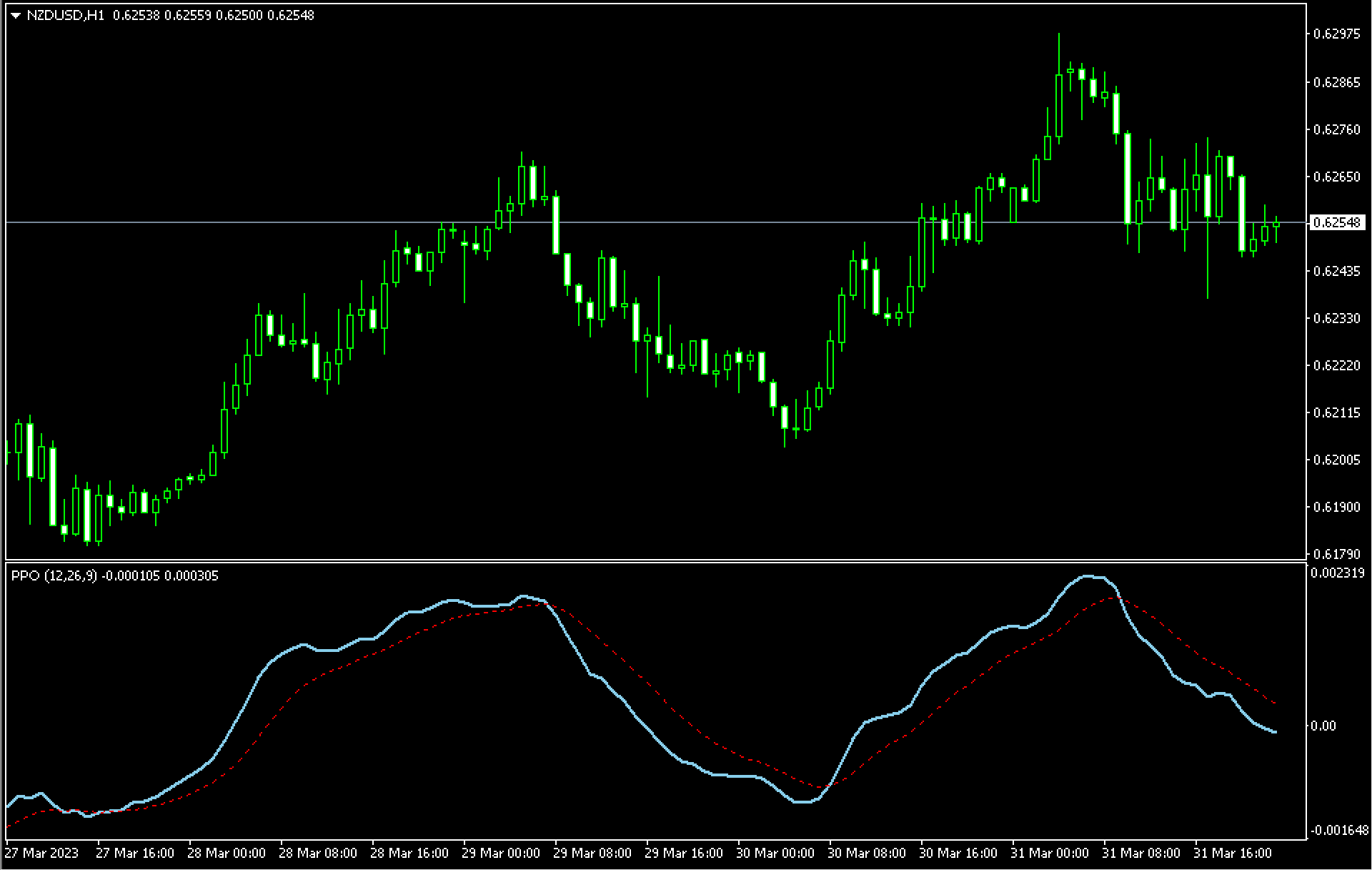

The trend reversal indicator uses two exponential moving averages as its base. Opens in a separate window beneath the price chart. When the exponential moving averages slow and fast intersect, the buy and sell signals will be activated. This indicator is a great indicator to identify trend reversal.

The trend reversal indicator MT4 is ideal for scalping and day trading. The indicator can be used on any time frame, from one minute to one month. The indicator is best used on H4 (four hour) time frames. You run the risk of experiencing multiple fluctuations over shorter time frames. This could lead to small losses that could significantly impact your portfolio.

This is an interesting point. The indicator is easy to read. This indicator is useful for all traders, whether they are newbies, professionals, long-term traders, scalpers or long-term traders. The indicator can be used to trade any pair. You can also change the EMA periods from the input tab to fit your trading strategy.

