Divergence Cheat Sheet

The basic principle of technical analysis states that momentum comes before price. The price will never move in an even line. Momentum is also often not in sync with prices. Divergence is the mismatch between price and momentum. Traders are able to profit from these price discrepancies.

The Divergence Cheat Sheet provides an easy-to-access, detailed look at what divergence is. It also explains the types of divergences and how to trade them efficiently.

Table of contents

Divergence: What is it?

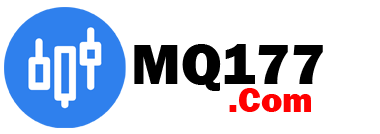

Divergences are a trading term that occurs when the indicator and price of a particular asset move in opposing directions. Divergence occurs when the indicator and the asset price are not in sync.

In normal market conditions the price movement of an asset moves in the same directions as the technical indicator. The technical indicator should also move higher when the asset price moves to a new peak.

Divergence as such is not an indicator, but rather a trading concept. There is no formula for calculating divergence.

Divergence signals momentum that is building into a new trend and early reversal signs when momentum slows down.

Divergence is not a sign of when the price will reverse, but rather an early warning that it might happen soon.

Convergence is the opposite of divergence.

What Is Divergence and How Does It Work?

To understand how any market price moves, traders should first grasp the basics.

When we are developing an upward trend, asset prices tend to move in a series higher highs and lower lows. When we are developing a downward trend, asset prices move through a series lower lows and higher highs.

The key to successful trading is buying low and selling high. You must buy at a low price and sell high.

Divergences help traders determine when to buy and sell. This is done by studying the divergence signals – the mismatch between the price and the technical indicator.

Divergence signals can be divided into two broad categories:

- The classic divergence, or regular divergence, is another name for the same thing.

- Hidden divergence.

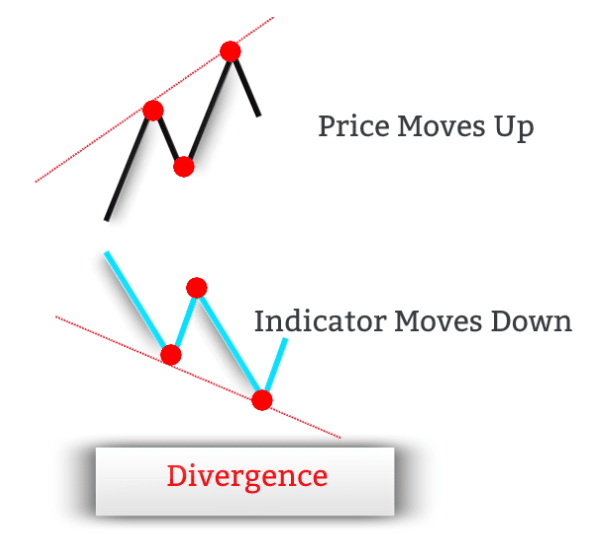

Tableau de Divergence Cheat Sheet

Below is a table that outlines different types of divergence, and the signals generated by them.

Download the Divergence Cheatsheet in PDF format to keep it handy!

