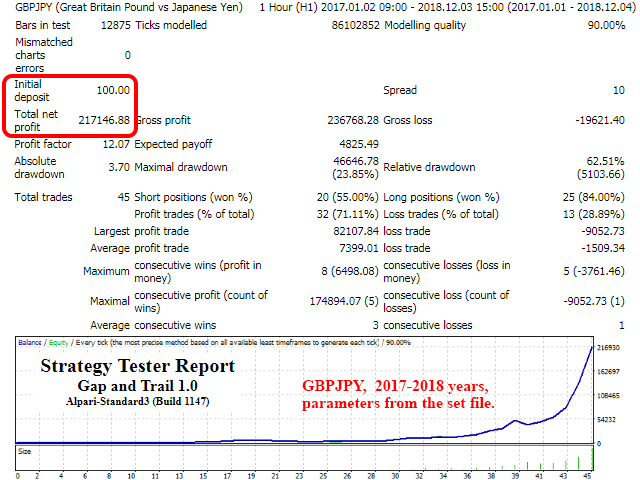

GAP as well as TRAIL EA. Effective trading using live accounts. The result of closing the gap in price (gap) is utilized. A trailing stop on open positions lowers the risk. The minimum deposit is $10.

The features of the strategy for trading

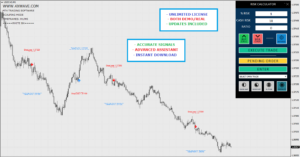

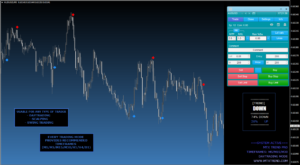

In the days following holidays and weekends, gaps can appear in the markets (gaps in chart prices). According to research, the majority of gaps are closed (the price is returned to the beginning at the beginning of the gap). The strategy for trading employed the robot based on this pattern. When there are gaps, the machine will open the position in the direction of closure. Each transaction has its own goals, which are calculated based on the specifics of the marketplace. Positions that are open are monitored by robots. When it comes to price movements, an ad-hoc stop is applied to the extremes of the candles, which drastically minimizes the risk of trading.

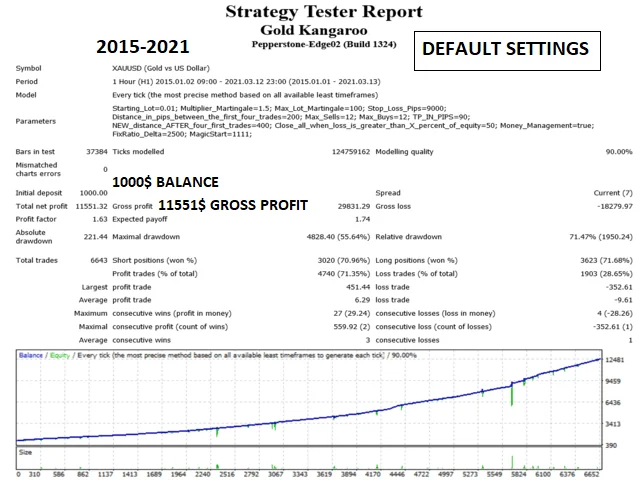

The system comes with all the security features that permit it to function with a successful outcome in the face of adverse circumstances in a real-time account. Additionally, flexible management of money adjusts transactions to the accumulated amounts and lets you invest the money that is received. This makes the operation of the machine as secure and effective as possible.

For major currency pairs, the gap occurs quite rarely, mostly on weekends or during holidays. Thus, the robot is able to open transactions very rarely (2-4 each month). But transactions are precise and are opened with higher volumes, which results in a high level of trading efficiency.

