Smart Market Structure Concepts MT4 [Reviews]

![Smart Market Structure Concepts MT4 [Reviews]](https://mq177.com/wp-content/uploads/2023/06/smart-market-structure-concepts-mt4-screen-8146-1024x504.png)

Smart Market Structure Concepts MT4 – a comprehensive indicator that simplifies trading by using Smart Money Concepts – is a comprehensive tool designed to help traders make informed trading decisions. Smart Market Structure Concepts MT4 allows traders to make better trading decisions by identifying key market levels, order block, Fair Value Gaps and other important concepts. This article will explore the Smart Market Structure Concepts MT4 to help traders make better trading choices. Understanding its features and how to use this powerful indicator effectively can help traders gain valuable insight into market dynamics, and possibly improve trading outcomes.

What is Smart Market Structure Concepts MT4?

Smart Market Structure Concepts MT4 combines Smart Money Concepts to streamline trading. It provides traders with a comprehensive framework to recognise important market levels, order block, mitigation blocks and fair value gaps (FVGs).

This indicator allows for real-time visualisation of market structures as well as order blocks, discount and premium zones, highs and lows that are equal, and FVGs. These indicators allow traders to leverage commonly used price action methods by automatically marking their charts. The SMC Indicator also includes alerts that are based on various price characteristics. This allows traders to be alerted for specific price movements.

Smart Market Structure Concepts for MT4 Strategy

Smart Market Structure Concepts MT4 allows traders to use any of the following trading strategies:

- Identify the market structure: Utilize the indicator to identify crucial support and resistance levels by observing break of structure (BOS) and change of character (CHoCH) levels. This helps in determining whether the market trend is bullish, for a long position, or bearish, for a short position.

![Smart Market Structure Concepts MT4 [Reviews]](https://mq177.com/wp-content/uploads/2023/06/smart-market-structure-concepts-mt4-screen-8146.png)

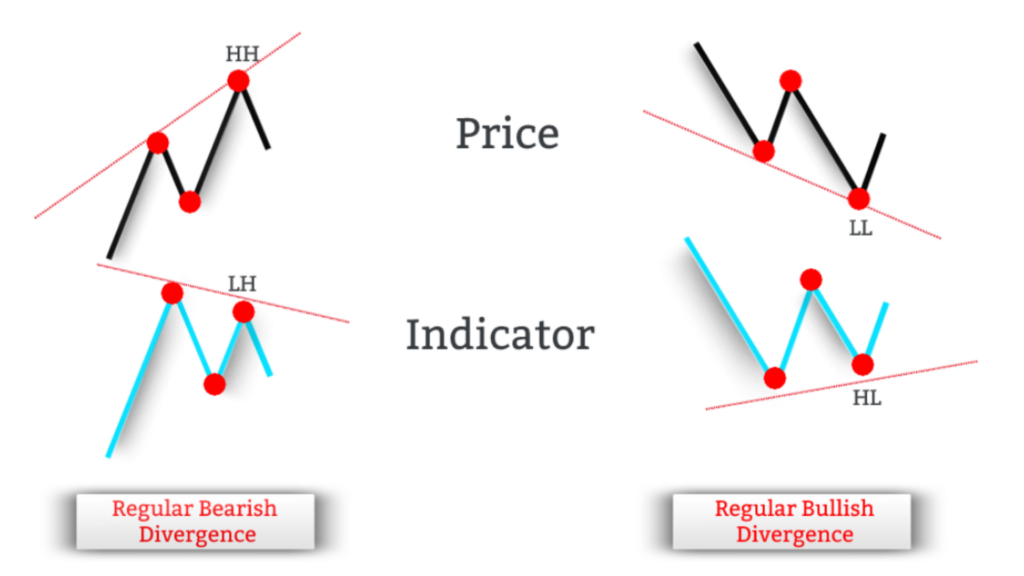

- Identify swing points: Take note of the swing points displayed by the indicator, such as higher highs (HH), higher lows (HL), lower lows (LL), and lower highs (LH). These points are valuable for identifying trend direction, such as a bullish or a bearish signal, indicating a buy or sell order respectively.

![Smart Market Structure Concepts MT4 [Reviews]](https://mq177.com/wp-content/uploads/2023/06/smart-market-structure-concepts-mt4-screen-8197.png)

- Identify fractal points: Pay attention to the fractal points displayed by the indicator, including PDH, PDL, PWL, PWH, etc. These points can indicate potential market reversals. Use this information to enter trades in the direction of the trend or exit positions when a market reversal is likely. Traders may buy if the price breaks above the fractal or sell if it breaks below the fractal.

