Money Management Forex Trading Quick Guide

You will lose money no matter how good your trading strategy is if you do not have the right money management skills.

Money management is the key to making you money.

In this article, we will explain what money management is in trading as well as how to implement some core strategies.

Forex Money Management Strategies

Money management rules that are simple and easy to follow can help you immediately in your trading.

Only risk the money that you can afford to loose

This should go without saying, but it is not always followed.

You should only trade with money you are willing to lose.

You may lose money if you use money for everyday expenses or a credit card.

The other side of this is that if you are using money to trade with that you really need, you will be trading with ‘scared’ money. When you use money you can’t afford to lose you are more likely to make bad trading decisions, and worry constantly about losing.

Use a Stop Loss

This is yet another simple strategy which should be always followed, but isn’t.

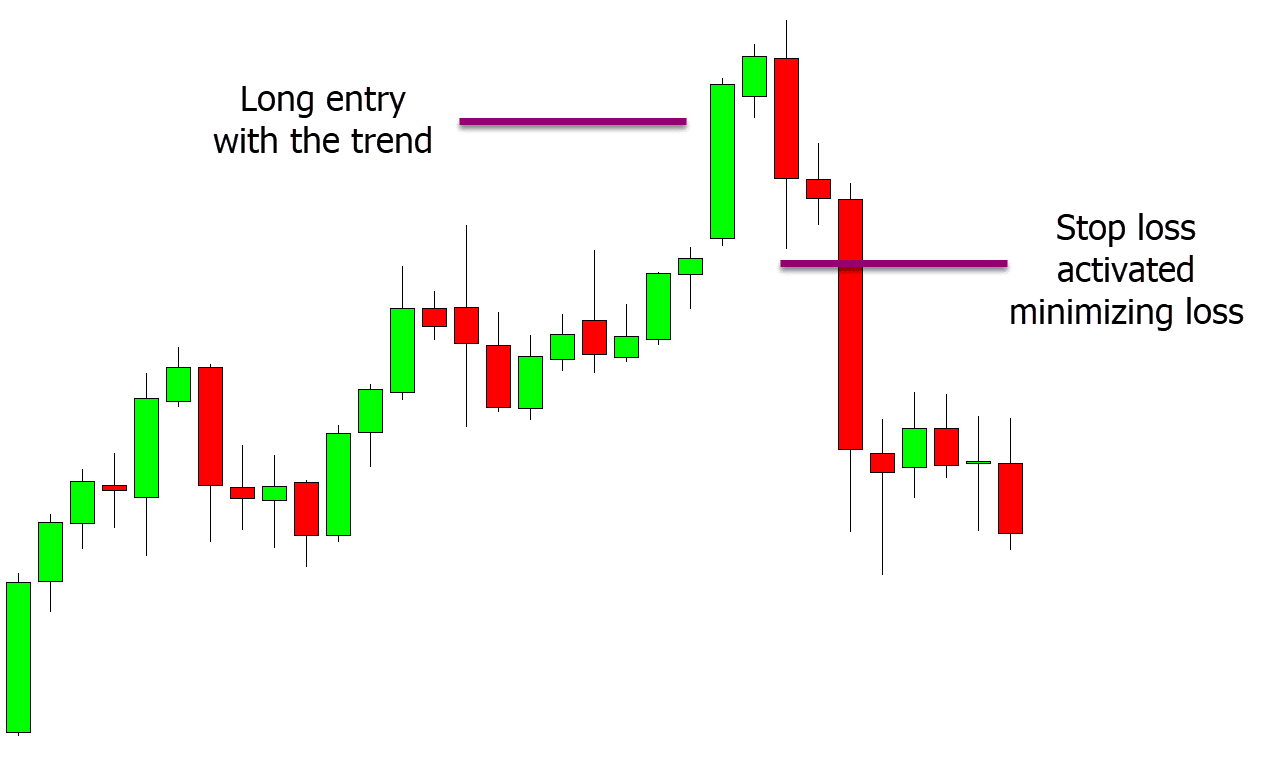

Smart stop losses can help you minimize your losses, and then take advantage of your wins.