Recommendations on how to use

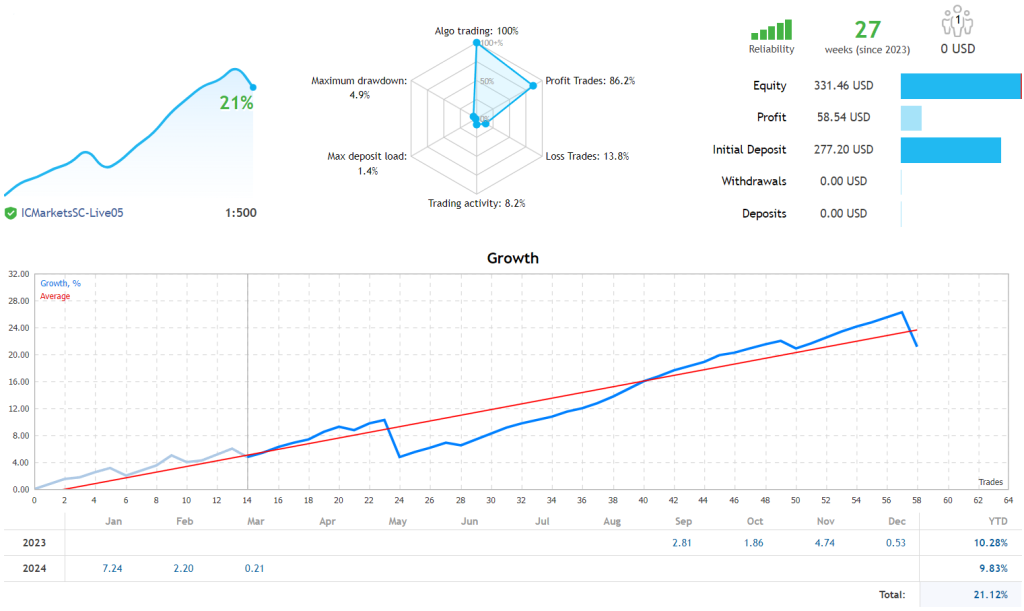

The robot tends to trade on any account. It is best to choose accounts that have 5-digit quotes, a low spread, and high speeds. The leverage of your account should be at least 1:500.

If you have floating spreads, in which it is possible to have an unacceptable spread, you should stop the placement of a non-valid spread by using the e parameter to regulate the spread by using the Yes parameter. The deal will be made available when the spread is reached; however, the value is stated in the maximum spread.

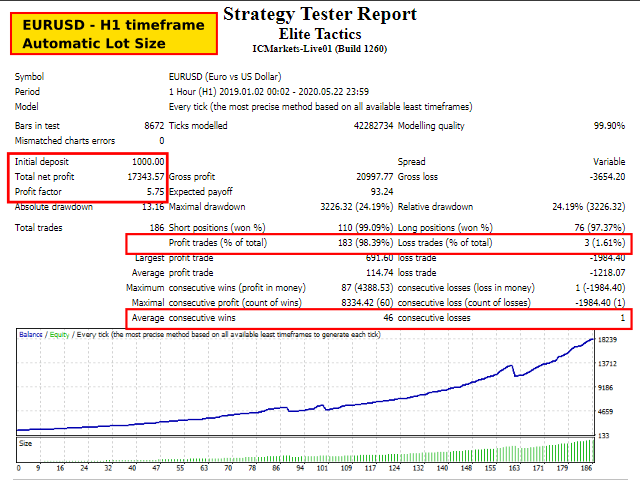

It is important that the spread maximum parameter be greater than the spread minimum for the selected account. In the absence of this, the robot won’t perform its job. It is best to get results if the broker has a fast and hard spread that is not more than 10–30 points.

Optimization over time is typically not necessary. However, when you switch to a different broker, particularly when there is a change in the spread, optimizing may also be needed.

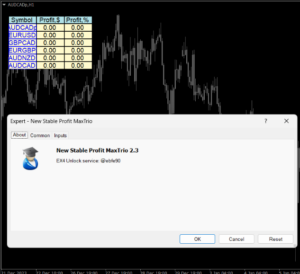

MTX TREND PRO Indicators mt4

MTX TREND PRO Indicators mt4