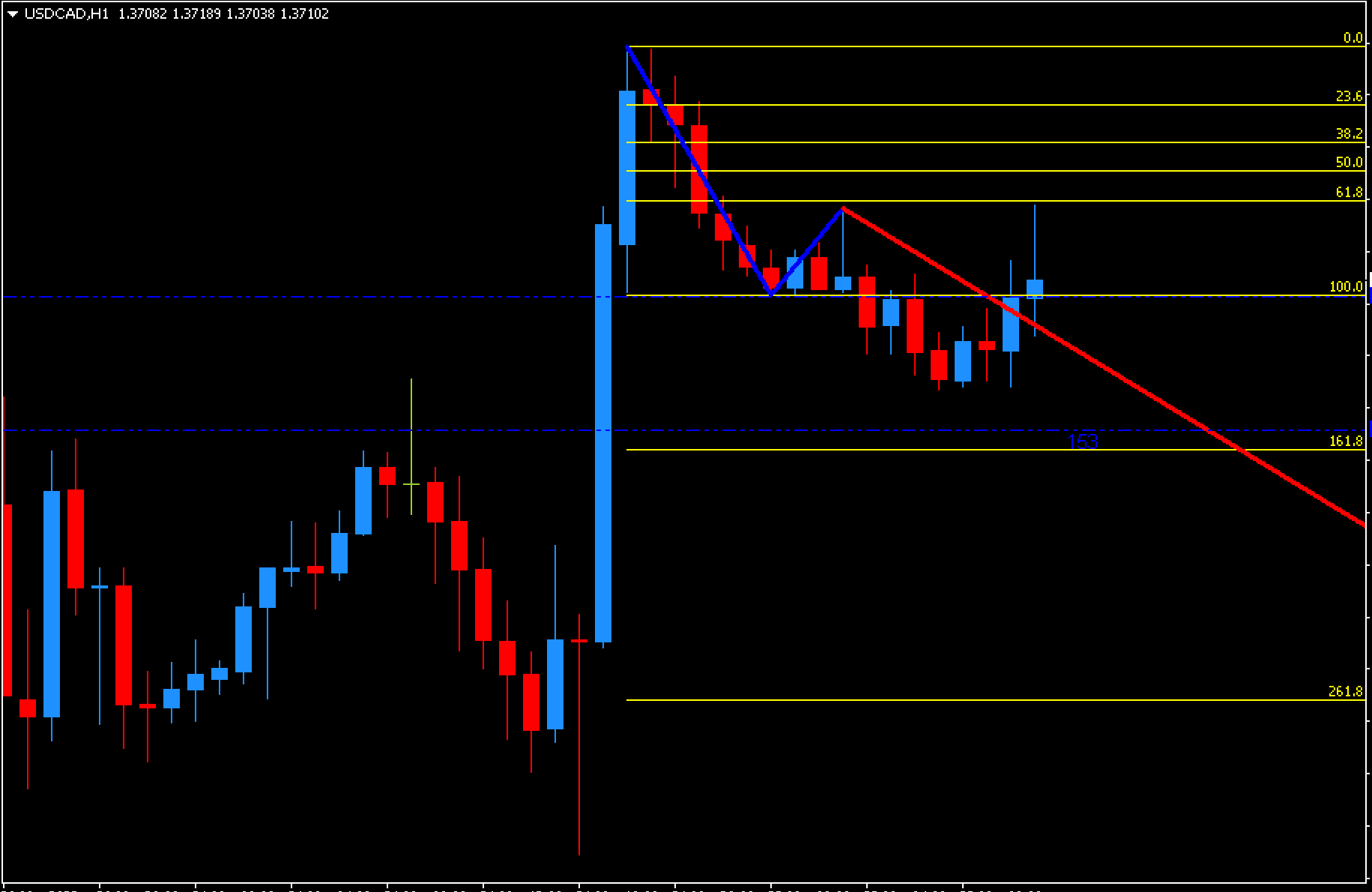

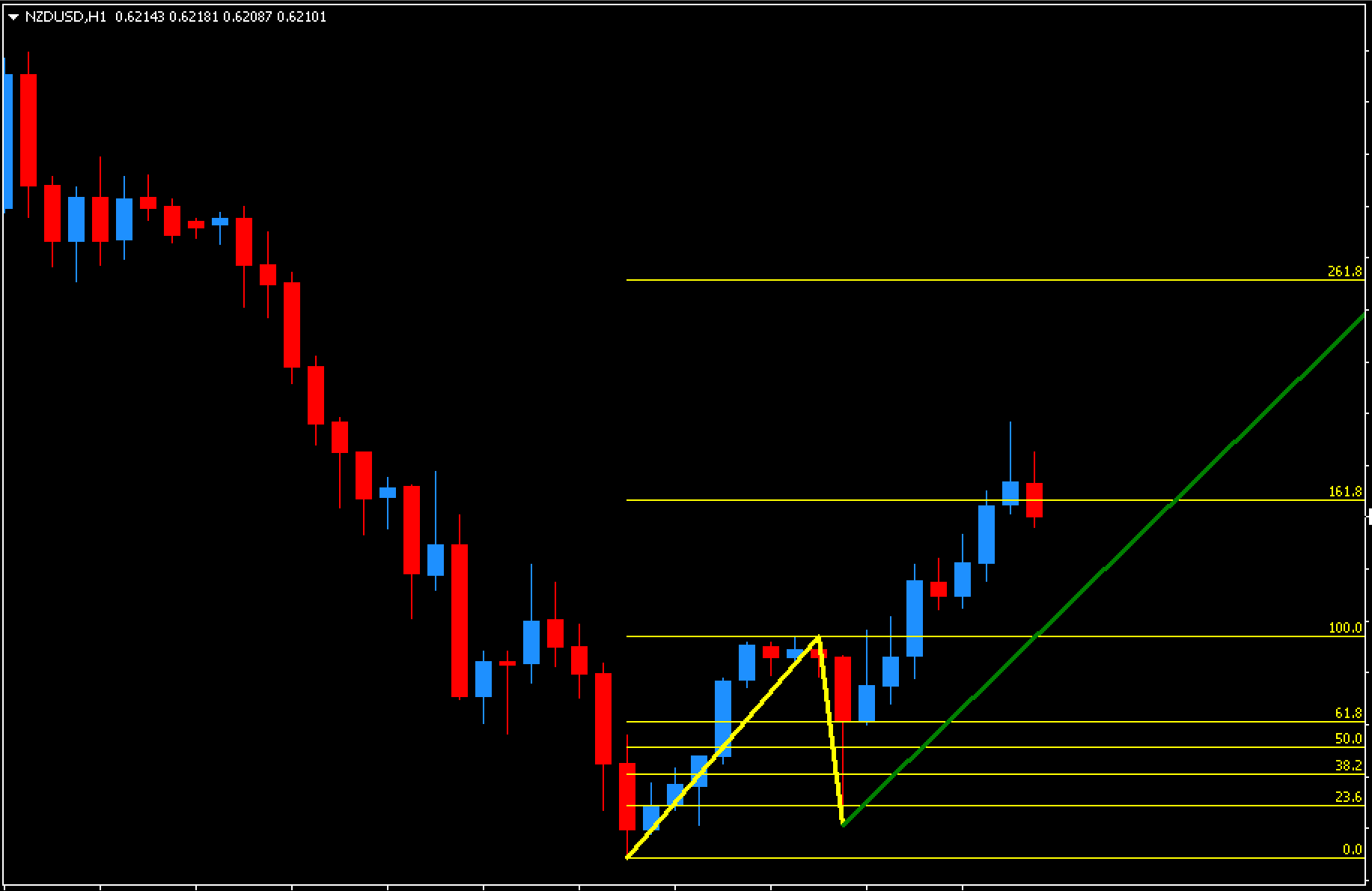

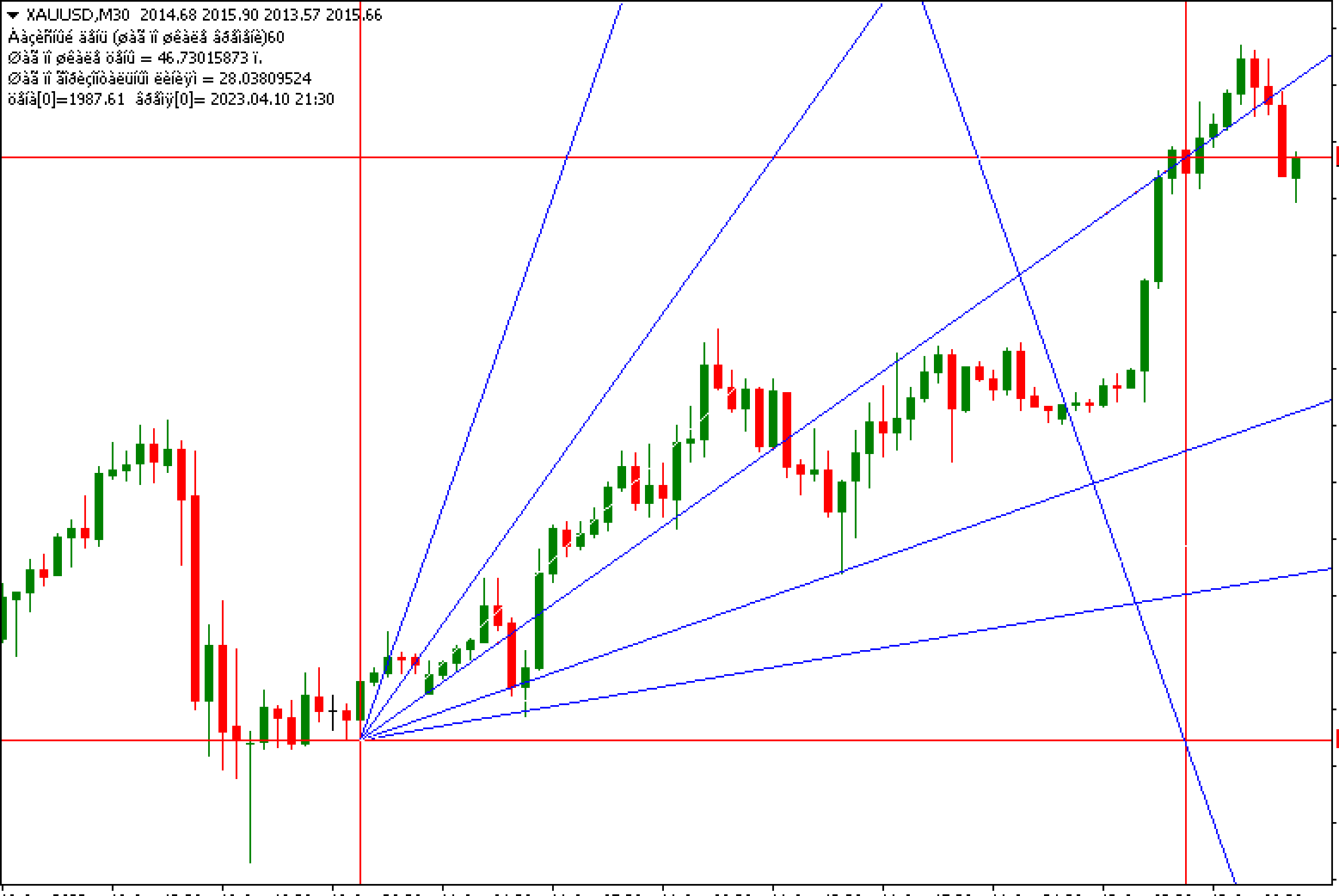

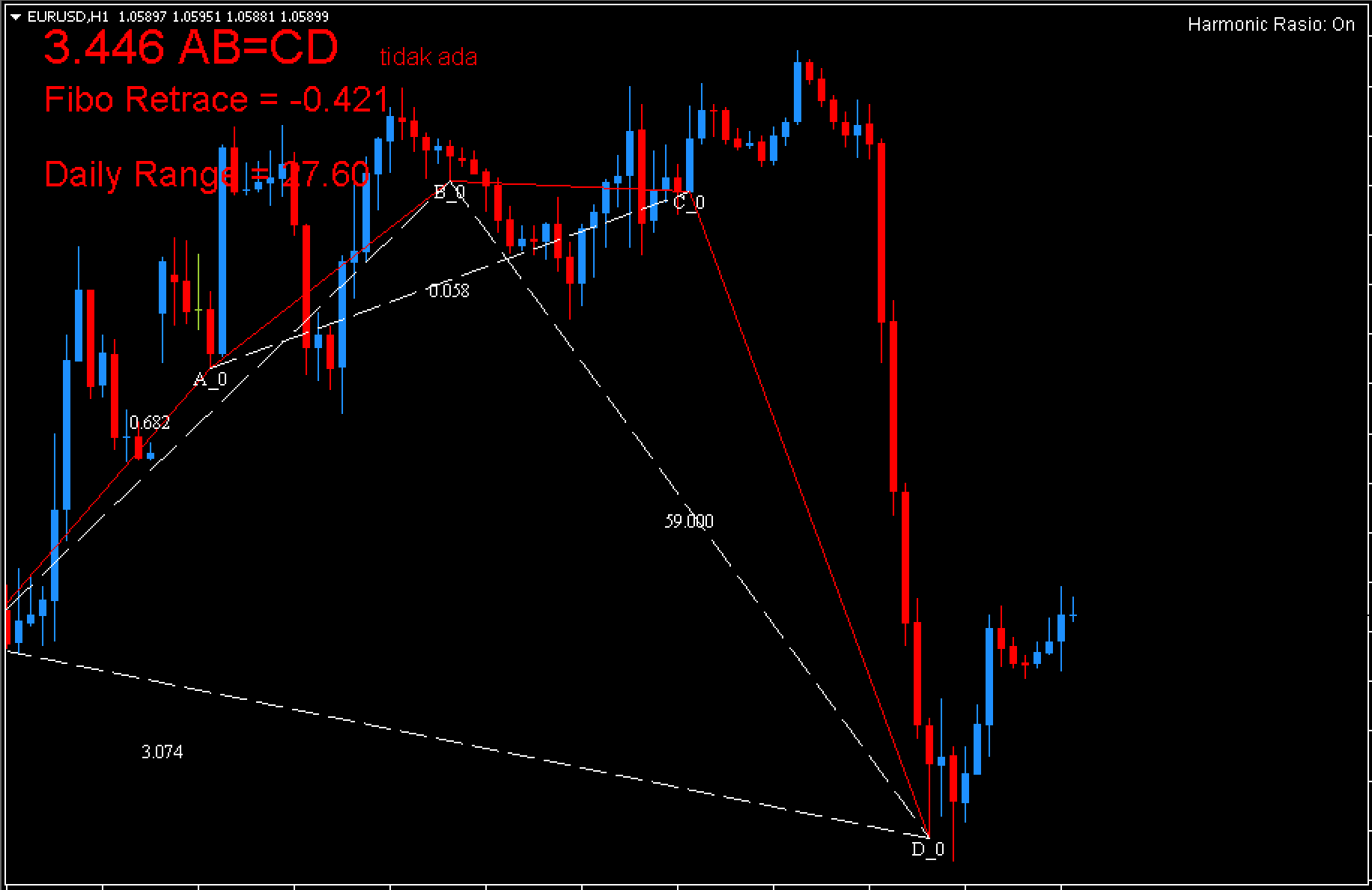

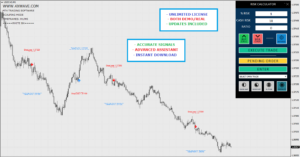

MT4’s 1-2-3 pattern indicator represents the three-point pattern at the bottom of the trend. The indicator plots a three-point herringbone pattern. These lines or dots are the high/low, entry and fibo points. It is also known as the 1-2-3 pattern.

These five Fibonacci levels are combined with the herringbone of the non-drawing pattern to highlight the five Fibonacci degrees.

These Fibonacci levels are used to detect price action along with the non-repainted pattern of three lines. The indicator’s ability to show price action trends makes it very useful for price action strategies.