The best place to set a stop loss is at the level where you have failed in a trade. Instead of a large loss being made, you can cut it off quickly.

Calculate your risk for each trade

Calculate your trades’ risk accurately to ensure you are only risking the correct amount.

Some traders do not calculate how much to trade in each trade, and instead use the same amount. This could result in you risking vastly different amounts depending on the pair and stop-loss level.

To control your risk, you should have rules in place. You will, for example, only risk 2% per trade. Position size calculators are used to calculate the risk of each trade.

Money Management Strategies for Serious Investors

If you’re a serious trader you will employ other, more advanced strategies that ensure that your losses are kept to a minimum and your profits come from your winnings.

A minimum risk-reward ratio

Even if you lose, you will still be able to make money if you use a minimum risk-reward percentage.

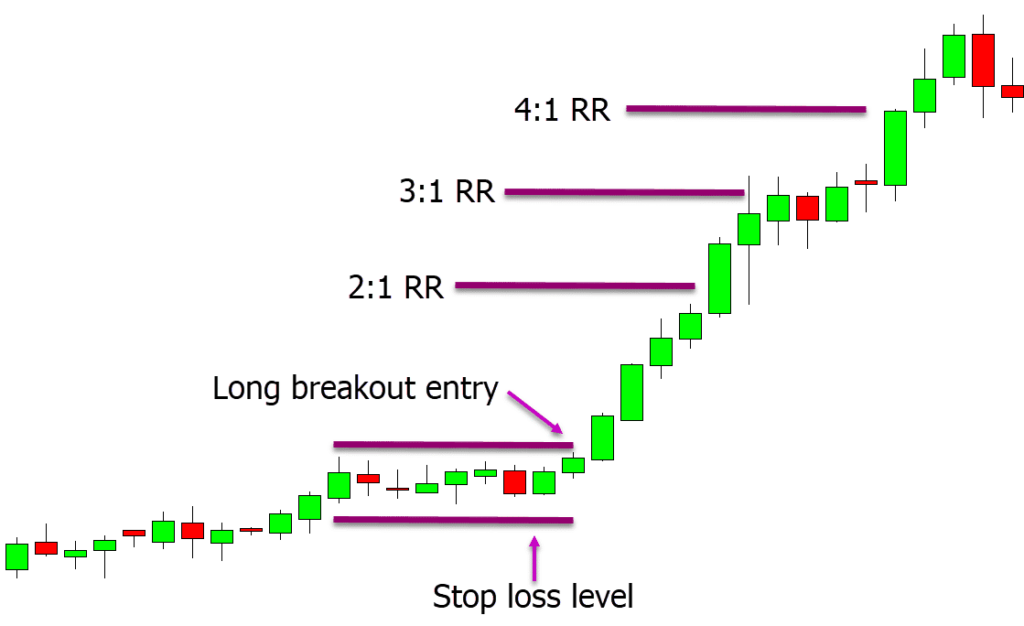

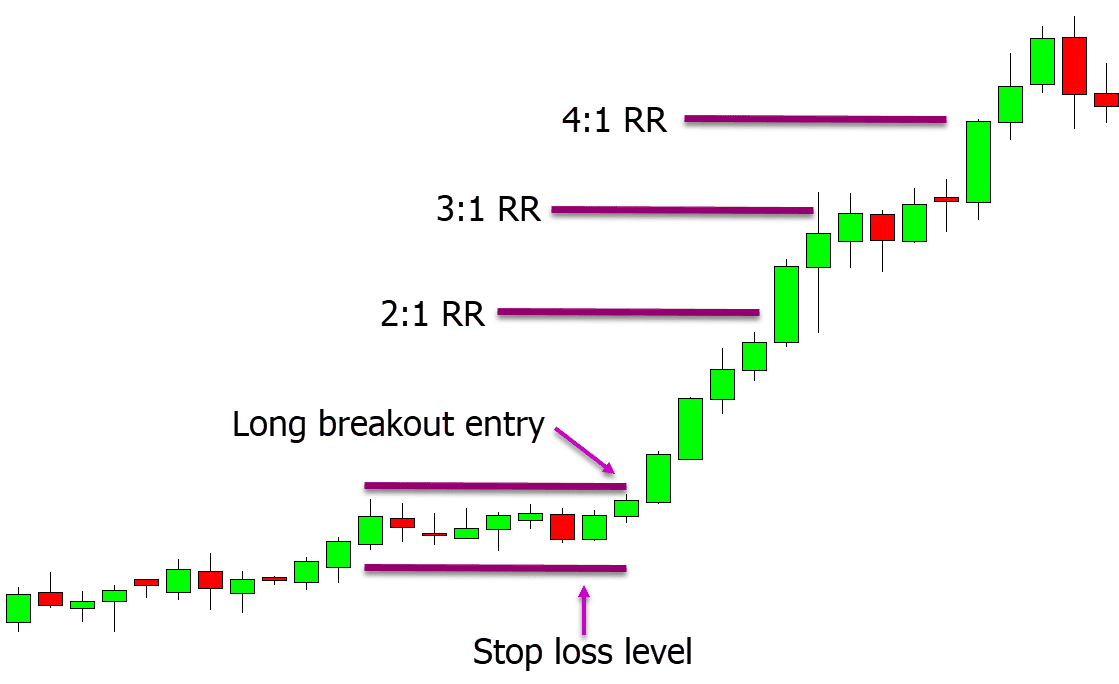