Regular Divergence

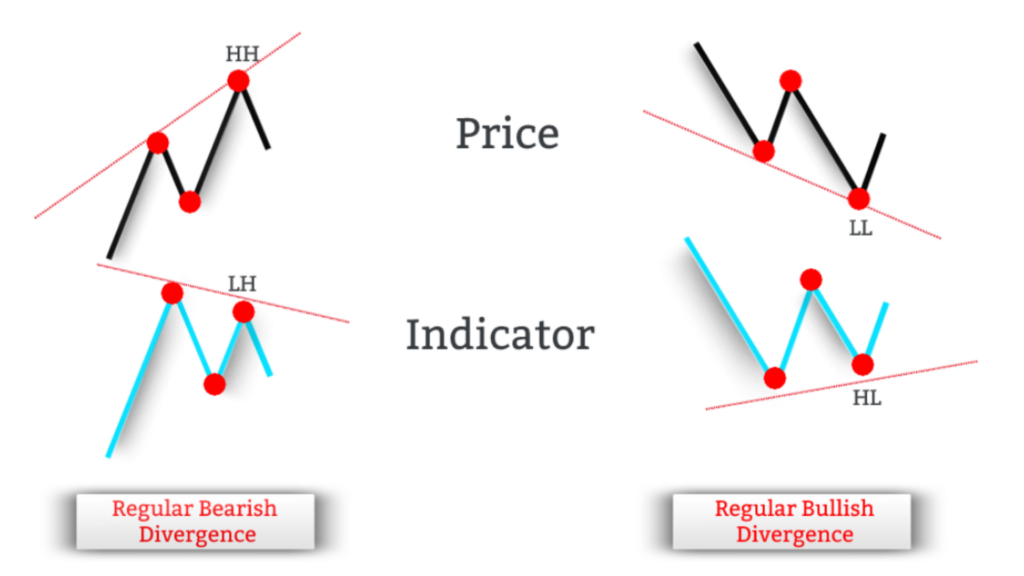

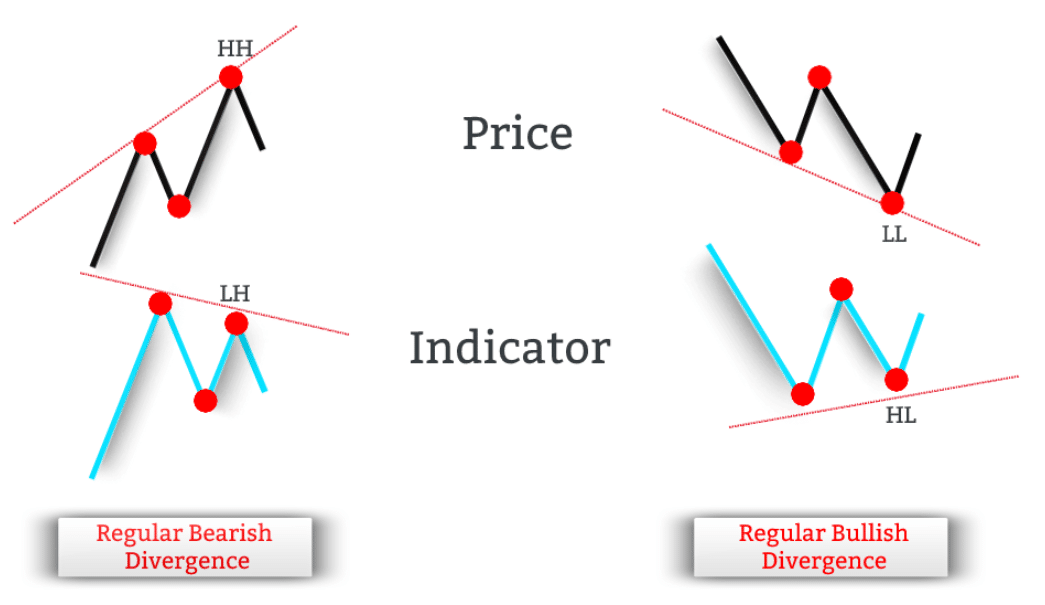

Regular divergences may be classified further into regular bullish or regular bearish divergence.

Bullish divergence is a regular occurrence when there’s a disagreement between a price that’s falling (making lower highs) and an indicator that’s rising (making higher bottoms).

