Simple Martingale Trading Strategies

Martingale’s strategy is designed to maximize profits over time. This is more a money-management method than a strategy for trading and can be used in conjunction with many different systems.

We will explain the Martingale trading system and show you how it can be used to your advantage.

What is Martingale Trading Strategy?

Martingale dates all the way back to the 18th century. You can almost guarantee your success if you’ve got enough money. Probability is used to calculate the odds.

Martingale was first used by casinos and gamblers. The casinos introduced minimum and maximum betting limits, which had a negative impact on its success.

The martingale system works on the principle that every time you lose, you double your trade or bet size. As you continue losing, you continue doubling your trade sizes.

After you have doubled your bets or traded sizes repeatedly, you only need one winning trade to return to profit.

This type of money management can be a problem because, while you may eventually succeed in making money, it can also lead to long losing streaks. You will need a large amount of cash reserves before you are able to turn a profit.

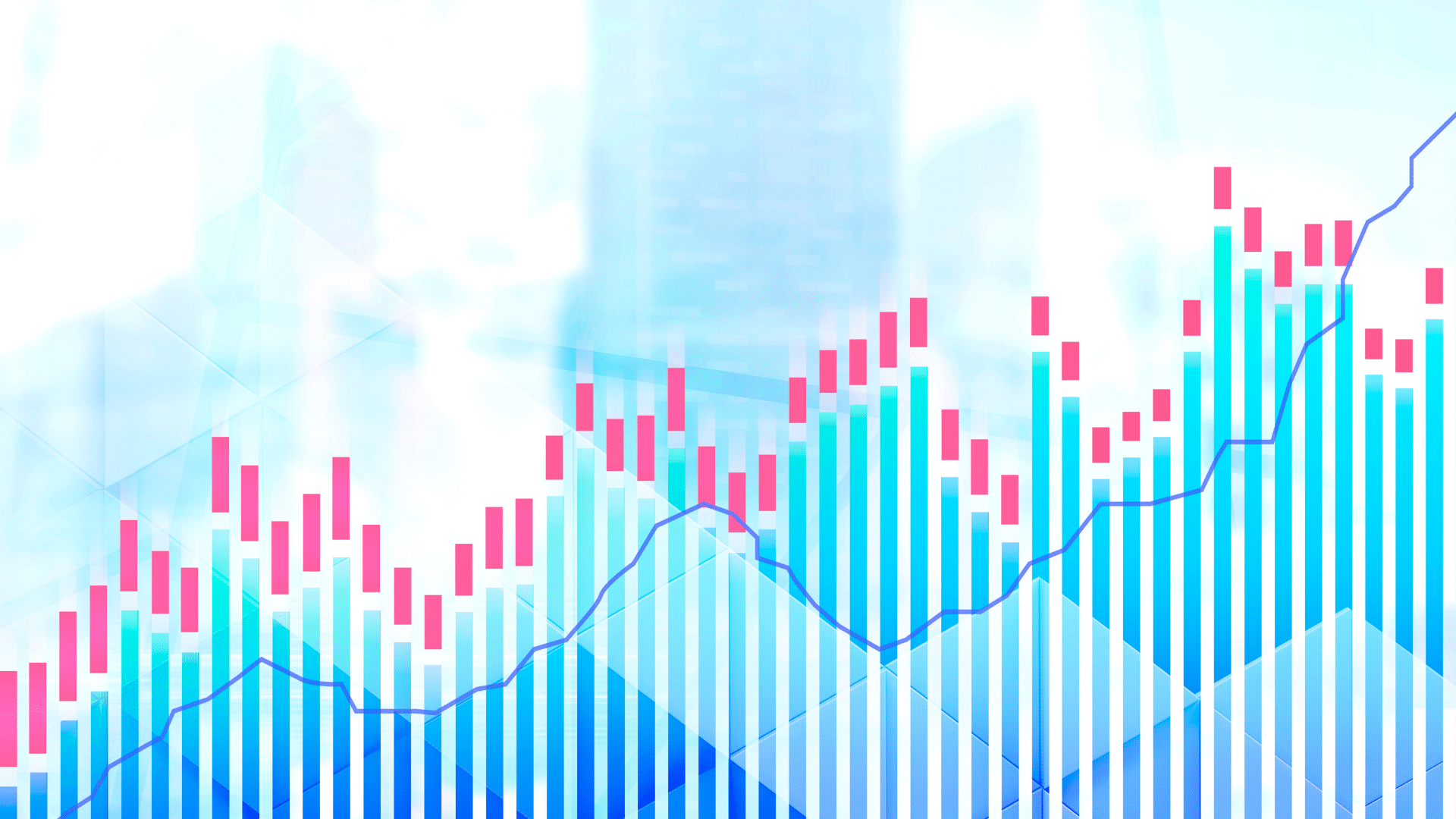

Start by risking $1. If the trade is a loss, you risk now $2. You risk $2 if the next trade loses too. You can continue this pattern until you have a winning trade.