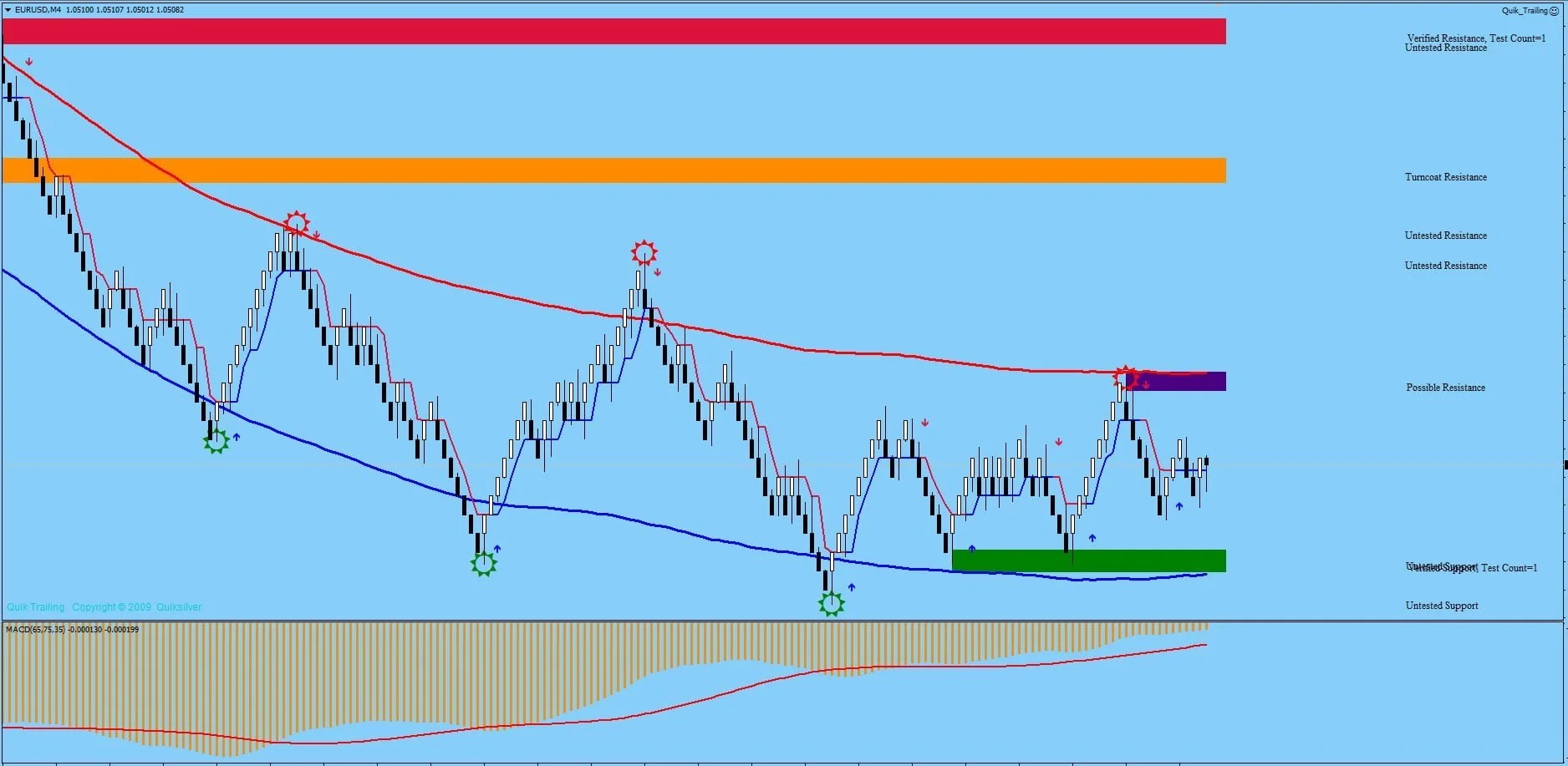

When the price consolidates, it is important to note that the indicator can provide multiple signals. To increase your profit ratio, you should incorporate other indicators and analyses into your strategy.

Sign up

When the fast EMA is higher than the slow EMA, a buy signal is generated. The blue dotted line intersects with the red line. You should aim to enter the long position at opening price of next candlestick.

When should you close a long position? The preset risk-to-reward ratio can be used to exit the trade. You can also exit the trade if a sell signal cancels the bullish price movement.

Sell Signal

When do you enter a bearish trading?

If the red line crosses above the blue line it signals a start of a downtrend. You should therefore start short positions. You should aim to enter trades at the opening of the next candlestick.

After the trade has reached the set reward or loss, you can exit the trade. You could also wait for the indicator’s bullish signal to start before exiting the trade.

Stop loss

A stop loss that is a few pips lower than the support level is a good choice. You can place the stop loss for sell trades a few pips higher than the swing high.

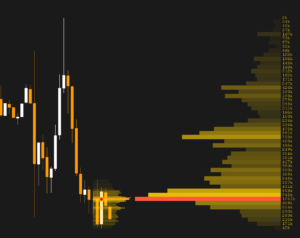

At 0.93314, the red line crosses over the blue line around 08:00 on June 1. The sell signal was activated at the open of the next candle. The blue line crossing over the red line is a good time to exit the trade.

At 18:15, the blue line crosses the dotted line red line and signals a bullish signal. The indicator showed another bearish signal when the price moved 30 pips earlier. A stop loss of just a few points below the swing low of 0.9304 is a good choice for the buy trade. The resistance zone at 0.9370 is a great stop loss for the short position.

Closing Note

Trend reversal indicators are a great tool to identify potential price reversal points that act as buy or sell signals. The best thing about the signals is their ability to be used in any currency pair and time frame.