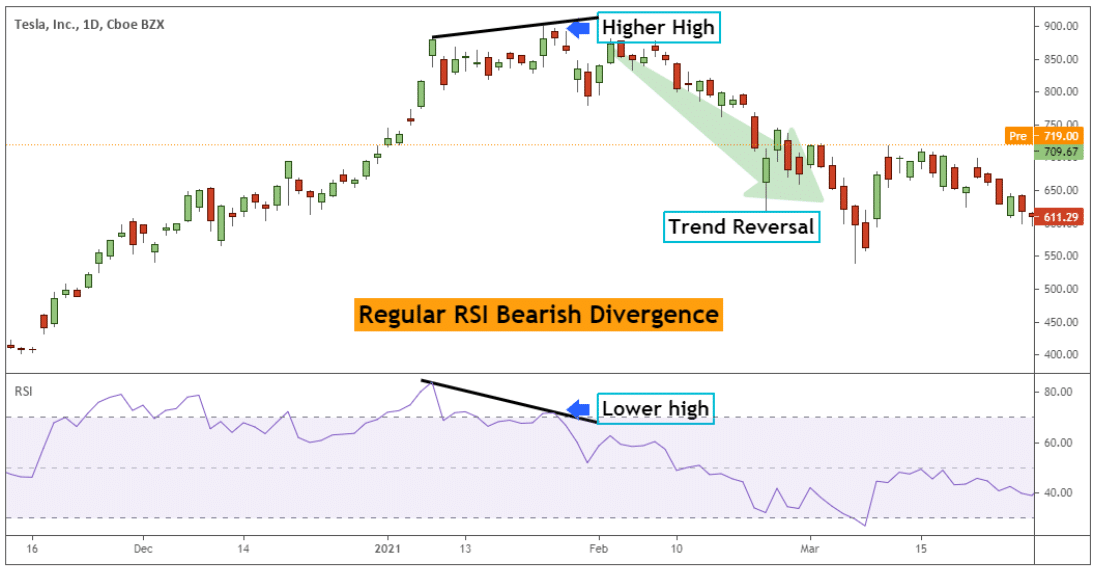

A regular bearish divergence occurs when there is a disagreement between a price that is rising (making higher peaks) and a technical index that has fallen (making lower peaks).

Regular bullish divergence can be a sign that the downtrend is about to change and move upwards. The regular bullish divergence in this case is a signal to buy.

In contrast, the regular divergence to the bearish is a sign that the current uptrend will soon change direction to the downside. The regular bearish divergence in this case is a buy signal.

The image below illustrates side-by-side, the difference between the regular divergence bullish and the regular divergence bearish.

At the end a downtrend is where you can find a bullish divergence. The uptrend is then triggered by this type of divergence.

In contrast, the best place for a regular divergence to develop is the end of a trend. A divergence of this type will lead to a downward trend.

Hidden Bullish Divergence

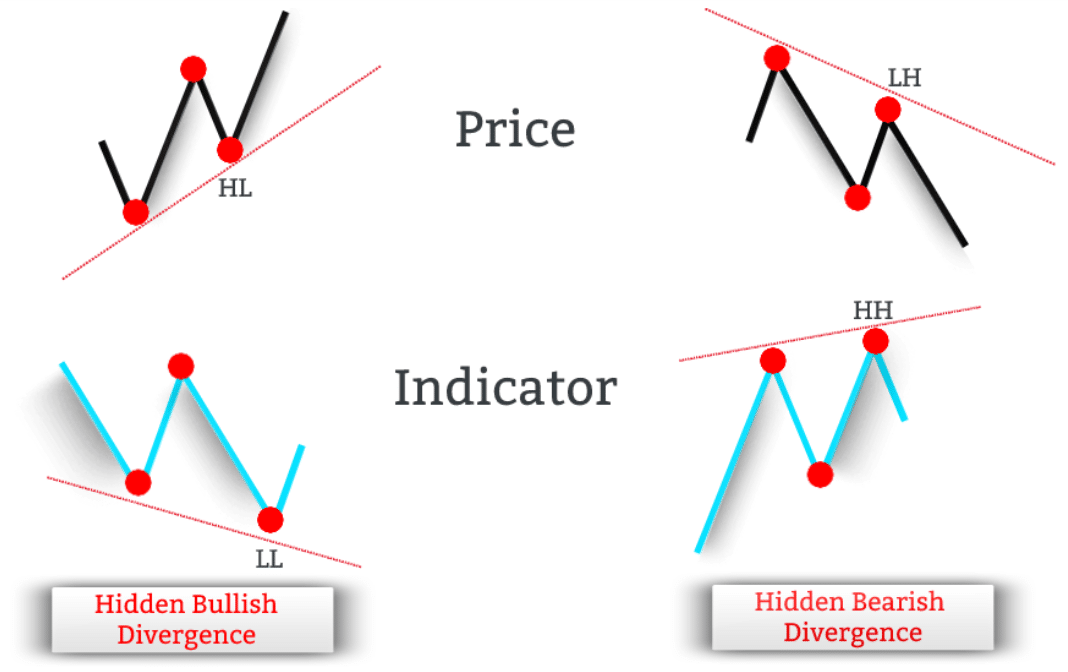

The hidden divergence is not that different from regular divergence. A mismatch between price and technical indicator is required for a hidden divergence.

While regular divergence can indicate a trend reversal possibility, hidden divergence indicates the potential for a trend continuation. Hidden divergences are more likely to occur within an established trend.

Hidden divergences are usually a sign that the prevailing trends is still strong enough for it to resume.

We can also distinguish between two types of hidden divergence.

- Hidden bullish divergence.

- Hidden bearish divergence.

A hidden bullish divergence occurs when the price makes a higher low while the indicator also makes a lower low.

