If prices and the RSI indicator are not reflecting the same pace, the RSI divergence indicator will alert traders.

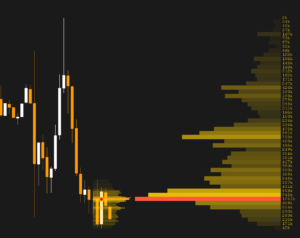

The RSI (Relative Strength Index) is an indicator of momentum that measures the price’s fluctuation to determine markets that are overbought or undersold.

It’s a scale ranging between 0 and 100. If you see that your Relative Strength Index drops below 30, the market is deemed oversold. If the index is higher than 70, it is considered overbought.

The absence of signals is among the main issues encountered when using an indicator. This indicator rarely reaches levels of overbought and undersold.

To combat this issue, To overcome this issue, you must diverge from the standard indicator.

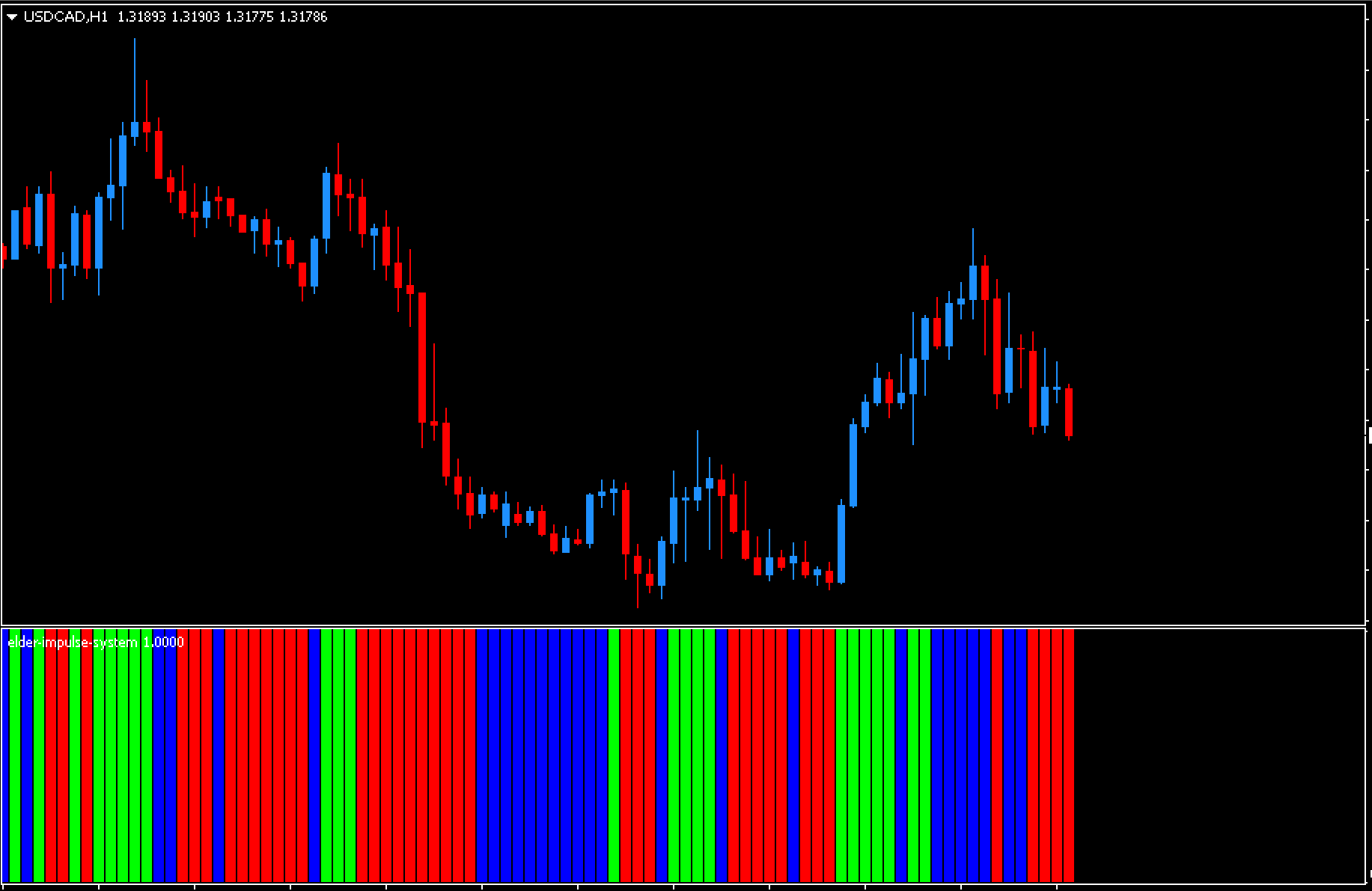

Divergence is a helpful tool for knowing whether the market is likely to continue its upward trend following an upward pullback.