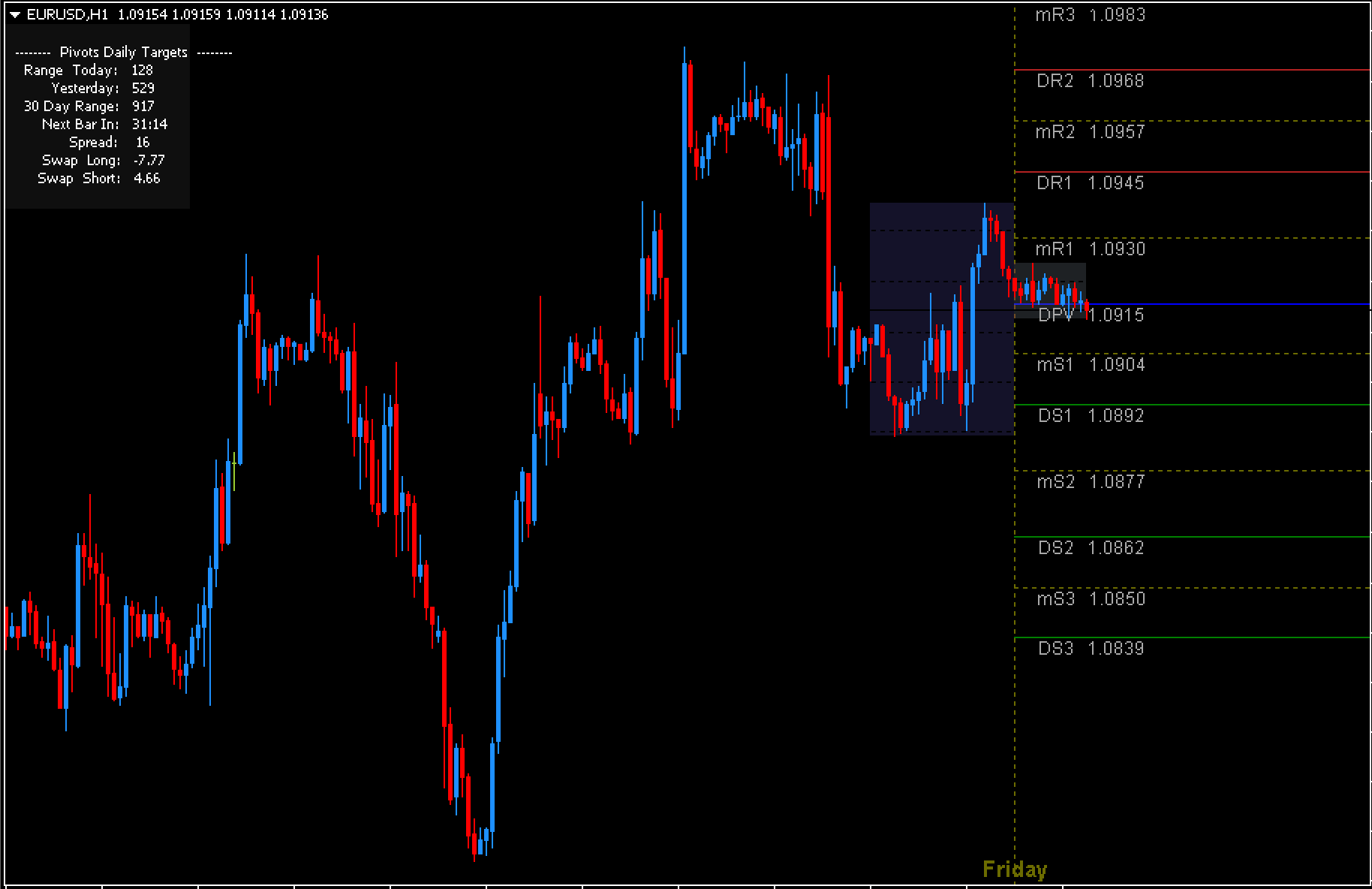

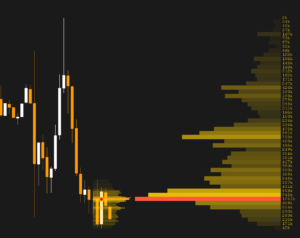

You can use the five Fibonacci levels as support or resistance to help you decide how to position yourself. 1-2-3 pattern indicators can be used in any time frame. However, it is best to use it between the 5-minute and 30-minute periods.

How do you trade the 1-2-3 indicator?