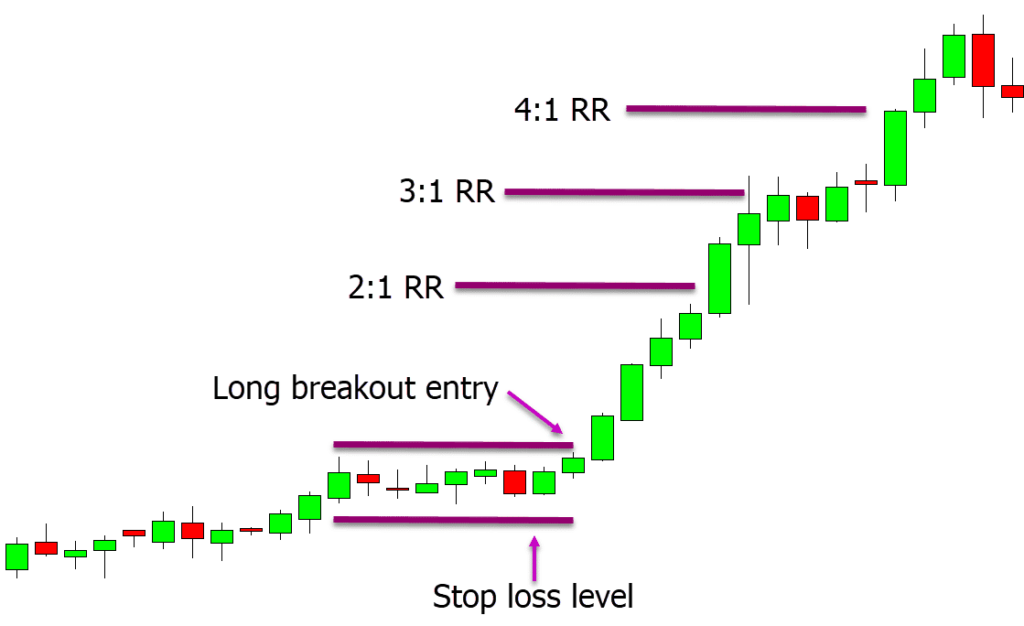

- Identify order blocks: Use the indicator to locate order blocks that signify areas of market interest, such as supply and demand zones, accumulation and distribution areas, and stop-loss clusters. This information helps in placing trades with favorable risk-to-reward ratios and managing risk by setting stop-loss orders.

Traders may choose to use different variations or combinations of these signals based on their individual trading style and preferences. It is essential, however, for traders to perform proper risk management techniques and exercise caution when making trading decisions.

Buy Signal

- After a Change in Character (CHoCh), look for Order Blocks. Traders can open a long trade when the price breaks above an Order Block (OB) with confirmation by the Change of Character (CHoCh), and the indicator displays a bullish sign.

- Fractals can be used to determine a possible reversal. When the price is above the Fractal, traders may want to open a position when the indicator shows a bullish sign.

- Trade in the direction that the trend is moving. When the indicator is showing a bullish direction and the price trending upward, traders may choose to open a long trade.

- Set your stop loss below the lowest low of your trade or in accordance with your money management strategy.

- If any of the entry conditions above reverses, it could indicate a possible trend reversal.

Sell Signal

- After a Change in Character (CHoCh), look for Order Blocks. Traders can open a short trade when the price breaks below an Order Block (OB) with confirmation by the Change of Character (CHoCh), and the indicator displays a bearish sign.

- Fractals can be used to determine a possible reversal. When the price breaks below the Fractal, traders may consider opening a short trade with the confirmation of the indicator showing a negative signal.

- Trade in the direction that the trend is moving. When the indicator indicates a downward trend, traders may choose to open a short trade.

- Set your stop loss behind the highest price or in accordance with your money management strategy.

- If any of the entry conditions above reverses, it could indicate a possible trend reversal.

Smart Market Structure Concepts MT4 Pros & Cons

Pros

- The aim of the framework is to provide traders with a comprehensive trading environment.

- This software allows traders to mark up charts automatically using widely used price-action methodologies.

- Customization options are available to allow traders to customize the look of the charts.

- The software includes alerts that are based on different price characteristics. This allows traders to be alerted for certain price movements.

You can also find out more about Cons

- This indicator is heavily dependent on technical indicators, price patterns and other price patterns.

- There may be a learning curve if you are not familiar with the concepts and functionality.

- The system is not perfect and can generate false signals. Additional analysis and confirmation tools are required to confirm trading decisions.

- The indicator can be affected by rapid price changes and abrupt shifts in the market.

The conclusion of the article is:

The Smart Market Structure Concepts MT4 Indicator offers several benefits, including simplifying trade and real-time visualization of market structure. It also incorporates widely used pricing action methodologies as well as customization options and price movement notifications. It also has some limitations, including the reliance on technical indicator, a steep learning curve, false signals that can occur, vulnerability to market volatility and customization. Risk management is important for traders to protect their capital and minimize potential losses in the financial market.

![PipFinite Volume Critical [Indicator Reviews]](https://mq177.com/wp-content/uploads/2023/05/5374034a40c8d6800cb4f449c2ea00a0-6.jpg)

Responses