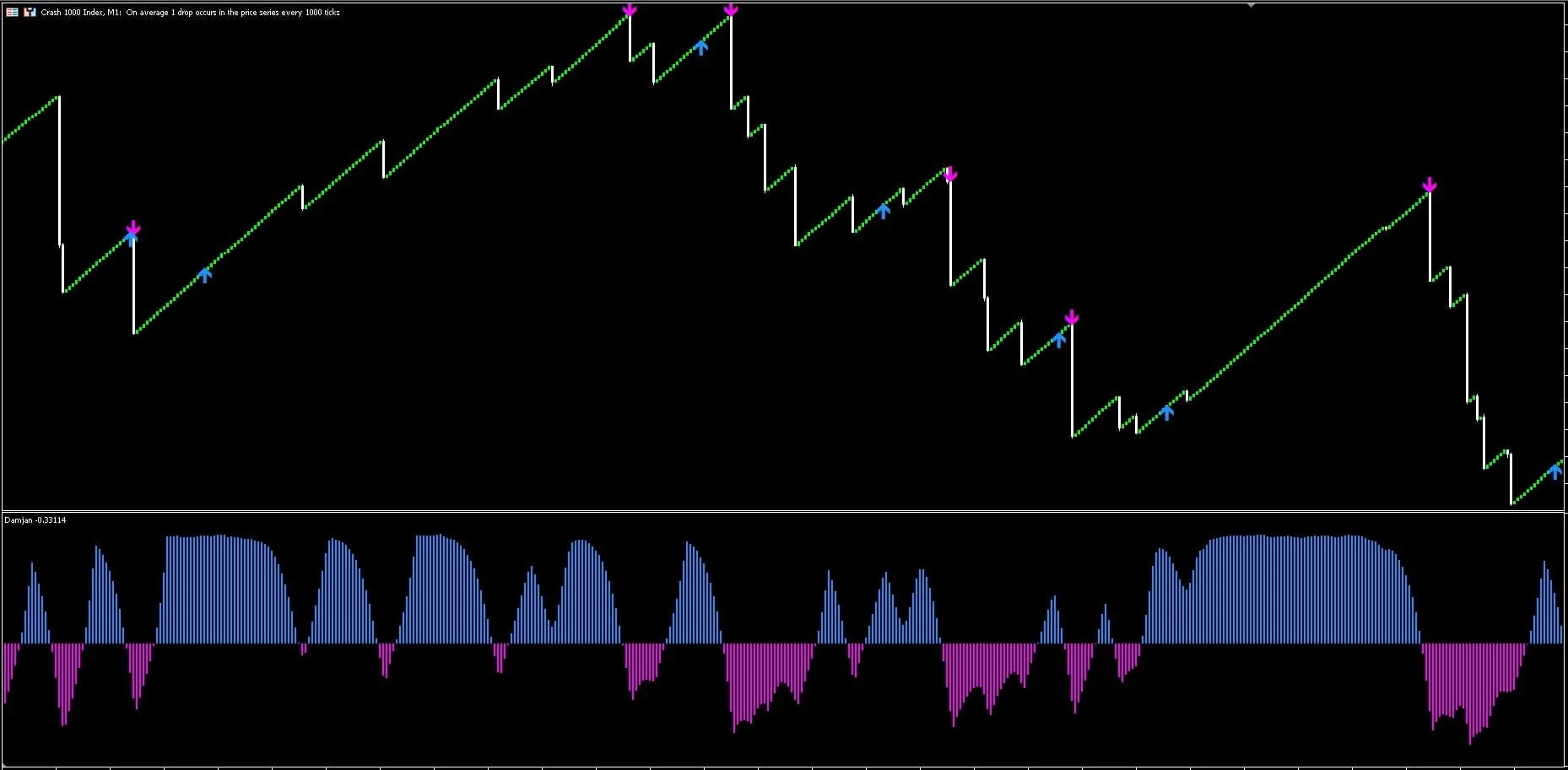

If a chart shows an RSI divergence in the index of relative strength, the chart creates lower highs. This is the case when the price is at its highest. However, when the price makes lower lows, this indicator displays higher lows.