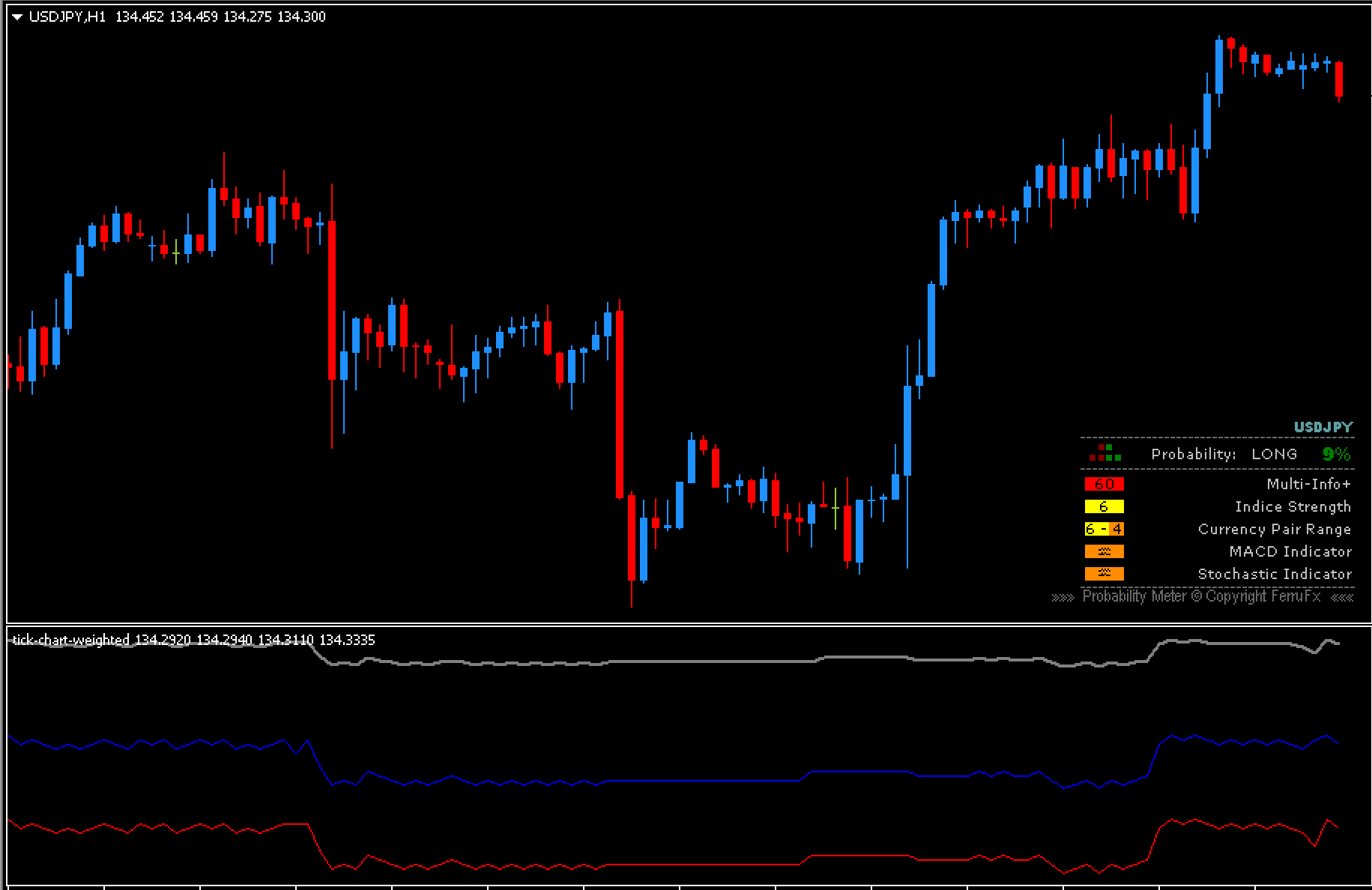

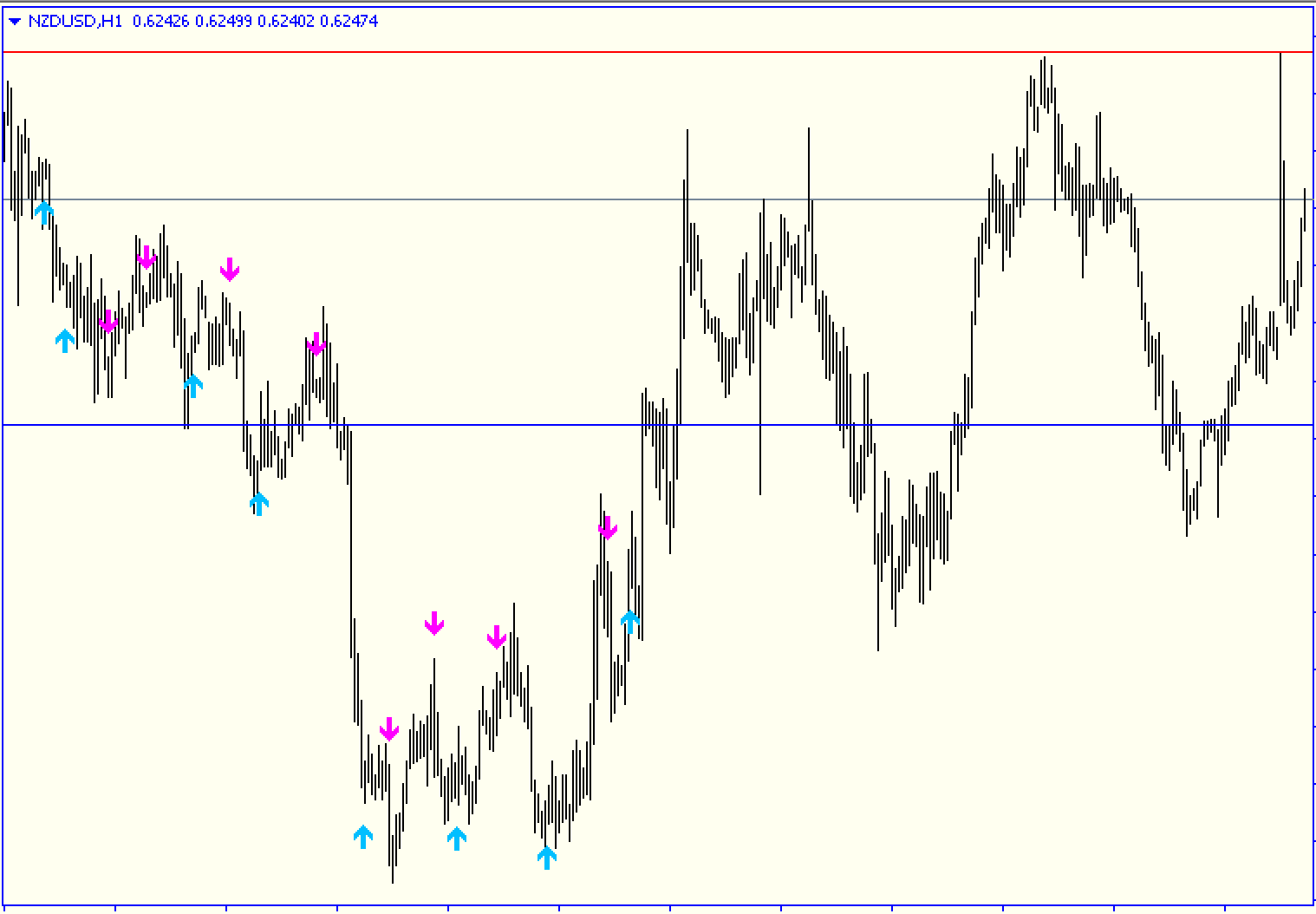

The 1-2-3 pattern indicator indicates price action at the bottom of a trend. The indicator provides entry and exit signals with non-replotted Fibonacci levels and herringbone lines.