Hidden divergence in favor of the bull is a sign that a new uptrend may be on its way. These divergence signals develop after prices pull back. The hidden bullish divergence in this case is a signal to buy.

The image below shows the difference between hidden bullish and hidden bearish divergence.

In uptrends, you can usually observe the hidden divergence.

Hidden Bearish Divergence

Hidden bearish divergence occurs when the price makes a low high and the indicator makes a high high.

This can be a warning sign that a downtrend is about to resume. Usually, the hidden bearish divergence signals develop after the price has pulled back. The hidden bearish divergence in this case is a buy signal.

Typically, downtrends will show a hidden bearish divergence.

Hidden divergences don’t occur as often as regular divergences. Hidden divergences, however, can alert traders to the possibility of a trend resuming.

The hidden divergence is a simultaneous occurrence with retracements of the price. The hidden divergence, in other words signals the end of the pullback.

- Hidden bearish divergence – the end of a pullback in a downtrend.

- Hidden bullish divergence – the end of a pullback in an uptrend.

Divergence Indicator

Traders must first choose a technical tool to help them recognize regular divergence or hidden divergence as well as possible signals of trend reversal, trend continuation and trend reversal.

Retail traders use momentum oscillators such as the RSI (Relative Strength Index), Stochastics, MACD etc. to determine when an asset’s price and the indicator do not converge.

In the same way that the price of an investment moves up and down creating peaks, and valleys, the technical indicators will converge with or diverge from it, creating peaks, and valleys.

Some technical indicators may be displayed directly in the chart of prices or in an additional window below.

Traders can use almost any oscillator for identifying divergence. However, the MACD indicator, stochastic indicator, and RSI indicator work best.

Money flow index (MFI), on the other hand, is a way to find hidden divergence. The money flow index, which is a trend-following indicator, is the reason for this.

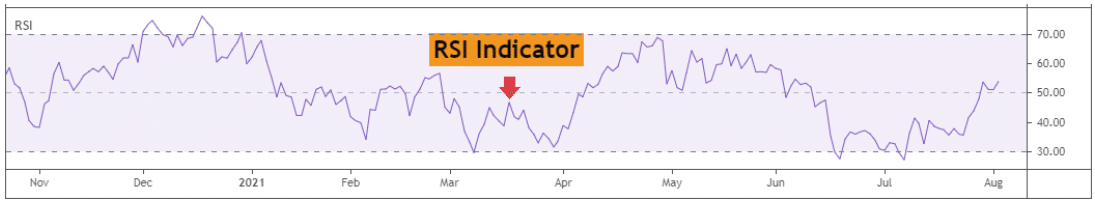

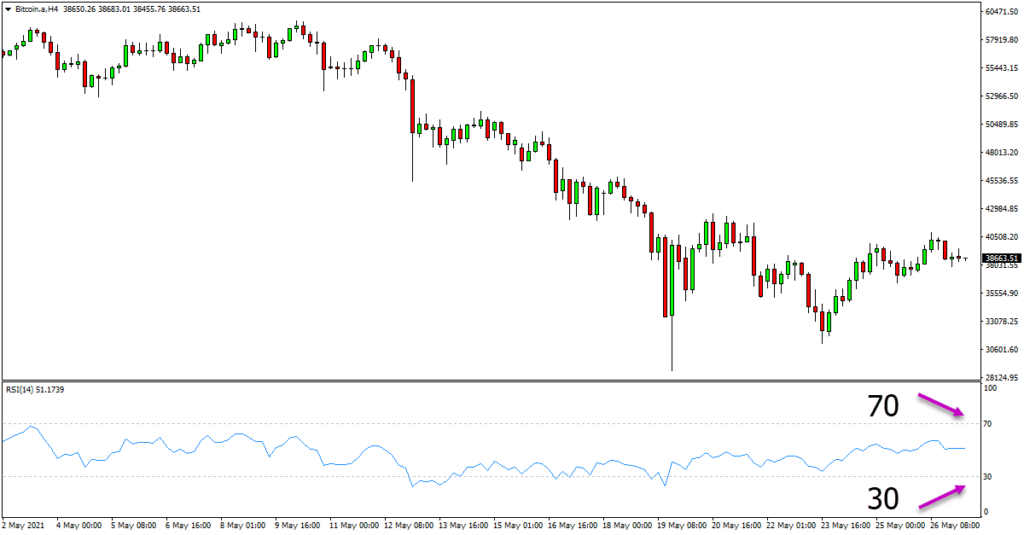

The Relative Strength Index is a popular technical indicator for spotting regular divergence or hidden divergence.

