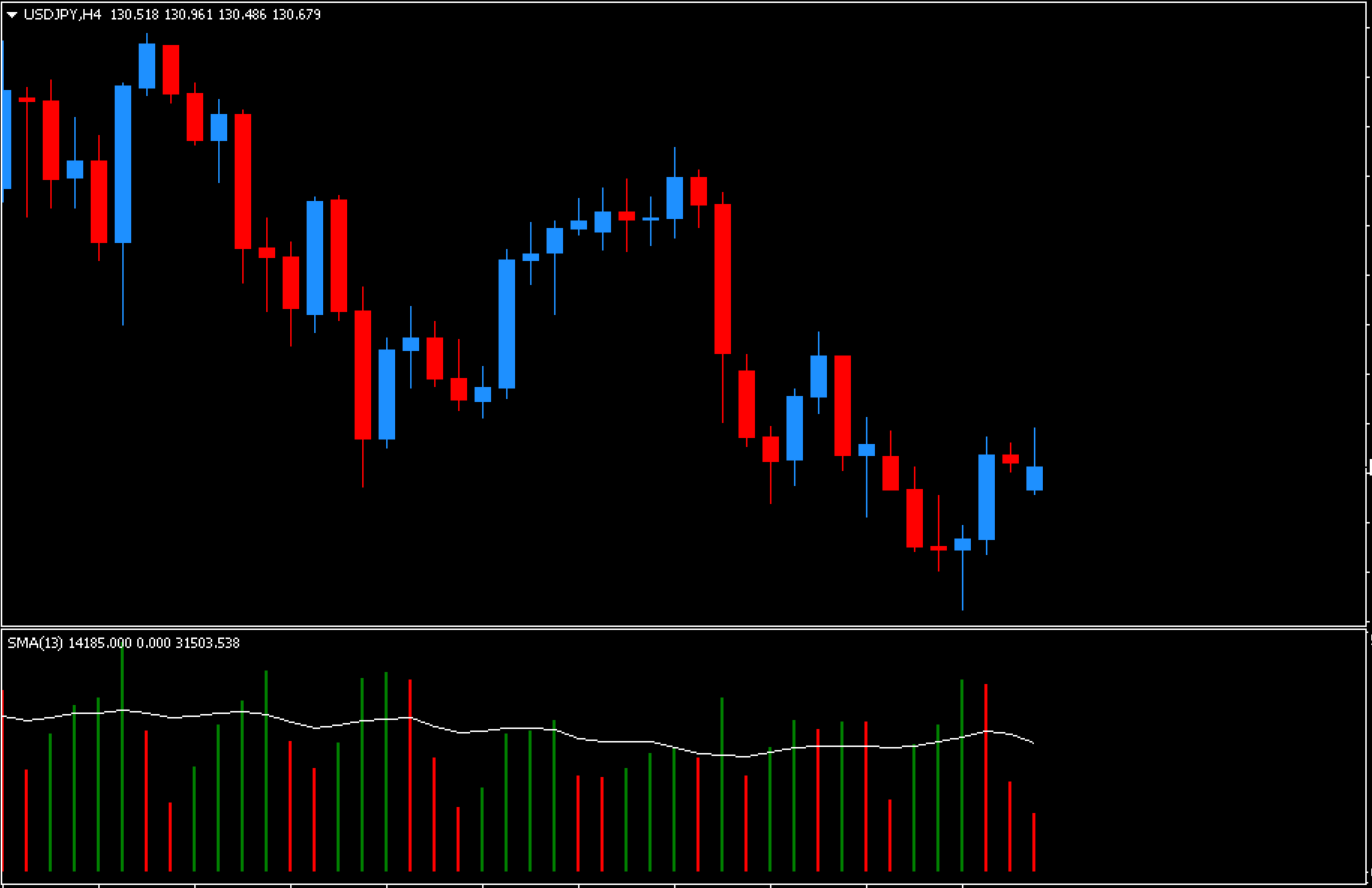

The Trend by Angle indicator for MetaTrader is an indicator that is custom-designed for forex trading and draws several slopes using angles of degrees. It draws a variety of trend lines with an angle that are in line with the current trends that the market is following.

The goal is to assist you in identifying opportunities to trade within the limits of the indicators. It shows a blue dodger trend angle in a market that is bullish and the opposite in an equities market. This indicates that the indicator, in some way, allows you to identify the trends of the market as well as the market’s direction of trade.

In addition, this indicator is suitable to determine different styles of trading, such as scalping, day/intraday trading, or swing trading. In addition, it’s advised for intermediate, beginner, or experienced traders.

How to Trade with the Trend by Angle Indicator

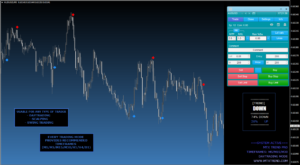

The screenshot above shows what the indicator might look like on the chart in MT4. It also illustrates how to spot and trade setups with high probability. In addition, the indicator could be utilized in conjunction with price action or other indicators of technical analysis to increase effectiveness.

SELL and BUY signals: First, you must wait for the indicator to draw an angle of blue with a dodger across your charts, and this could indicate an eventual bullish trend. Then, wait for the price’s formation to form a channel inside the indicator and display a wick rejection after the retest. You can then start a buy/long trade when the price prints an ebullish candle.

The buy principle above can be applied to identify an entry and setup for a sale. In addition, you could look at the screenshot above to gain a better understanding of the best way to trade the indicator.

Conclusion

This trend by angle indicator for MT4 is ideally suited to assist you in defining the direction of the market and also trade as well as the direction of price. In addition, the indicator is available for download at no cost.