In this example, you would risk $1, $2, and then $4. If you are only aiming for 1: RR – risk-reward (double the amount you lose on a potential trade), and you win the third trade, then you would be back in profit. You would have made a loss on $1 and $2, resulting in a total of $3. However, after making a profit of $4, you’re now $1 ahead. The method can be repeated again.

Martingale Method: How to use it

This system’s biggest flaw is the speed at which your losses can grow, as they double each time.

You can only make it work if you are willing to take a small risk or have a big reserve to use when you finally return to profitability.

If you risk $100 on each trade, and you lose six consecutive trades, you have already lost $6300. You will now have to risk another $6400 to return to profitability. If you lose your seventh trading, you’re now down $12700, and you have to put up $12800 in order to recover those losses.

Even professional traders can have losing streaks so it is vital to manage your money.

Martingale methods are best used in the markets that have the highest returns.

Martingale works best in certain markets.

If a certain company files for bankruptcy, stock prices may drop to zero. You would lose all your capital and have no way of doubling up or getting your money back.

It is very unlikely that a foreign currency will ever drop to zero. Stocks can go to zero but it’s not likely to happen. Forex can also have large swings in price, but rarely, if at all, do prices reach zero.

Other reasons why people use martingale on the Forex markets are that they can leverage their trading and that there are so many different markets and timeframes available.

It is possible to return to profitability by finding high-quality investments.

Martingale Trading Strategies

Martingale allows you to use a variety of strategies.

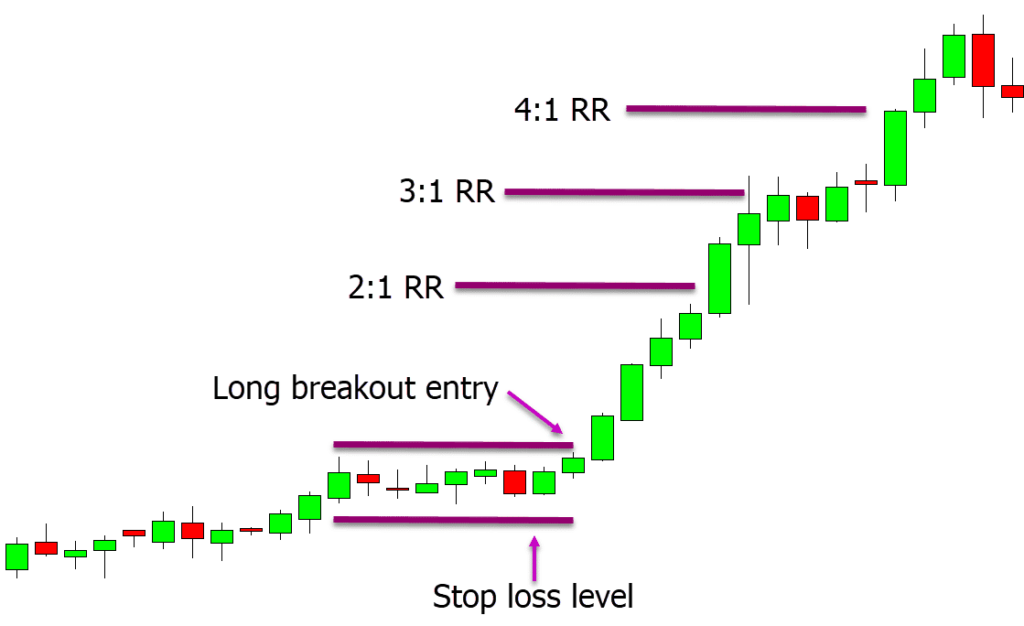

Simple and clear strategies are the best.

You could, for example, enter a trade each time the 21-period moving average crosses over the 50-period moving average. This is an easy strategy that you can automate using the martingale technique.

When using this money management strategy, it is important to be consistent. This means that you must always follow the same rules. If you take only half of the profits from your winning trades, or if your winning trades are low-reward, you won’t be able to get back to profitability, even if you do win.

![PipFinite Volume Critical [Indicator Reviews]](https://mq177.com/wp-content/uploads/2023/05/5374034a40c8d6800cb4f449c2ea00a0-6.jpg)

Responses