Divergence RSI

The Relative Strength Index is a leading indicator. This means that it anticipates price movements.

Below you will find an image of RSI Indicator.

The RSI can be used to identify both regular and hidden divergences.

The RSI divergences cannot be used to time the market. In this situation, candlestick patterns can be used as a confirmation of the resumption (in the event of RSI hidden diversgence) or reversal trend (in cases of RSI normal divergence).

Traders should look to take long positions if RSI divergence is visible or regular. Traders may also consider selling positions if RSI divergence is regular or concealed.

Bullish Divergence RSI

The chart below shows the regular bullish RSI Divergence.

The price has made a lower low in comparison to the swing low on the chart. RSI prints a higher high relative to the prior low.

After the lower low was formed on the chart, the dominant trend changed from bearish into bullish.

The trend continues to move higher after the chart forms the higher low.

The bullish hidden divergence is possible anywhere within an uptrend, as long as the technical requirements are met.

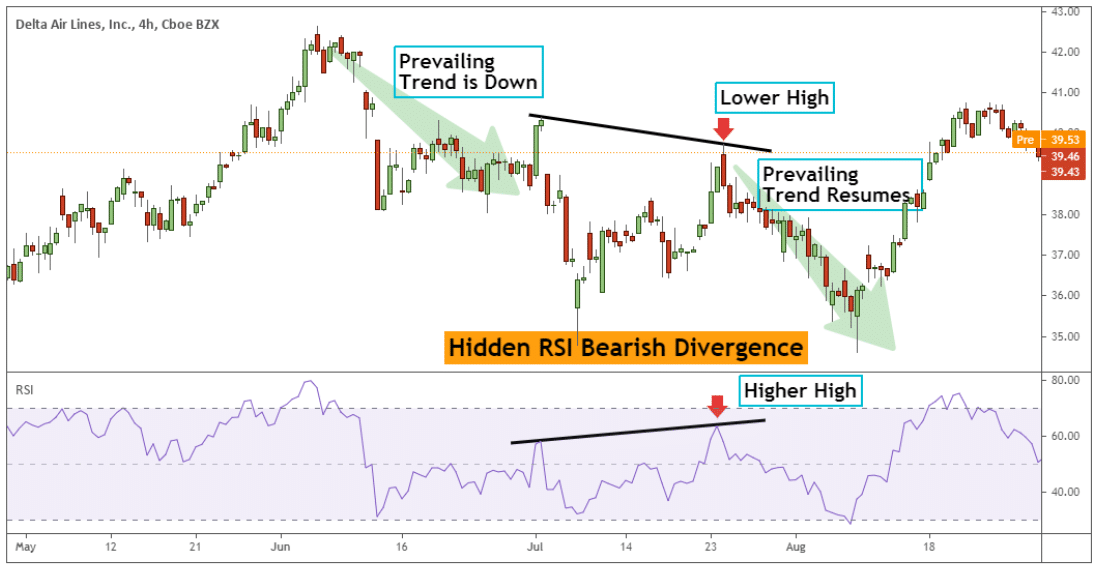

Bearish Divergence in RSI

The price is making higher highs during a regular bearish RSI crossover, but the RSI indicator prints lower highs.

In the following example, traders will see that the price has made a new high in comparison to the previous high on the price chart.

RSI also prints a lower peak in relation to the previous peak on the RSI-oscillator. After the RSI divergence to the downside, the price reversed quickly and a new trend appeared.

Last but not least

Summary: Traders need to be aware that divergence is a signal of a trend change, whereas hidden divergence signifies a continued trend.

The trend following trader would be better off focusing their attention on hidden divergence, as this will allow them to ride the overall market trends. Hidden divergence signals a continuation of the trend, so it is more likely to be successful than the other types of divergence.

![PipFinite Volume Critical [Indicator Reviews]](https://mq177.com/wp-content/uploads/2023/05/5374034a40c8d6800cb4f449c2ea00a0-6.jpg)

![Smart Market Structure Concepts MT4 [Reviews]](https://mq177.com/wp-content/uploads/2023/06/smart-market-structure-concepts-mt4-screen-8146-1024x504.png)

Responses