In the following example, we’re taking a long break-out trade. We will automatically exit the trade if price drops below our stop loss.

In this example, however, the price rises and we can take a profit of four times what we risked, or 4:1 risk/reward. This means that we could have made 8% profit if we had risked only 2%.

Use Leverage Wisely

Leverage can be a double-edged blade. It can be used to boost your winners and make them much bigger, but if it is not used correctly it can easily destroy your account.

Calculate the trade size before each trade to ensure you’re not using too much leverage.

If we want to open a new position, and we’re going to be risking 2% on each trade, then we will use a calculator for the size of our trade.

As our account grows or shrinks, we will continue to risk 2% while making sure not to use too much leverage.

Follow Currency Correlation

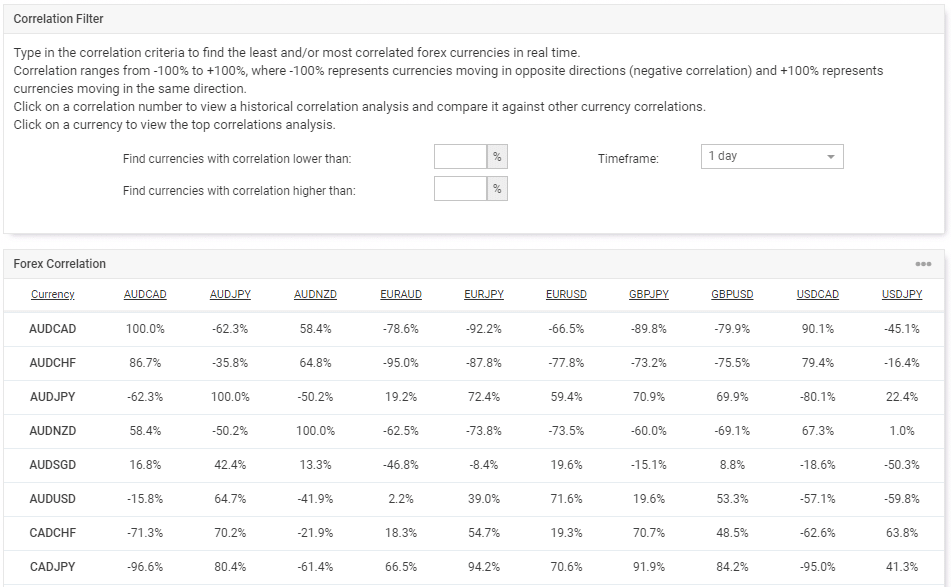

You should always consider the correlation in the Forex market if you are trading more than one pair.

When you use correlation incorrectly, you could end up losing more than you intended.