RSI Divergence Indicator BUY/SELL Signals

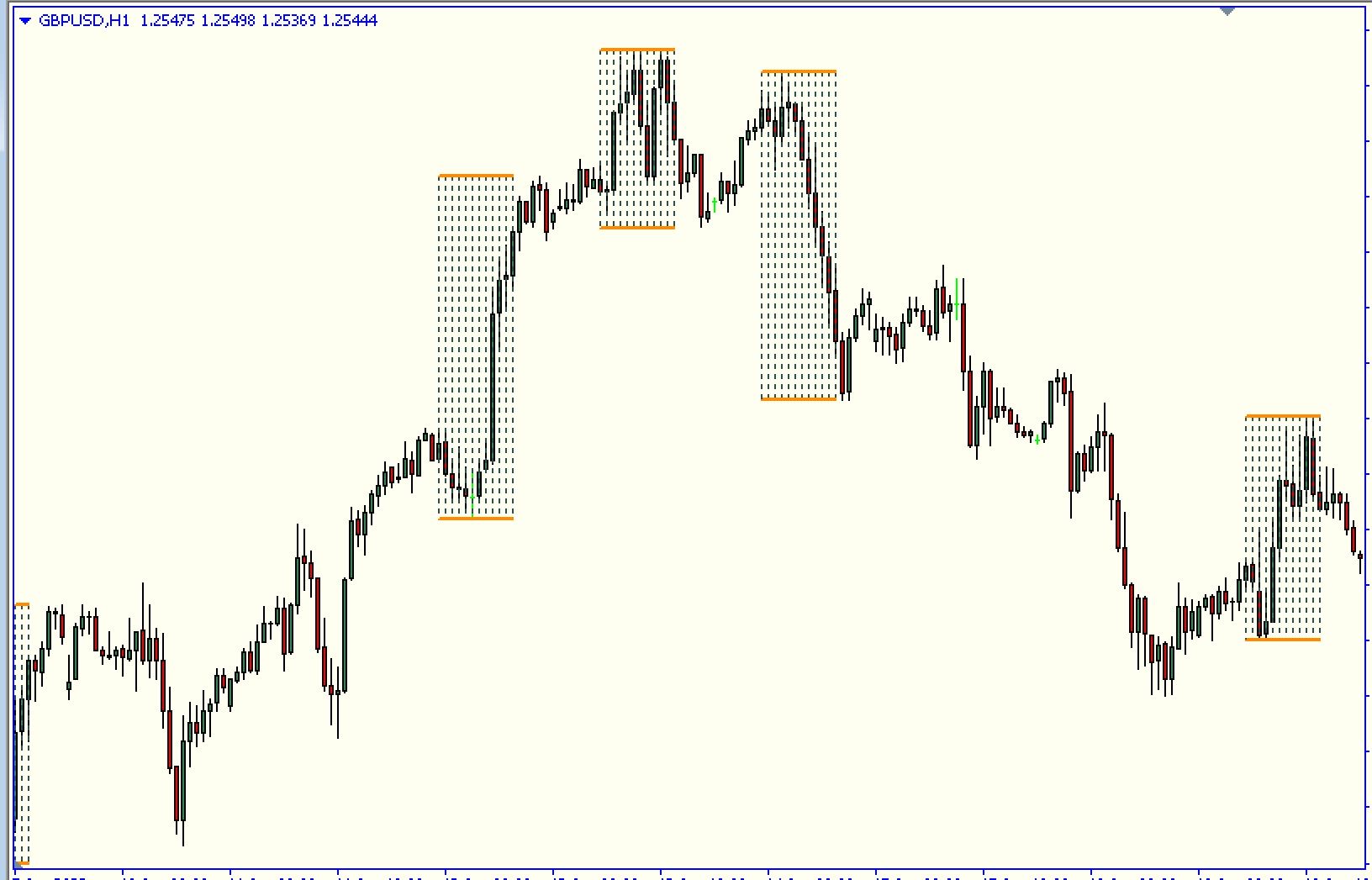

To find the buy and sell signal that uses the indicator, you must find bearish and bullish divergences. The bullish divergence can give buyers signals, and the bearish divergence gives us sell signals.