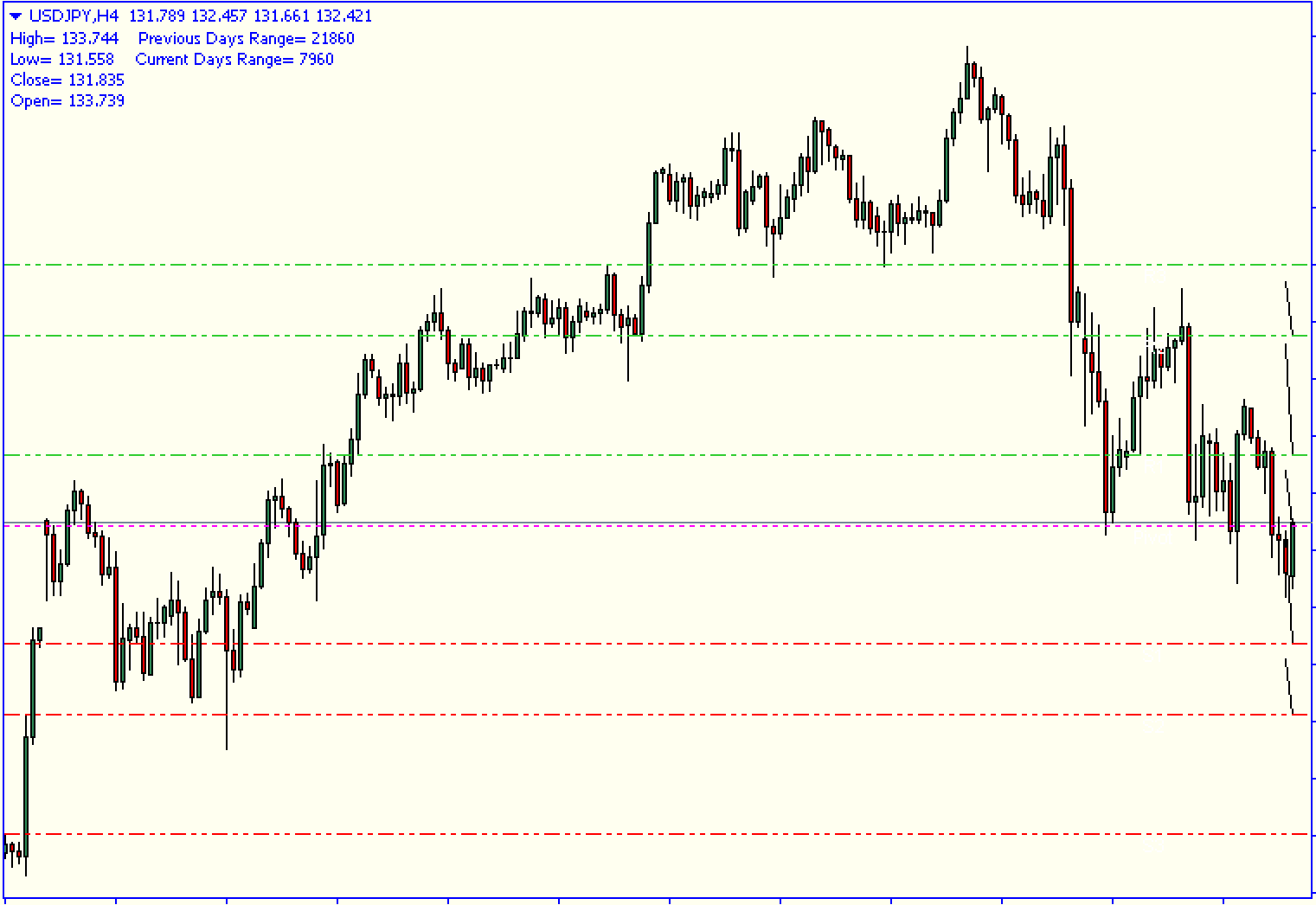

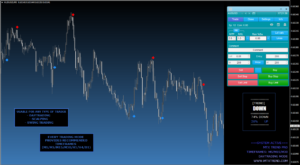

When the market is in an uptrend, the indicator will draw a green line to indicate a buy signal. Conversely, when the market is in a downtrend, the indicator will draw a red line. This indicates a sell signal.

Support and resistance are provided by the five Fibonacci levels. The lower Fibonacci level acts as support and the higher Boone as resistance.

When the trend changes, the color of the indicator changes. It can change from green to red, or vice versa. You can also exit the trade. You can exit the trade if the price moves below the line or rises above it.

1-2-3 Pattern Indicator Buy Setup

The indicator should show an uptrend.

Do not count on it until the trend is fully formed.

Place a trade where the indicator starts.

Stop loss should be placed near the lowest point of the purchase.

When the price falls below the line, exit the trade.

Setting of 1-2-3 pattern indicators for selling

The indicator should indicate a downtrend.

Do not count on it until the trend is fully developed.

Trade at the place where the indicator starts.

Stop loss should be set near the highest price of the sell point.

When the price reaches that line, exit the trade.

Conclusion

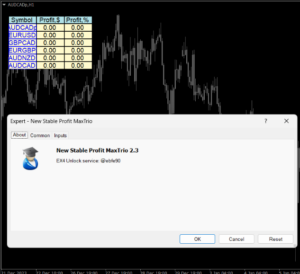

The 1-2-3 pattern indicator shows you the entry and exit points and also tells you the price action trend. The indicator can be used to show support or resistance levels by using Fib levels.