On a daily timeframe, EURUSD and GBPUSD may have up to a 90% correlation. If you trade on both Forex pairs, it is highly likely that they will move in the exact same direction. It would be two wins or two losses.

Use the correlation calculator at investing.com to see if there is a potential correlation between your trades.

Forex Money Management Plan

To ensure that you remain on track, create a plan for money management and clear rules.

This plan should include

#1: Calculate Your Acceptable Risk Per Trade

Two methods are used to determine the risk level per trade.

The first method is the fixed percent method. You can use this method to determine how much of your account percentage you are willing to risk for each trade.

The second method, the fixed-money method, is a good option. This method allows you to risk the same amount on every trade, rather than a percentage. If you have a $5,000 trading account, for example, and decide to risk $250 each trade, this is the method that works best.

Calculate your maximum account drawdown

Understanding and using an intelligent drawdown level will help you avoid blowing your bank account or adding huge chunks to it.

You might decide to take a rest if you are losing 25% of your account. This will allow you to figure out where the problem is. You can decide to go back to the demo account and see what mistakes you are making.

You can have a rule about when to stop risking your real money by setting a certain drawdown level.

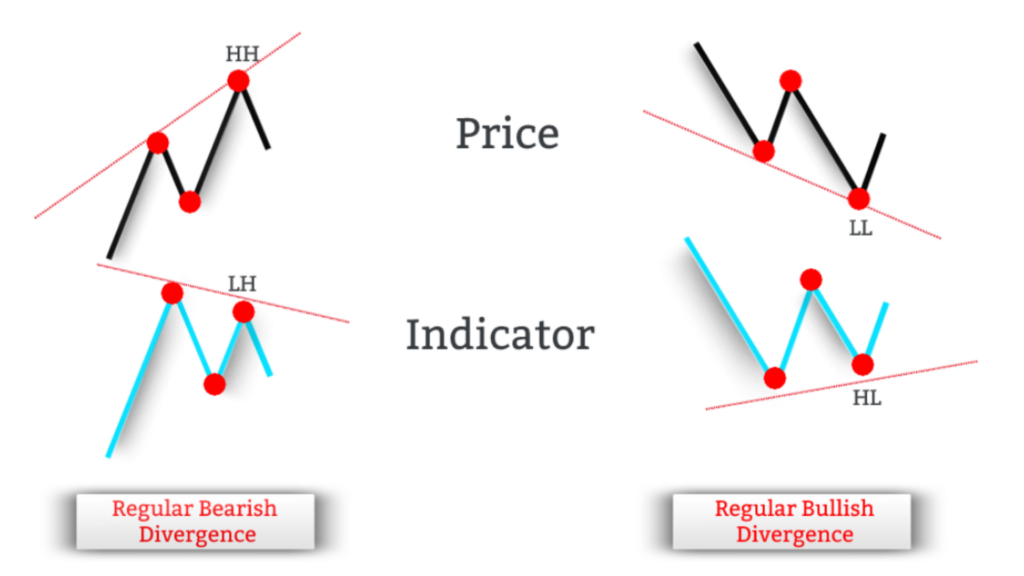

Create Rules for Taking Profits and Using Your Stop Loss

There are many traders who have rules about what they will trade, but not clear rules on stop loss and take profits.

It is only when you close a trade that you win or lose any money. Therefore, it is important to have a set of rules that outline how you can take profit or reduce your losses.

This rule set can help you to minimize your losses while taking advantage of larger winners.

Create and follow a money management plan

The best trading plan will be written down with a clear rule set that is easy for you to follow.

Your money management plan must include rules about;

- What is the leverage that you use?

- The percentage of your risk expressed in money or percentage terms.

- How much you can withdraw from your account without it being considered a problem.

- How much risk you are willing and able to take on each trade.

- How you will use the correlation.

- How to set your stop-loss and take-profit levels.

Trading Risk Management Books

If you’re looking to improve on your money-management strategies, it might be worth checking out some books that go into more detail and cover different approaches.

![Smart Market Structure Concepts MT4 [Reviews]](https://mq177.com/wp-content/uploads/2023/06/smart-market-structure-concepts-mt4-screen-8146-1024x504.png)

Responses