Buy signals

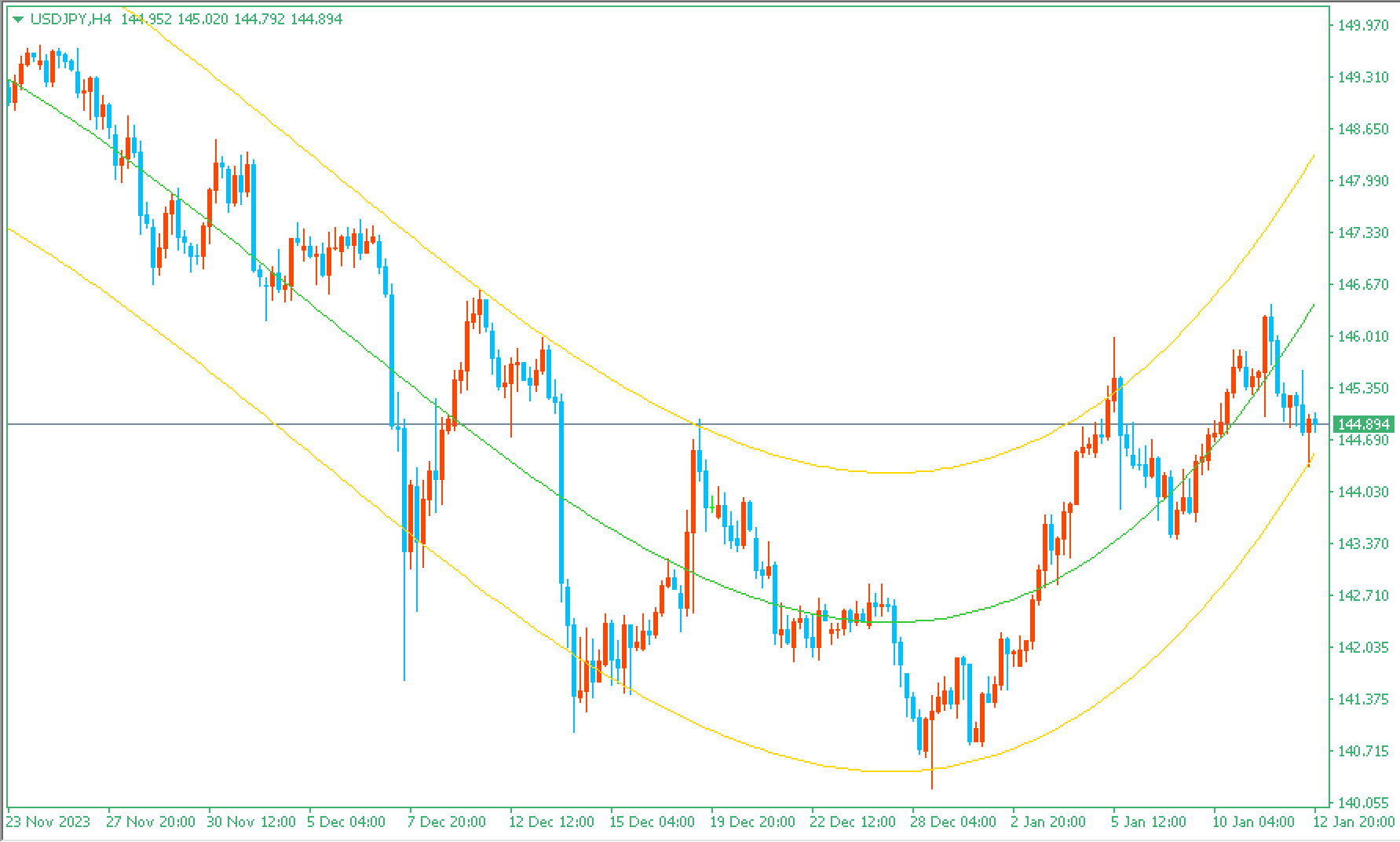

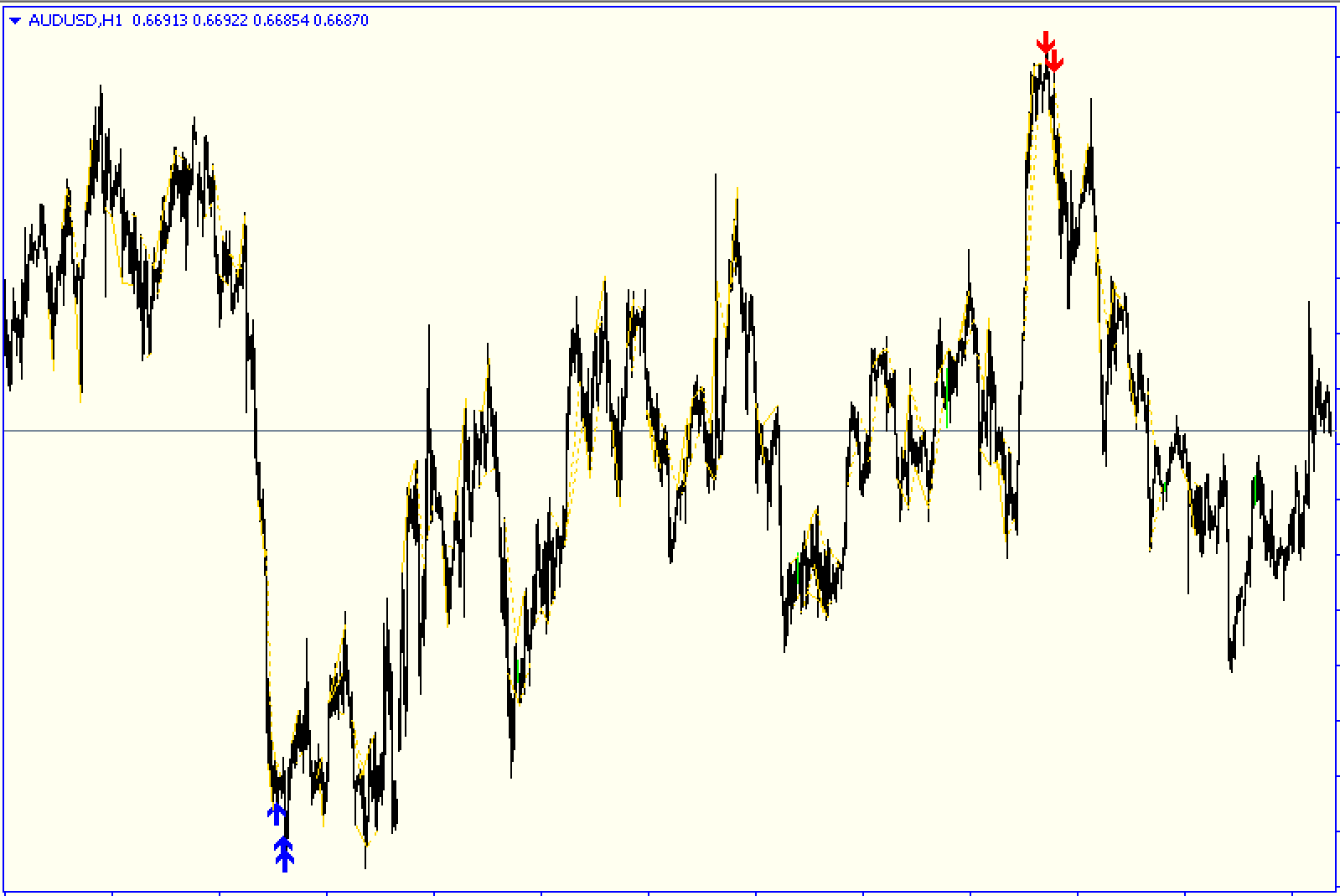

The above chart shows an upward trend. As you can observe, we enter the market when our indicator displays lower highs and an oversold situation. This indicates a bullish divergence.

You could hold off until the candle confirms or enter a position once the RSI crosses the territory of oversold. It is possible to place a stop loss close to the low of the last session and then exit the trade when you see that the RSI divergence starts to downturn.

Bottom line Bottom line Divergence indicator

The conventional RSI indicator can be prone to false signals, and often it doesn’t display overbought and undersold zones. The RSI Divergence Indicator incorporates divergences and the standard RSI to provide a general idea of where prices could be heading in the near future.